India’s Media & Entertainment sector has been experiencing a rise in animation content consumption, due to new viewing platforms and viewing services, both in India and abroad, resulting in increased demand for quality animation.

Opportunities abound for the Indian Animation and VFX industry, across film, television and digital outsourced projects, representing 85 per cent of total animation services turnover in India, and for original content with universal appeal for the global market. (Ernst&Young India, March 2019)

Ernst & Young noted that Indian animation and VFX services continued to gain traction among international production houses. They provide a cost efficiency of up to 50 percent compared with other countries. With improvement in animation quality over the last few years and the cost advantage, international studios and animation houses are increasingly utilizing services from India.

During the last few years, Indian animation studios have worked with major international players such as Disney, Warner Brothers, DreamWorks, Sony, Viacom/Nick, BBC, Cartoon Network, Fox, Ubisoft and Zynga, among others. Technicolor India has worked on animation movies such as Penguins of Madagascar, Kung Fu Panda: Legends of Awesomeness, Mickey and the Roadster Racers, Alvin and the Chipmunks, All Hail Kind Julian, Wallykazam, Fanboy and Chumchum and Puss in Boots, among others.

Growth of digital content consumption in India created a significant opportunity for broadcasters and OTT platform providers. Correspondingly, they increased investments in original IP creation. Smartphone penetration, coupled with more OTT, enabled tier-II and tier-III cities to access content online, both on YouTube and large OTT platforms of broadcasters. Due to this, average content consumption of a common Indian has gone up from 450 hours a year. Animation-based content had a major share in this growth of online content consumption.

In April 2018, Cosmos Maya collaborated with Yupp TV to launch its digital channel Wowkidz on the OTT platform. Under its brand Wowkidz, the company owns content portfolio of over 1,000 half-hour shows.

In the same period, Discovery Kids announced plans to launch its own OTT app to ensure strong presence of the channel in the digital space. As part of the plan, it has also collaborated with Netflix for digital distribution of its series.

There are now five Indian companies in the top 100 animation companies on YouTube from companies such as USP Studios, Chu Chu TV, Green Gold, Hoopla Kids, CVS 3D Rhymes, etc.

The next phase of growth for the segment is expected to be driven by the global digital push. Netflix is expected to spend US$1.1 billion on animated content worldwide in 2018 and Amazon is projected to spend US$300 million. This translates into roughly 10 per cent of total content budget for these companies. This number is expected to go up to about 15 per cent of their total content budget in 2021.

In addition to OTT platforms, traditional broadcasters are getting into the animated content space. Most national broadcasters like Viacom, Sony, Disney and Discovery have increased their focus on animated content in India, with other national and some local broadcasters also gearing up to launch original animated content.

Spilling Over with Animation – But is it All Good?

A word of caution to the wise. When iNSiGHTS magazine recently caught up with Lattu Kids founder and CEO Vivek Bhutyani, the ex-Star India vice-president and head of the content syndication, to understand the issues he is facing as a buyer today, it was noted that the chasm between quality and quantity is still an issue. It was what started the idea of Lattu Kids, and it is what continues to drive its growth.

Here, the very recent uproar from the overwhelming fury of MyPinguTV’s “Dina and The Prince Story” on the YouTube kids’ channel comes to mind. YouTube has since pulled down the content across several languages, but not without first being heavily criticised.

MyPinguTV has around 720,000 subscribers on YouTube and “Dina and the Prince Story” has been watched nearly 400,000 times.

“I think there are two different ways of seeing this,” Bhutyani, noted, referring to volume of content versus the quality. Thus, the many studios active on YouTube producing kids’ animation content does not directly equate to successful engagements.

“Kids today have a huge variety to choose from. On the one hand, this is a good thing; however, the question we must ask is, ‘how much of this content is really engaging and fun for kids and are these ideas original? Does the content impact children in positive way or even leading to some talking points between children and parents?

“Mindless and copycat content for kids is on the rise on many platforms; I see this as an opportunity for quality content creators, platforms and studios to stand out and create meaningful content for kids.”

