The question of the global adoption of cryptocurrencies is on very different planes. It is possible to calculate these aspects based on many points, but in our article, we will rely on the data of ChainAnalysis, which publishes reports on the state of the cryptocurrency market every year. Also, we decided to track the most recent crypto keywords, to understand where the traffic comes from. This article was created by the Quickex Team, which is always responsible for the best place where people exchange cryptocurrency in the fastest way. So, our team collected for you the best excerpts from this report, and compiled them into a single article.

Primary metrics (economic) for counting the crypto exchange rates by countries

1.1. The value of the cryptocurrency on-chain, measured by purchasing power parity (PPP) per capita.

1.1.1 Metric Goal: Rank each country by the total amount of cryptocurrency activity, but weigh the ranking in favor of countries where this amount is more significant, based on the wealth of the average person and the value of money in the country as a whole.

1.1.2 Calculation Methodology: We calculate the metric by estimating the total amount of cryptocurrency received by a given country and weighting the value of assets received based on PPP per capita, which is a measure of a country’s wealth per capita. The higher the ratio of the value received on the CHAN to the PPP per capita, the higher the country’s ranking, that is, if two countries have equal value of the received crypto currency, the country with a lower PPP per capita will rank higher.

1.2 Received retail value online, weighted by PPP per capita

1.2.1 Metric Goal: Measure the activity of lay individual cryptocurrency users based on how much cryptocurrency they use for transactions relative to the wealth of the average person.

1.2.2 Counting Methodology: We approximate the cryptocurrency activity of individual users by measuring the amount of cryptocurrency moved in retail transactions, which we denote as any cryptocurrency transaction under 10,000 USD. We then rank each country according to this metric, but weight it in favor of countries with lower PPP per capita.

1.3 Trade volume on peer-to-peer (P2P) platforms, weighted by PPP per capita and number of Internet users.

1.3.1 Aim of the metric: The aim is to highlight countries whose residents invest a large share of their total wealth in P2P cryptocurrency transactions

1.3.2 Metric Methodology: P2P trading volume accounts for a significant percentage of all cryptocurrency activity, especially in emerging markets. For this index, we rank countries by the volume of trading on P2P exchanges and weight it in favor of countries with lower PPP per capita and fewer Internet users.

