The year 2020 was unprecedented for the gaming industry. The industry has proven its resilience despite the challenges posed by a global pandemic. The year 2020 has encouraged users to stay home and play apart as per WHO campaign due to Covid-19 pandemic. With the entire world being restricted to their homes for months, individuals rushed to adopt gaming as a mode of entertainment. According to the Unity 2021 Gaming Benchmark report, user behaviour towards gaming has transformed from where it was in 2019.

“It’s still too early to tell if changed habits will become the new norm once the pandemic is over, but given our understanding of past player behavior changes, it would be surprising to see many players revert. In a year where online entertainment content – more than ever – became the cornerstone of social connections for so many when seeking a semblance of normalcy, ” said Unity senior VP and general manager, operating solutions Ingrid Lestiyo.

Here are the key highlights:

- COVID-19 had a notable impact on the way people play video games. The volume of HD gaming (video games on PC, macOS, and other desktop platforms with graphics typically rendered in high definition) rose by over 38 per cent in 2020. Additionally, play has shifted to weekdays, and this trend held well beyond the onset of the pandemic – the difference between weekday and weekend gaming increased by 52 per cent, in weekday gaming’s favor.

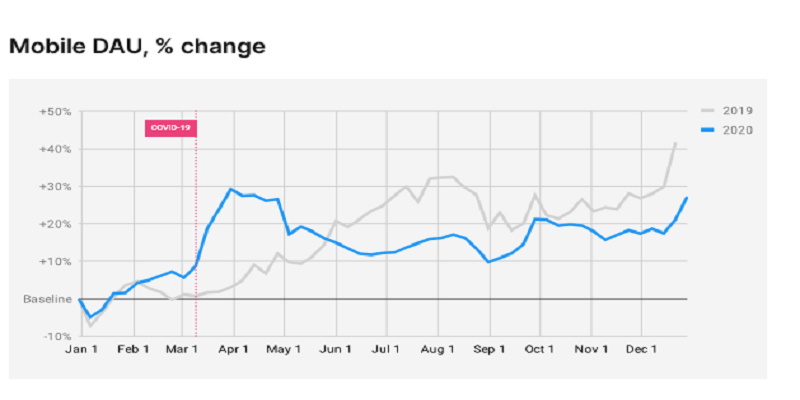

- Mobile gaming also saw strong positive impact in 2020. When comparing this year’s growth to last year’s, first day microtransaction purchases were up by more than 50 per cent year over year, and ad revenues saw over eight per cent growth. This is on top of already strong baseline growth rates for both in-app purchases (IAP) and ad revenue.

- Creating new content to delight and engage players should still be a top priority for game developers. On average, large new content updates for live games resulted in peak concurrent user spikes of over 11 per cent.

- At the start of the pandemic, the popularity of mobile games spiked, but usage settled back down as the year progressed. However, HD games on PC/macOS held steady their initial increase, and then rose significantly during the fall and winter. With the onset of colder weather keeping people indoors and other forms of entertainment unavailable, HD gaming became the foremost media that many people turned to. Over the course of the year, HD gaming daily active users (DAU) increased on average by 38.27 per cent.

- A similar usage pattern emerges with stickiness, which is how often a monthly user of a game plays it daily. Mobile games fell slightly in stickiness, though their stickiness was still higher than that of HD games in 2019.

- HD games, on the other hand, showed tremendous stickiness over the course of the year, and ended at an all-time high. This was likely in part due to new console launches, but also thanks to limited access to alternative entertainment. HD game stickiness increased on average by 1.82 per cent. While that number may sound low, given that most games have stickiness of around 10 per cent, it’s actually a very significant increase.

- First-day IAP purchases in mobile games spiked with the springtime lockdowns around the world, but quickly ramped back up during the summer and were sustained throughout the rest of the year. Typically, the revenue stays below the 1 January baseline until the winter holiday season begins in November, but 2020 set new records for the mobile game business. Over the course of the year, first- day IAP purchases rose by over 50 per cent compared to 2019.

