If it rained OTTs in India in 2018, 2019 saw the OTT space flooded with high-quality original content, updated marketing strategies, course correction, new partnerships, striking distribution deals, entering new segments, innovating and getting to know the consumer better.

With the accelerating shift in the digital paradigm, the OTT market in India turned more saturated in 2019, making a dent in the cluttered space. The contenders have naturally upped their game by incorporating new technologies, increasing marketing spend, tempting offers on monthly/yearly plans. The online consumption of content, in a diversified country like India who’s never satisfied of consuming good content, is on a steep rise and the OTT gambit that has gained momentum over the last two years is now reaching an inflection point.

What do the numbers say?

- As per FICCI EY 2019 report – ‘A Billion Screens of Opportunity,’ the OTT sector in India grew by a whopping 59 per cent in FY2019, growing from Rs 13.5 billion in 2018 to Rs 17 billion in 2019. The sector is expected to reach Rs 24 billion by 2021.

- PricewaterhouseCoopers (PwC) in its report titled “Global Entertainment & Media Outlook 2019-2023” predicted India’s video streaming industry to be valued at INR 11.97K Cr by 2023.

- As per RedSeer, a leading Indian media market research group, the Indian OTT market is expected to grow by 80 per cent from 170 million in 2019 to 300 million by 2022.

- The demand for consuming regional content online has grown more than ever and according to KPMG report, nearly 95 per cent of the video consumption in India is in the regional languages.

- MICA’s (the leading media institute of India, along with Ahmedabad-based startup Communication Crafts where they analysed data about trends seen in the Indian OTT platform markets which were shared by Comscore), recent report ‘Indian OTT Platforms 2019’ suggests that the time spent on video streaming apps in 2019 has gone up by 140 per cent in India besides Australia, Thailand, Indonesia.

- FICCI EY 2019 report states that due to lucrative data offers from telecoms, smartphone users have reached 340 million in the past year and is predicted to touch 925 million by 2023.

- The digital subscriptions are expected to hit Rs 20 billion by the end of 2020, and over 500 million Indians would have watched videos online by the end of this year.

New players in the business

The VOD industry in India is poised with increasing number of OTT players every day besides existing homegrown platforms like Hotstar, ALT Balaji, ZEE5, Jio Digital Life, EROS NOW, Arre, Voot, Sony LIV, Hoichoi, Sun NXT and many others, going strong parallely to streaming powerhouses, Netflix and Amazon Prime Video.

New players forayed into the market in 2019, creating quite a buzz. In February 2019, Times Internet launched one of its most ambitious bets – MX Player. To grab more eyeballs, MX player commenced with five MX Original Series.

Says MX Player CEO Karan Bedi, “2019 has been of utmost importance for the Indian content market. The market is growing like never before but to survive in this ever-changing environment, OTT platforms need to conquer the one important audience – the Real Bharat! Indian sensibilities are driven by culture, region, and language. So, the first thing you need to ask is – does it appeal to the sensibilities of the audience? If it does not, then they won’t come back for more and this is where we as a platform have learnt to leverage our ability to personalise via technology – be it with acquiring and producing more regional content, dubbing, subtitling and so on.”

Owning a rich content library, Shemaroo Entertainment, one of the legacy players, also plunged into the space around the same time. However, Shemaroo banked on its existing content for ShemarooMe rather than making a hole in their pockets for original content. But while MX Player went totally advertising-led, ShemarooMe took the freemium route.

Reveals Shemaroo Entertainment COO Kranti Gada that ShemarooMe’s Bollywood Premiere, the offering that showcases World Digital Premiere of critically acclaimed movies every Friday, was launched in September 2019 and has received positive response from not only the audiences but also the actors and the teams involved in the making of the films.

“Shemaroo has seen a loyal base of audience as well as manifold growth with the increase of more varied content. Content is the only factor that lures viewers to any OTT platform or deters them,” Gada added.

In the second half of 2019, IN10 Media with a diversified offerings in Media and Entertainment like channel Epic TV launched a new subscription-based documentary streaming platform DocuBay.