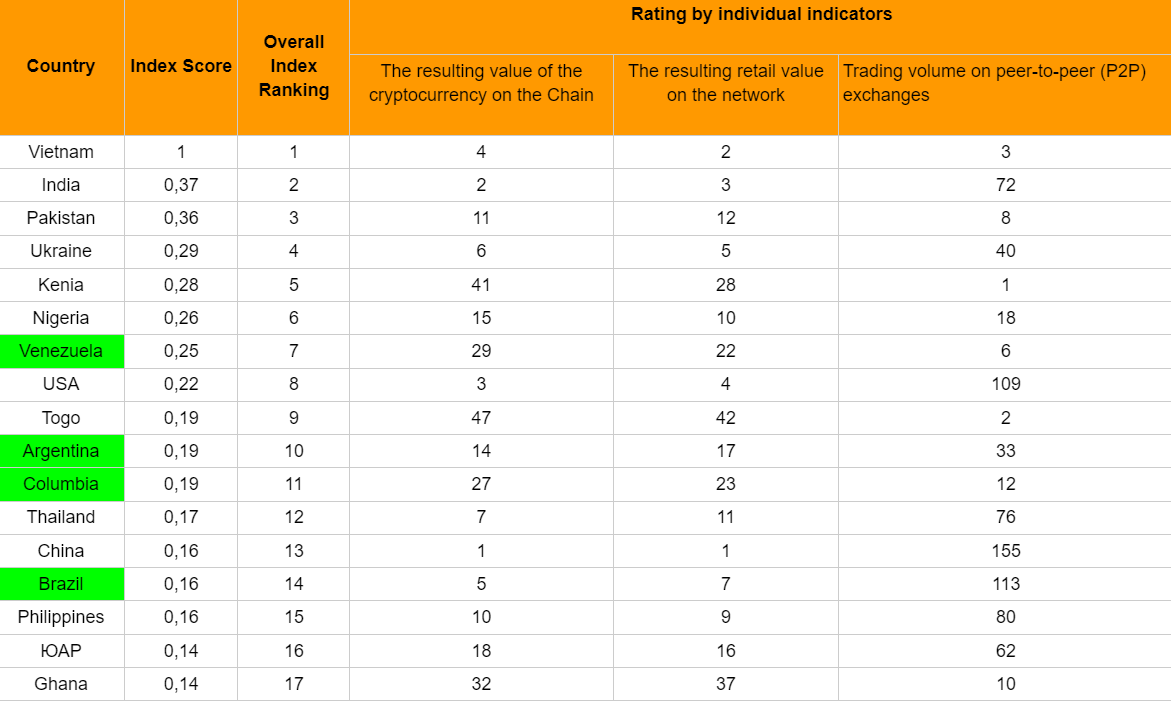

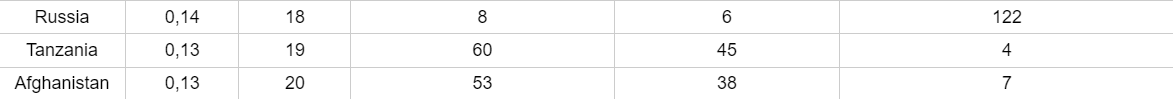

1.4 Ranking of countries using the cryptocurrency segment based on economic metrics

The purpose of these indices and metrics is to provide an objective assessment of which countries have the highest level of cryptocurrency adoption. One way to do this is to simply rank countries by transaction volume. However, in this case, only countries with high levels of cryptocurrency adoption in the professional and institutional markets will be given preference, because these market segments move the largest amounts. While professional and institutional markets are crucial, we want to highlight the countries with the highest transaction volumes. And focus on cryptocurrency use cases related to transactions and individual savings, rather than trading and speculation, and that is the aspect with which to enter the market.

So, as we can see Vietnam, India, Pakistan, Ukraine and Kenya are at the top of the ranking in terms of acceptance of cryptocurrencies. Most likely, these things have a lot to do with the fact that these are emerging economies, and that cryptocurrency is a great way to save your money from inflation, as well as a good opportunity to earn extra money.

Secondary metrics (web metrics) for calculating crypto exchange platform rate by countries

In order to select the best geo to launch the product, we will collect the most relevant key queries for the crypto segment and a general analysis of the incoming traffic to P2P solutions.

2.1 Monthly Share of Web Traffic to P2P TOP Crypto Exchanges

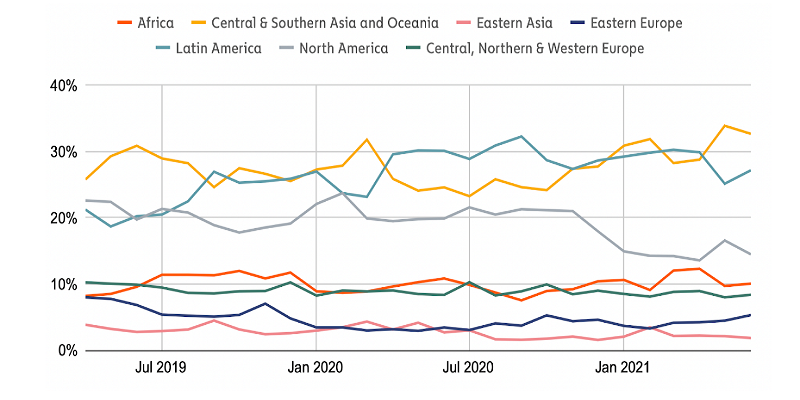

Several emerging markets, including Kenya, Nigeria, Vietnam and Venezuela, rank high in the index largely because they have huge transaction volumes on peer-to-peer platforms, adjusted for P2P per capita and population using the internet. Conversations with experts in these countries showed that many residents use P2P cryptocurrency exchanges as their main route into cryptocurrency, often because they do not have access to centralized exchanges. Knowing this, it is not surprising that regions with a large number of emerging markets account for a huge share of web traffic to P2P service websites.

Central and South Asia and Oceania, Latin America, and Africa direct more web traffic to P2P platforms than regions with larger economies, such as Western Europe and East Asia. Many emerging markets are facing significant currency devaluations, prompting residents to buy cryptocurrency on P2P platforms to preserve their savings. Others in these regions use cryptocurrency for international transactions, both for individual remittances and for commercial purposes such as buying goods to import and sell. Many emerging markets represented here limit the amount of local currency residents can take out of the country. Cryptocurrency gives these residents a way around these restrictions so that they can meet their financial needs. This contributes to an interesting dynamic in which P2P platforms have a large share of total transaction volume consisting of small retail payments of less than $10,000 in cryptocurrency.

Summary

So, the question posed is in the plane of a fairly large number of economic aspects, but we were able to find those countries that conduct the largest number of transactions related to cryptocurrency. It can be noted that these are emerging economies, which are directly interested in the development of a particular sector of the economy within their own state.