YouGov has enhanced its Global Fan Profiles tool, therefore properties, sponsors and rights holders can now track fan sentiment and attitudes in esports.

Global Fan Profiles is built upon more than 300,000 interviews per year collected on a continuous basis. It provides an instant view of the size, make-up, attitudes and behaviors of fan bases in 32 key esports markets including the United States, China, India, Brazil, Germany, South Korea and Malaysia.

It is designed to help properties, sponsors and rights holders identify the size of their fan bases, who their fans are, how fans consume content and how they align with the thousands of brands and audience trends YouGov tracks on a daily basis.

As it is connected to YouGov’s market-leading depth and breadth of consumer data, YouGov Global Fan Profiles provides a much deeper dataset than just isolated esports and sports attitudes. Subscribers can connect data across sport and esports with core demographics, media consumption, brand preference, interest, following, viewing and awareness. It is an extension to YouGov’s connected data solutions and is complementary to YouGov SportsIndex.

The new YouGov Global Fan Profiles means that for the first time the esports industry can fully understand the nuance of the marketplace. It gives an instant view of fan bases around the world, providing comprehensive and precise data across 200 leagues, 50 events, 45+ game titles and 2,000 teams in sport and esports. Subscribers can easily create side-by-side comparisons of individual game titles, leagues, events, tournaments, and team fan bases.

Global Fan Profiles is designed to help esports stakeholders in a number of ways:

- Sponsorship: Develop compelling propositions using real data on the number of fans a title, league or team has, who they are, and how they align with potential sponsors

- Esport properties: Create side-by-side comparisons of individual game titles, leagues, events, tournaments, and team fan bases

- Marketing: Use media consumption data to more effectively and efficiently reach target consumers

- Strategy: Assess international market differences in fan base size and make-up to inform strategic plans and decisions

- Broadcast: Prove growth and composition of a fan base to support broadcast negotiations

- Sponsor activation: Use fan profile data to create laser-focused activation strategies with real impact

- Benchmark: Compare fan bases with key competitors for internal analysis or external validation

YouGov’s Global Sector head of esports and gaming Nicole Pike shared, “Esports is such a valuable and fast-developing industry that properties, partners and rights holders deserve to have accurate and always-on data at their fingertips. Sponsors are getting more sophisticated about how and where they choose to invest in the space, and YouGov Global Fan Profiles is the most comprehensive, in-depth and valuable dataset in the market. This tool represents an important step in moving the conversation away from generic “esports fans,” and toward a more nuanced view of the distinct fan bases within this growing space.”

Global Fan Profiles in action: Esports team fandom across key markets

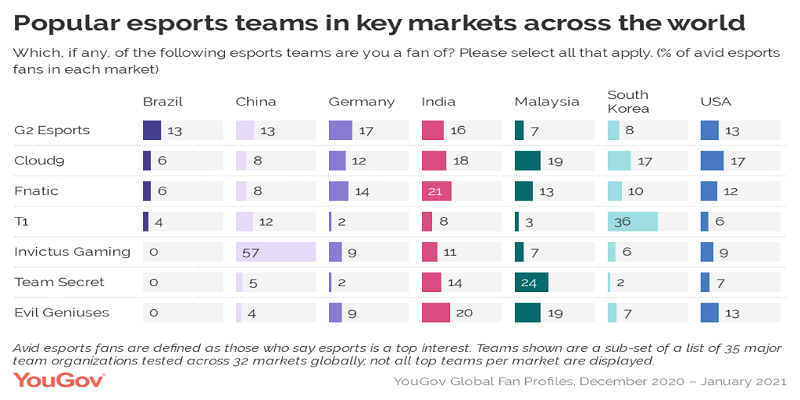

Data from YouGov’s Global Fan Profiles shows just how much affinity toward major esports teams and organisations varies by market:

- Brazil: The influence of large global esports teams is relative more limited in this market, where instead esports culture is more driven by engagement with regional and local organisations. The country’s fervor around Garena Free Fire, a battle royale title where individuals are more commonly followed than teams, may also contribute to this trend.

- China: The picture is noticeably different in this highly-engaged esports market. Here, fandom is emphatically strongest (57 per cent) for Chinese-based organisation Invictus Gaming; engagement with major non-Chinese teams is more limited by comparison.

- Germany: In its home market, Berlin-based G2 Esports is most popular (17per cent), followed by two of the most established esports organisations fielding teams in multiple popular titles – Fnatic (14per cent) and Cloud9 (12per cent).

- India: Given the lack of Indian-originated teams competing at a global level, following is fragmented and Western teams are the favorites. One in five (21per cent) avid esports fans in India follow London-based Fnatic, whose popularity may be aided by the team’s signing of XSpark – an Indian-based roster for PUBG Mobile – in 2019. The American esports organisation Evil Geniuses is just as popular with Indian esports fans (20per cent), likely due to the success of the team’s former Indian-American Dota 2 player, Universe.

- Malaysia: Though based in Europe, Team Secret boasts a PUBG Mobile roster that is almost entirely Malaysian – and fans in the market have followed them across borders.

- South Korea: Over a third (36per cent) of esports fans are T1 fans, one of the most storied Korean esports organisations. Cloud9 is also popular in the country, unsurprising given it has several teams under its umbrella with a majority or all of its players being South Korean.

- USA: American esports fans tend to gravitate toward successful teams regardless of borders, but American-based organisation Cloud9 still holds a slight advantage in this market. Of note, influencer-driven team organisations 100 Thieves and Faze Clan also rank highly in the US, but engagement is more limited in other regions.

Global Fan Profiles in action: Understanding Garena Free Fire’s fanbases around the world

After debuting in 2018, the mobile battle royale game became wildly successful in Southeast Asia and Latin America. Garena Free Fire filled a market gap for playable battle royale games in developing countries given the scarcity of phones powerful enough to run PUBG Mobile or Fortnite, and its popularity has since caught fire in countries such as Brazil, Peru, Indonesia, and Vietnam.

While people who follow esports tend to be younger in many countries, the share of people who watch or follow Garena Free Fire in Brazil is more equitably split across age groups. While nearly 6 in 10 fans in Brazil are within the coveted 18 to 34 demographic, another 21 per cent are aged 45 and over. In Peru, 14 per cent of the game’s fanbase skews 45 and older though a full 53 per cent are under the age of 25.

In select markets, the game is also unique for its popularity among the female esports audience compared with more traditional esports titles such as League of Legends or CS: GO. Significant minorities of those who watch or follow Garena Free Fire are women and this is true in the game’s biggest markets such as Brazil, India, Peru, and the US. In Indonesia, two in five (41%) fans of the esports title are female.