DocuBay COO Akul Tripathi mentioned to Animation Xpress, “The paradigm shift that was forecast with the growing proliferation and penetration of the internet and other online services is happening all around us. Riding this wave of digital transformation, the factual community of viewers and makers is growing at an unprecedented rate. For example, 16 per cent of the Cannes film market is now documentaries – a remarkable growth, and one which indicates the popularity of this genre. This is the piece of the pie that DocuBay focuses on.”

The end of 2019 witnessed another major announcement – the launch of VOOT Kids from the house of Viacom18 which has already established a significant digital play with VOOT. Unlike its main OTT platform, Viacom18 is relying on subscription for the kids’ platform right from the get-go.

“VOOT Kids is a synergy of growth stories from the house of Viacom18. Marking our sharper segmented foray into the world of subscription-based VoD, VOOT Kids is India’s first and only multi-format Kids app offering fun and learning. No other kids app offers Watch, Read, listen and learn all at one place,” said Viacom18 Group CEO and MD Sudhanshu Vats.

Moreover, the year was equally eventful in the global OTT market as well. Tech giant Apple delved deeper into streaming with the launch of its subscription-based video streaming service Apple TV+ in November 2019, followed by Walt Disney launching its much awaited streaming service Disney+ at a very reasonable sticker price. While the former made its streaming service available in India at Rs 99 per month, Disney+ is going to be available in India through the hugely popular Hotstar.

Collaboration and Co-creation

2019 even witnessed unconventional happenings in India’s OTT ecosystem, like the partnership between two major players in the market. In the month of July 2019, ZEE5 joined hands with ALTBalaji.

The two players, in accordance with the partnership, will co-create original content which will be available on both the platforms. This can be crucial in terms of increasing the user base of both the platforms which abide by the SVoD model. Recently, ALTBalaji also partnered with Microsoft to bring online streaming to offline users with peer-to-peer local Wi-Fi.

Pricing

Another significant event in the Indian scenario was the introduction of sachet pricing by OTT platforms including the streaming giant Netflix in India. Besides experimenting with content to strengthen its consumer base, the streamers were also exploring with pricing in order to appeal more consumers.

With the ever expanding market of India in terms of content and market, monetisation seems to be a much more significant challenge in contrast to the developed markets, as those markets have traditionally had much more robust monetisation systems in the traditional media sector. All the major players – Hotstar, Amazon Prime Video, ZEE5, SonyLIV followed this strategy.

A Netflix spokesperson said, “Our members in India watch more content on our mobiles than members anywhere else in the world. Recently, we launched our fourth plan in India, in addition to the existing basic, standard and premium plans, for Rs 199 a month. With this plan, our members can now enjoy all of Netflix’s content—uninterrupted and without ads—in standard definition (SD) on one smartphone or tablet at a time. We strongly believe that this plan broadens access for Netflix and better suits the audience who prefer watching content on smartphones or tablets. Our other existing plans enable our members to watch Netflix on multiple devices, with multiple concurrent streams in SD, HD, Ultra HD, and 4K.”

Hotstar launched a Hotstar VIP pack at Rs 365 a year, much lower than its premium service which is priced at Rs 999 per year. SonyLIV has already tested a weekly subscription package priced at Rs 29 only. While ZEE5 has launched special packages in languages including Tamil, Telugu and Kannada, it is looking at a mobile-only plan as well. Even ALTBalaji is also likely to consider having sachet pricing in the coming years.

While the subscribers are increasing in numbers and the SVoD model is prevailing in almost all scenarios, a fresh entrant into the market, the aforementioned MX Player, has chosen the AVoD side of things. Adds Bedi, “We believe that for an AVOD model to exist effectively, one must have scale. We have over 700 million downloads, 175 million monthly active users with an average of 42 minutes spent per day on the app by each user. This kind of scale is almost unparalleled in the OTT business and therefore, MX and appeals to potential advertisers, making it a viable business model. For the consumer, our promise was to offer premium content for free and we are living up to that.”

