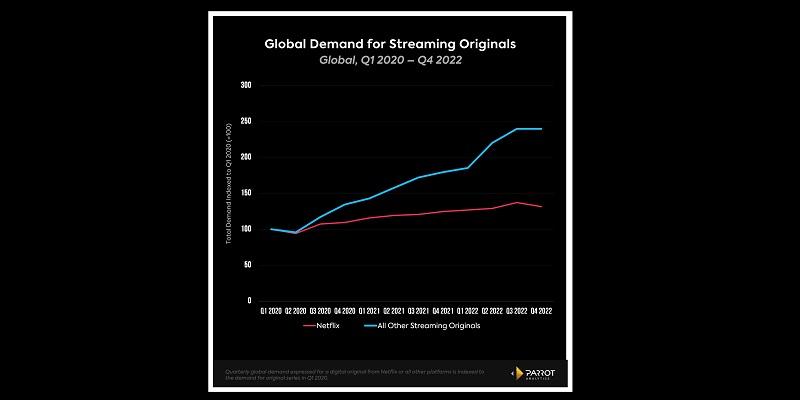

A recent study by Parrot Analytics revealed that after nine consecutive quarters of growth, the total demand for original content on Netflix reversed course and shrank in Q4 2022. It went down 4.1 per cent as compared to Q3 2022. To everyone’s surprise, the total global demand for all original SVOD series shrank by 1.6 per cent in Q4 2022 compared to Q3, hinting at the fact that they may be approaching saturation levels.

After record breaking demand for Stranger Things in Q3 this isn’t a major surprise. The total demand in Q4 2022 was still 1.85 per cent higher than Q2 2022, owing to a new season of Emily in Paris and breakout smash hit Wednesday, among others. When we look at the trend of demand growth for originals on all other streamers combined, we see that after growing 139.8 per cent between Q1 2020 and Q3 2022, that growth effectively flatlined in Q4 2022, with total demand for all streamers besides Netflix up a minuscule 0.05 per cent.

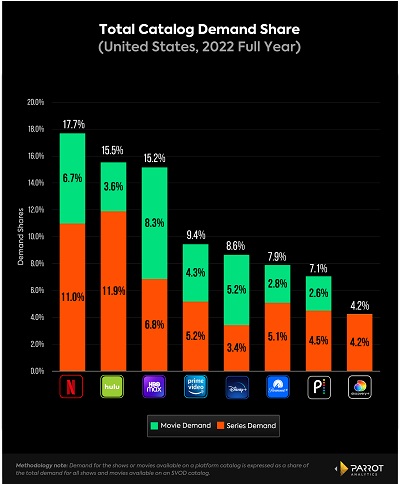

Total Catalog Demand Share — TV & Movies Combined: US, FY 2022

This is Parrot Analytics’ first ever reveal of the total demand for each major SVOD’s full catalog — all TV and movies, both licensed and originals, combined.

- During the year 2022, Netflix had the most in-demand overall catalog at 17.7 per cent share with US audiences.

- This broader look at the streaming landscape shows a more competitive field than demand for original TV content only, with a clear Big Three — Hulu (15.5 per cent) and HBO Max (15.2 per cent) are both within striking distance of Netflix.

- However, when factoring in potential future platform consolidation at both Disney and Warner Bros. Discovery, Netflix would fall into third place. Hulu and Disney+ combined would be 24.1 per cent, while HBO Max and Discovery+ combined would be 19.4 per cent, both outpacing Netflix’s 17.7per cent.

- While demand for original content drives subscription growth, library content is key for customer retention, and the catalog demand is a good indicator of which SVODs consumers are most likely to use as a default ‘streaming home.’

- Breaking it down further, HBO Max is the leader in catalog demand for movies but in third place for TV. Hulu is the leader in TV but is in fifth place with movies. Netflix’s second-place position in each of those categories puts it over the top when all the demand is combined.

Global Streaming Original TV Demand Share Q1 2020-Q4 2022

- In Q4 2022, Netflix’s global share of demand for original TV content fell below 40 per cent for the first time ever, dropping to 39.6 per cent. In the United States, Netflix’s share dipped to 40.9 per cent from 41.5 per cent, but that was still ahead of the US record low of 40.5 per cent in Q2 2022.

- The stronger numbers in Q3 2022 were fueled by record breaking demand for season four of Stranger Things, which hit higher peak demand than any streaming original as tracked by Parrot (data goes back to 2015).

- Disney+’s demand share grew almost a full percentage point in Q4 2022, up to 10.2 per cent. This is the highest ever quarterly global demand share for Disney+, and the first time the platform has cracked double digits. Disney+ is now within one point of overtaking Amazon Prime Video (11.1 per cent) for second place in global demand for streaming original series.

- The Disney+ growth was driven by demand for its flagship franchises: Marvel and Star Wars. Disney+ originals accounted for four of the top 10 most in-demand streaming originals with global audiences in Q4 2022: #4 Andor (51.5x more in-demand than the average show globally) #5 She Hulk: Attorney at Law (50.6x), #7 The Mandalorian (43.8x), and #10 Moon Knight (39.6x).

Global Streaming Original Demand Share Full Year 2022

- For the full year 2022, Netflix’s global demand share for original TV content fell to 41.5 per cent. Netflix finished at 47.1 per cent in 2021, and 53.5 per cent in 2020.

- Fellow legacy streaming outlets Hulu (5.8 per cent to 5.4 per cent) and Prime Video (12.2 per cent to 11.2 per cent) also lost demand share in 2022.

- So which outlets cut into Netflix’s lead? The SVODs that gained the most demand share in original TV content in 2022 were:

Disney+ (7.4 per cent to 9.8 per cent)

HBO Max (5.0 per cent to 6.0 per cent)

Paramount+ (3.2 per cent to 4.2 per cent)

Apple TV+ (5.8 per cent to 6.5 per cent)

These platforms combined for a 5.1 percentage point gain in 2022, accounting for the vast majority of Netflix’s 5.6 per cent year over year loss. This decrease in demand is also a possible warning sign that the global streaming market may be nearing a saturation point, suggesting that consumers have quite literally seen enough, or at the very least are done adding new SVODs to their inflation-impacted personal budgets.