For Bhutyani, what matters to kids is that one great show or a few high-engaging IPs that kids watch repeatedly and connect with.

“What is difficult to find sometimes are kids’ shows that are produced with high production standards; when I say ‘production’, it doesn’t need to be high-end 3D. There are times when we come across really great kids’ shows in 2D, but well-executed with the right scripts and good direction.The edutainment genre is a tough one to crack, as there’s a chance of the show becoming too boring and preachy. We prefer shows that have a good balance of fun and learning and these are not very easy to find,” noted Bhutyani.

“At Lattu kids, kids engagement is our first priority, We are looking at building our library with more edutainment, musicals and STEM content that helps kids learn while they are having fun. We are generally open to all entertaining content as long as it’s made with decent production quality and neutral English accents. Overall, we plan to acquire 100+ hours of content this year,” added Bhutyani.

In the recent one to three years, Lattu Kids’ top-performing content that has experienced great success include Maya the Bee , Talking Tom & Friends, Leo & Coco, Wondergrove – that have seen high engagement on its app from kids – and recently-acquired Fireman Sam & Messy goes to Okido from DHX Media .

“Our latest acquisition has been for Little Brown Bear and Charlie Goes to School from France TV distribution, as well as the Gruffalo series by Magic Light pictures.”

There are different TG within India for kids’ content, seeing the size of the market. It is a complex country with kids watching multiple languages apart from English. There are some homegrown IPs that are doing well in India on TV and again, Bhutyani notes that these are very few, as it takes time and effort to build a new IP in India.

“Lattu Kids is focused on aspirational kids who come from multilingual backgrounds, so they are comfortable watching their own languages and at the same time, they study in English medium schools.

“We are open to all content from across the globe as long as the accents are not very heavy and easy for Indian kids to understand. We do invest in dubbing and localizing these IPs to suit the Indian kids. We have had great success with localizing Talking Tom & Friends for the first time in India, and the same version was then bought back and run on Netflix India, as our partner, Outfit7, loved our quality.

“We believe in long term partnerships with our studio partners and help them build strong IP in India

that kids relate to,” said Bhutyani.

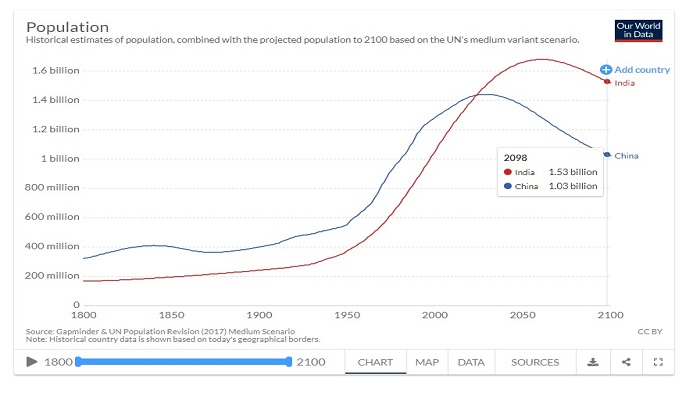

Content flow, therefore, looks promising both ways and India looks set to dominate, surpassing China in the years to come. The percentage of the population that is young (under 15yo) is projected to be higher in India than in China throughout the 2000—2035 period (JSTOR, 2011).

Credit: Gapminder and UN Population Revision (2017) Medium Scenario

Nowadays, with the Strategy of Jio’s free phone promotion, the game has changes and the tabled turned on who has become the global market of the century.

“On an ecosystem level we have seen a massive surge in video consumption post Jio in India. This country has the world’s highest data usage per smartphone at an average of 9.8 GB per month and likely to double to 18GB by 2024, fueled by rich video content.

“There are first time smartphone users who are immediately experiencing 4G, and these new users are going to fuel the way forward. We have been talking to Jio for some time now, and you will soon hear

something exciting on this front for Indian kids,” Bhutyani promised.

By Lulu M

Article is contributed by ATF iNSiGHTS.

For more information, visit ATF homepage at http://www.asiatvforum.com/, and the ATF Animation web page: at https://www.asiatvforum.com/