Originals Galore

With increasing numbers of new OTT players entering the market, the existing platforms pumped in research and investments in original content. ZEE5 spent the year increasing its focus on large-scale originals, franchises, digital original films and regional language shows even as it has already developed a robust original content library across languages.

According to a MediaPartnersAsia report in July 2019, ZEE5 holds 44 per cent, Amazon Prime Video holds 17 per cent, Netflix holds 11 per cent, SonyLIV holds 10 per cent, VOOT and Hotstar hold 9 per cent each of the cumulative original content hours for OTT in India.

Among the shows that made a mark with viewers include: Rangbaaz, The Kunal Khemu-starring BP Singh-produced Abhay, Kaafir, Posham Pa, Bhram, Barot House, Broken but Beautiful, The Final Call, Parchayee, 377 Ab-normal, The Lovely Mrs. Mukherjee (Bengali), Sharate Aaj (Bengali), was much talked about. ZeeL took its successful TV show Jamai Raja to Zee5 in the shape of Jamai 2.0 during the year.

Star India’s Hotstar also decided to invest in premium original content. Reportedly, Hotstar jumped onto the bandwagon with a Rs 120 crore investment plan. The primary reason to introduce originals was to increase its subscribers base in the face of increasing competition. By adapting successful foreign shows by infusing local flavours had been an important aspect of Hotstar’s strategy but it is certain that the platform is not going to limit itself to adaptations.

Notable originals this year from their kitty were Out of Love, Hostages, Chhappad Phaad Ke and Criminal Justice.

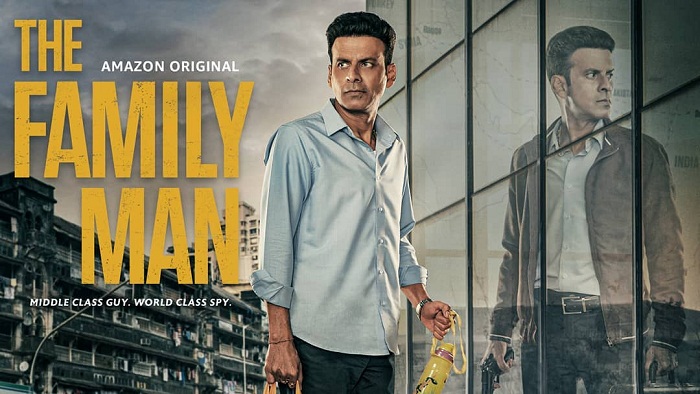

Another major player, Amazon Prime Video has also scaled up its local content offering along with a stellar roster of movies. With highly acclaimed originals like Made in Heaven, The Family Man, Inside Edge 2, the global OTT platform has already attracted enough user attention. Moreover, the second seasons of earlier hits are also in the pipeline.

Exulted Amazon Prime Video India director and country manager Gaurav Gandhi, “The shift in content over the past few years has happened as we cater to different sectors of people. The genres being explored today, the treatment and execution were not seen in any other formats. Thus originals were popular and successful.”

Coming to another streaming powerhouse, Netflix has gradually evolved its investment in India, as Netflix CEO Reed Hastings in his latest visit to the country revealed that it is looking to invest Rs 3000 (400 million) crore in this year and next for the slate of Indian content. In fact, Netflix has reported revenues of Rs. 466.7 crore for FY19 with a net profit of Rs. 5.1 crore, according to its filing with the registrar of companies sourced from Veratech Intelligence. In FY18, Netflix India had a turnover of Rs. 58 crore with Rs. 20 lakh net profit, which reflected financials for seven months starting September last year after the actual transfer to local distribution entity from Singapore.

In the past two years, Netflix has doubled on offering local content, low-cost mobile plans and partnerships with telecom operators that adds into its 700 per cent growth in the country.

Mentioned Netflix director of partnerships Abhishek Nag, “Two out of three people who have watched Sacred Games are non-Indians. It was localised in 24 languages and viewed in 190 countries. Because of the portrayal of Mumbai in it. Resonating stories and gripping content are what we are focusing on.”

