Leading technology-enabled visual effects and animation company DNEG and Sports Ventures Acquisition Corp., a publicly-traded special purpose acquisition company, announced they have entered into a definitive business combination agreement that will result in DNEG becoming a public company. Upon closing of the transaction, the combined company will be renamed DNEG and it is expected that its ordinary shares will be listed on the Nasdaq. The combined company will be led by DNEG’s chairman and CEO Namit Malhotra.

“As we take the next logical step in our evolution, partnering with Sports Ventures on the road to becoming a publicly traded company, I would like to thank and celebrate our talented teams across the globe. Every day, they come together to create incredible new worlds for our storytelling partners, raising the bar for every project that we deliver. This transaction creates long-term stability for our teams while also allowing us to exploit the tailwinds in the media and entertainment industry and the explosion in demand for content, which are huge growth drivers for our company. I am excited to take the best of everything that makes our company so successful and to use it as a platform on which to build and innovate further. Leveraging our leading technology stack, DNEG is already making great strides into new growth areas such as gaming and content creation partnerships, and we are perfectly positioned to exploit massive new opportunities in the metaverse and the convergence of all forms of content creation,” said Malhotra.

“As a recognized worldwide VFX and animation industry leader, DNEG has a huge opportunity to capitalize on rapidly growing demand from Hollywood studios, production companies and streaming services. The sterling reputation that Namit and his exceptional team at DNEG have built is reflected not only in the awards they’ve won, but in the deep and longstanding relationships the company holds with the world’s largest content creators. The opportunity for expansion into new markets, such as gaming and the metaverse, as well as new markets for its core VFX and animation services, offers tremendous growth potential. We could not be more pleased to partner with DNEG and Namit’s team and look forward to our future together, as we grow the company and provide exceptional returns to our shareholders,” said Sports Ventures CEO and board chairman Alan Kestenbaum.

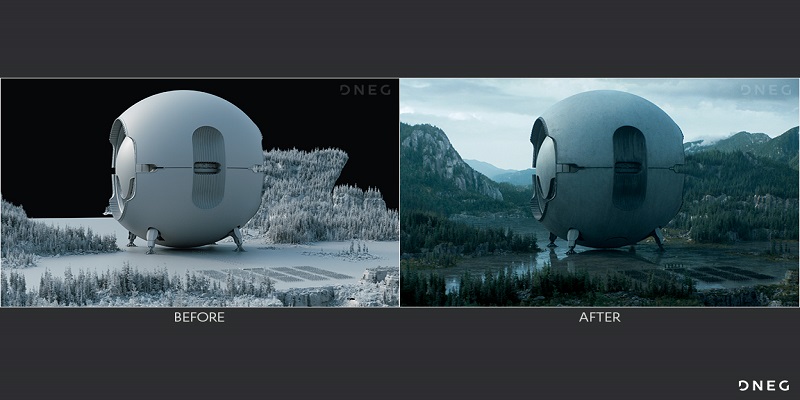

DNEG is a leading technology-enabled visual effects (VFX) and animation company for Hollywood studios, streaming services and production companies worldwide, with operations based in North America (Los Angeles, Montréal, Toronto and Vancouver), Europe (London) and Asia (Bangalore, Chandigarh, Chennai and Mumbai). With more than 20 years of industry experience, DNEG has been awarded six out of the last ten Academy Awards for ‘Best Visual Effects.’ Formed through the 2014 merger of Prime Focus (founded in 1997) and Double Negative (founded in 1998), DNEG has focused historically on building close working relationships with filmmakers.

DNEG is positioned to be a true, global media powerhouse, with its fast-growing visual effects and animation businesses and significant opportunity to expand into new geographic markets, as well as adjacent products such as gaming, further accelerating its lead in visual effects and animation.

Investment Highlights

- DNEG benefits from massive content creation industry tailwinds across the globe

- Long-term and well-established relationships with the world’s largest content creators, such as major Hollywood studios, production companies and streaming services, all of which have increasing demand

- Highly visible, recurring revenue streams coupled with an integrated global workflow drives strong profitability

- Multiple avenues for growth, including increased capacity, strategic M&A, emerging markets, gaming, and other adjacencies

- Substantial barriers to entry from cutting edge technology infrastructure and global workforce at scale

- DNEG is led by a visionary, creative, and entrepreneurial management team with a proven history of success

Transaction Overview

The transaction implies an enterprise value of approximately $1.7 billion for the combined company, representing approximately 11.4x FY2023E (ending March 31 2023) adjusted EBITDA. Current DNEG equity holders will retain approximately 71 per cent ownership in DNEG and will, assuming no redemptions by Sports Ventures’ existing public stockholders, roll 85 per cent of their equity interests into the pro forma company.

Concurrently with the consummation of the proposed business combination, investors have committed to purchase $168 million of common stock of the combined company at a purchase price of $10 per share (the “PIPE investment”). The $168 million PIPE investment is anchored by top-tier institutional and private investors including affiliates of Sports Ventures, Novator Capital Limited, affiliates of Fairfax Financial and Arbor Financial. Assuming no share redemptions by the public stockholders of Sports Ventures, approximately $230 million in cash currently held in Sports Ventures’ trust account, together with the approximately $168 million in PIPE investment proceeds (excluding transaction expenses) is expected to be used to help fund significant investments in technology, increase DNEG’s capacity to undertake project work including hiring additional talent, expand newer business segments (such as gaming and content creation), and pursue accretive acquisitions and partnerships.

Contingent upon and concurrently with the closing of the proposed transaction, DNEG will enter into new senior secured credit facilities, consisting of a $325 million term loan facility that will be fully drawn at closing, and a $125 million revolving credit facility. In the event of any redemptions by Sports Ventures stockholders in connection with the transaction, an affiliate of Sports Ventures has agreed to backstop a portion of the $350 million minimum cash condition, subject to limitations.

The proposed business combination, which has been unanimously approved by both the Board of Directors of Sports Ventures and the Board of Directors of DNEG, is expected to close in the first half of calendar year 2022, subject to approval by Sports Ventures’ stockholders and other customary closing conditions.

Advisors

Deutsche Bank Securities Inc. is acting as exclusive financial advisor to DNEG and is acting as joint placement agent on the PIPE investment. Latham & Watkins LLP is serving as legal advisor to DNEG.

J.P. Morgan Securities LLC is acting as exclusive financial advisor to Sports Ventures, and joint placement agent to Sports Ventures in connection within the PIPE investment. Arent Fox LLP is serving as legal advisor to Sports Ventures and Sidley Austin LLP is serving as legal advisor to the placement agents.

The proposed transaction includes committed debt financing arranged by Deutsche Bank Securities Inc. and NatWest Markets PLC, subject to customary funding conditions.