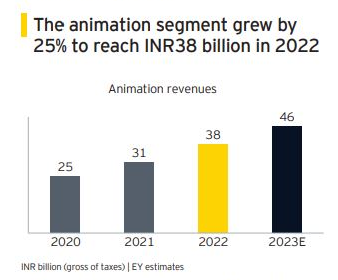

The FICCI EY Report 2023 revealed that as the content production resumed, service demand – both domestic and exports –increased, resulting in the animation and VFX segment growing 29 per cent and crossing INR 100 billion for the first time. The animation and VFX segment exceeded its pre-COVID-19 levels in 2022 and reached INR 107 billion. The Indian animation industry that touched great heights with world class series and features grew 25 per cent over 2021 to reach INR 38 billion in 2022, 71 per cent higher than the pre-pandemic levels.

Here are the key highlights of the report:

1) Demand for animated content began to normalise to pre-pandemic levels:

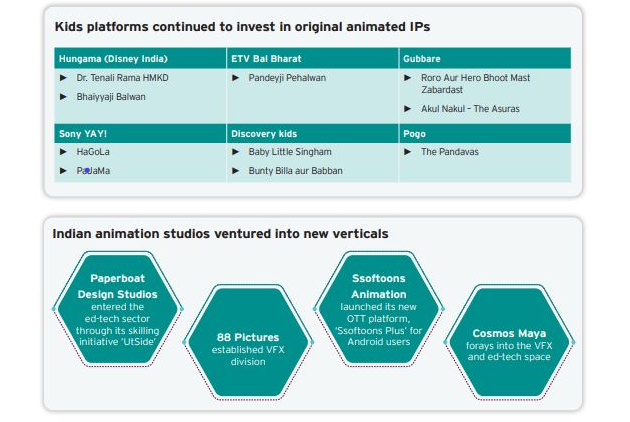

- Kid’s TV viewership reduced by 13 per cent in 2022 over 2021 as school resumed and consequently, there was a slowdown in investment in new IPs and in new seasons for existing IPs

- 10 new IPs were launched in 2022

- The major IPs included Twinkle Sharma, Baby Little Singham and Pandeyji Phelwan

- YouTube remains the most preferred digital platform for kids. However, monthly views for the top kids content channels decreased in 2022 owing to:

- The effect of the ad policy introduced in 2021 which reduced incentive for kid’s content production

- Life getting back to normal after the pandemic

2) Dedicated kids’ OTT platforms have grown and more options, especially in regional languages, have emerged:

- More than 10 OTT platforms provide kids with animated content in 2022, including Disney+, Netflix, Voot Kids, Sony Liv, Zee5 etc., across multiple languages

- The number of dedicated kids OTT platforms streaming content across multiple languages increased:

- Ssoftoons Animation launched its OTT platform Ssoftoons Plus for Android users in 2022, with 500+ shows in more than five languages

- QYOU Media India launched their third IP channel in April 2022, a digital exclusive animated content channel that targets young viewers between the age group of 13 to 35 years

3) Demand for 2D animation increased globally:

- 2D animation opportunity revived in 2022 –

- Disney is working on a traditional ‘hand-drawn’ 2D animated film based on the French folk tale of Bluebeard and the recently announced Wish4

- DreamWorks latest heist comedy, The Bad Guys used 2D animation to subvert CG animation

- For the first time, DreamWorks is outsourcing 2D work to Indian animation studios –

- 2D is a more cost-effective animation technique, which saves 40 to 50 per cent of creation cost, and the demand for the same is expected to remain high for various types of content, especially in the Indian ad space and in emerging markets

- Stagnant growth rate of 2D animation finally gained momentum globally in 2022, which will have a positive impact on the Indian animation segment owing to the large number of companies creating 2D content in a cost-effective manner

4) Studios made more use of gaming engines like Unity and Unreal:

- Unreal, originally a game engine, is now becoming a vital TV and film tool with more and more studios using it to reduce rendering time – some studios were able to save approximately 90 minutes per frame, or 70 per cent of the rendering time.

- Artificial intelligence (AI) and machine learning (ML) offer many advantages to the animation and VFX segment, as there are so many repetitive and time consuming tasks that currently require operators to manage, sort and manipulate vast amounts of data – Charuvi Design Labs is adopting AI to provide more specialised content in the immersive space.

- Machine learning was used for data capture, compositing, scripting and 3D; it has the potential to evolve current practices and pave the way for more streamlined workflows, allowing artists to spend more time on creative decisions.

Future Trends:

1) Prasar Bharati has also signed a memorandum of understanding (MoU) with YuppTV, an OTT platform, in March last year to make DD India available in various countries, including the US, UK, Singapore, Australia, New Zealand, besides Europe and the Middle East. In addition, it proposes to launch a kids’ channel which will use animated content.

2) 83 per cent of the Indian audience prefers anime content across all animated content options available. The top three favourites in India are Naruto, Death Note and Attack on Titan. Increased popularity of Anime among millennials suggests a strong base of audience interested in quality animated content, which remains untapped by Indian studios.

3) Currently, 10 to 15 per cent of the animation segment’s revenue comes from domestic IP generation. Artists are acquiring world-class skill sets through collaborating with top international players. Indian IP creation is expected to grow, taking advantage of the skills acquired, which can also provide additional export revenues to India.

4) Estimates show that the overall gaming market in India can reach US$8.6 billion by 2027, with gamers crossing 630 million by 2026. There lies an opportunity for animation studios to diversify into game development by acquiring more relevant skill-sets and creating new monetisation avenues for their IPs.

5) Metaverse and Web 3.0 growth provide a nascent opportunity:

- While still premature in India, the metaverse is expected to gain significant scale globally

- The AVGC sector will be needed to support content creation across AR, VR, XR, character creation, world building, and so on. These areas will evolve over the next five to 10 years and the Indian industry needs to augment and train its talent and artist workforce to take advantage of this opportunity- Further, the UX/ UI design and animation areas will also get a boost with novel changes and requirements. Experts like designers, copywriters, dubbing artists, developers, testers, spatial artists, quality checkers, governance managers, community builders, security analysts, and so on are newer skill-sets which will be needed to grab these opportunities

- Indian studios have already joined the bandwagon and are launching innovative products:

- Paperboat Design Studios’ TATTVA118 is a unique global Metaverse, where the universe is bounded by a theme of elements from the periodic table

- MythoverseStudios, concentrates on building more immersive experiences based on Indian mythology for its audience

- PartyNite, a Metaverse platform created by AR/ VR robotics company Gamitronics, has successfully hosted virtual events like the Indian pop star Daler Mehndi’s concert, Space Tech framework