Netflix launched a number of appreciated local original content like Soni, Selection Day, Delhi Crime, Sacred Games 2, Fireband, Mighty Little Bheem, Chopsticks, Hotel Mumbai, Little Things season 3, Typewriter, Bard of Blood.

In fact, Mighty Little Bheem was one of the most popular shows on Netflix US in 2019! Hastings revealed at HT Leadership Summit 2019, “Mighty Little Bheem has been viewed by 27 million households outside India. Baby Bheem is going strong.”

Other homegrown players like VOOT, SonyLIV also realigning their focus on original content as they don’t have significant play in the segment.

VOOT launched 12 original shows under the name of ‘Shortcuts’ which includes – Derma, Googly, Joy Ride, Bauma (Bengali), Chacha and Cheetah’s trip, Glitch, Grey, A(U)N, Teaspoon, Maya, On the Road, Red Velvet and It’s not that Simple.

VOOT business head Akash Banerji comments, “Originals have a very tangible business value. It helps us accelerate the business drive through edginess in stories, exploring uncharted genres and attract audience attention. We are not creating originals just for the sake of it.”

EROS NOW too ramped up their OTT game. Their slate of originals this year include Metro Park, Flip, Operation Cobra, Flesh, Bhumi, Crisis and many others. EROS NOW chief operating officer Ali Hussein revealed that they eyed to launch 100 originals in 2019 and also looking for partners and distributors in Southeast Asia.

ALT Balaji’s 2019 slate consists of titles like, Fittrat, Cold Lassi and Chicken Masala, Apaharan, CyberSquad, Hum, Tum aur Them, Ragini MMS Returns, Gandi Baat 2, Bose: Dead/Alive and others.

“2019 for the digital streaming industry was a revolution with multiple shows being launched, and many platforms experimenting with new technologies and new business models. 2019 also saw the rise of gamification for the non – fiction shows that were tried as a successful experiment with at least two other platforms. However, they have been for network-related apps with shows being broadcast simultaneously on television. The crux lies in independent apps adopting this to engage audiences with their Original content as a scalable model. It also saw the OTT platforms experimenting with influencer marketing, AI and VR filters, microbloggers, VR innovations, extensive usage of UGC apps etc,” ALTBalaji senior VP and head marketing Divya Dixit said.

Further notes ALTBalaji Group and Balaji Telefilms chief executive officer Nachiket Pantvaidya commented, “India is not a place for single person content except for OTT space where they watch something of their option. And any content we create is driven by this thought.”

Every major streaming platform has eyed to extend its content slate in several local languages, including Hindi, Tamil, Telugu, Gujarati, Marathi, Malayalam, Kannada, Bengali, Sikkimese, Urdu and Punjabi. Other platforms are following the same route parallel to the already existing regional OTTs like Hoichoi and SunNXT.

Hoichoi’s slate had titles like Eken Babu o Dhaka Rahasya, Stories by Rabindranath Tagore, Odbhuturey, Montu Pilot, The Stone Man Murders, Phul Toss, Paap, Dhaka Metro, Pnaachforon, Dhanbad Blues, Bou Keno Psycho?, Astey Ladies, 3 Cup Cha and others.

Key people movements

Along with changes in business plans, content strategy, the OTT platforms reshuffled their teams in 2019 as well. Major appointments and reshuffling includes the likes of Netflix hiring former Voot content head Monika Shergill and the BBC’s Myleeta Aga. VOOT on its part recruited its new COO Gourav Rakshit from Shaadi.com keeping its subscription business in mind. After Uday Sodhi left, SPNI handed the reins of SonyLIV to television vet Danish Khan. Ekta Kapoor-led ALTBalaji has seen high profile exits as CEO Sunil Lulla and COO Sunil Nair quit the organisation this year.

The Indian OTT space is intensifying with competition as more names and innovative storylines are pouring in. It’s now a matter of time to see which model will work, but it’s sure to grow multiple folds and generate revenue and reach a wider audience base across the country and globe.