- In 2019, weekday gaming volumes remained lower than weekend gaming volumes. However, during the summer months, that gap shrank – players shifted their play days to weekdays. Then, in the first week of September, gamers shifted their play days back to the weekends as school started back up and vacations ended. The weekday/weekend split at the beginning of 2020 was similar to that in 2019. However, when lockdown started, the difference between weekday and weekend gaming habits greatly narrowed, especially during the summer months. They even inverted for a brief period in May.

- On average, the difference between weekday and weekend gaming activity during 2019 was 1.39 per cent being in the weekend’s favor. In 2020, this difference was just 0.91 per cent. This represents a shift of 52.7 per cent in redistributing weekend gaming time to the weekdays.

- Nearly all mobile gaming categories, with the exception of sports games, demonstrated significant ad revenue growth in 2020. With real-life sporting events on pause in 2020, interest in this gaming category declined alongside it; ad revenue for sports games had -26.7 per cent growth.

- Two standout ad revenue growth leaders for this year were action and card games. Earlier Unity’s 2019 gaming report showed ad revenue for action games grew by 1.9 per cent and card games grew by 66.5 per cent compared to the previous year. In 2020, action games have come back into the spotlight with 51.9 per cent growth in ad revenue, while card games ad revenue grew by 108.1 per cent, surpassing their already strong 2019 performance.

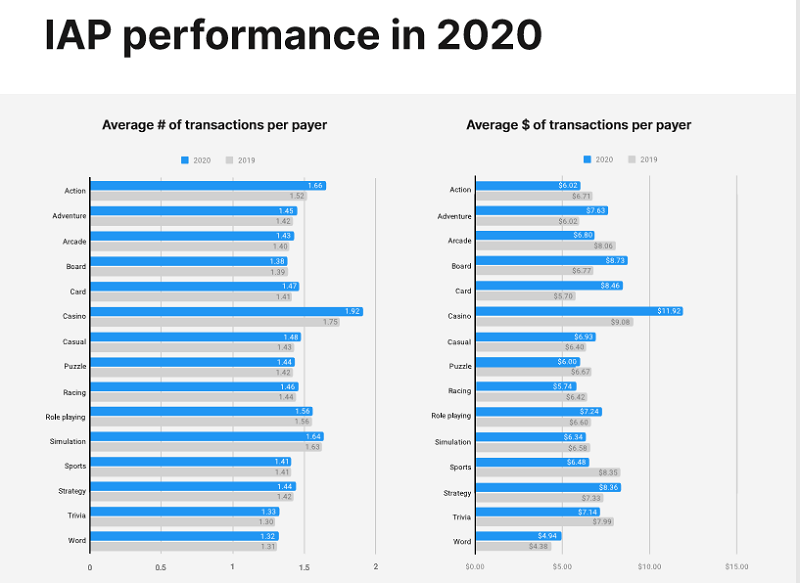

- Comparing 2019 to 2020, casino games were a standout performer, with a notable increase in both the average number of in-app purchases per paying user, as well as the average amount spent per transaction. For casino games the average number of in-app purchases per paying user rose by a respectable 0.17, while the average dollar amount per transaction rose by an impressive $2.84.

- Even sports games held steady at an average of $1.41 transactions per paying user, despite a decrease in the dollar amount per transaction.

- While gamers in 2020 had ample time to try out new games, their data showed that most game genres showed retention improvements on new installs. In the majority of game genres, best practices in ad strategy and placement continue to drive engagement and extend player lifecycles year over year. Overall, day one retention dropped for mobile titles in 2020 compared to 2019. However, the drop was steeper for games without ads. Surprisingly, day seven and day 30 retention actually increased year over year. The day seven and day 30 retention numbers show that games with ads have higher long-term retention. Intelligent and thoughtful ad implementation is just as important this year as it was last year around.