Despite the ban on popular gaming titles like BGMI and Free Fire, the esports industry in India remained resilient, with tournaments continuing to thrive. Now, as the ban lifts, the industry is poised for even greater growth.

AnimationXpress spoke to India’s biggest esports tournaments organiser Skyesports and Ampverse – whose newly launched collegiate esports IP College Rivals is fast garnering attention of the gaming community – to understand the scale of esports events in 2023 and fruitful collaborations forged by the tournament organisers. The two organisers also spoke about the evolution in the Indian audience’s perception of esports, the challenges as well as production improvements in organising tournaments.

Scale and reach of esports events

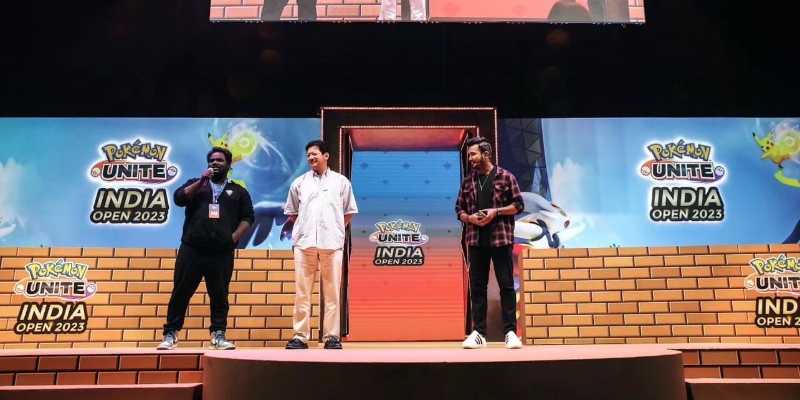

Skyesports organised several open-for-all tournaments for Pokemon Unite, Counter-Strike and BGMI, and saw more than 10,000 players compete across its IP throughout the year.

In 2023, the organiser’s esports tournaments gave out a combined $1.5 million in prize pools. “This growth in prize money came as we were able to attract more sponsors by making our IPs more lucrative,” said Skyesports founder and CEO Shiva Nandy.

He added, “Viewership saw a sharp year-over-year increase particularly due to the return of BGMI. Our Skyesports Champions Series – BGMI, saw a peak viewership of 131,000 people. Additionally, we witnessed growth in the viewership numbers of Pokemon Unite as well as Counter-Strike, two titles that will be building even further in 2024.”

Ampverse, whose College Rivals took esports to various colleges across India, saw a total footfall of 70,000, with 67 million views and a prize pool of 50 lakh rupees.

Bringing brands on board

Major collabs were seen between esports tournament organisers and broadcast/streaming services. Krafton India teamed up with JioCinema to stream the Battlegrounds Mobile India Series (BGIS) live. The Skyesports Masters announced Loco as its broadcasting partner. Nodwin Gaming collaborated with Indian broadcaster Star Sports for BGMI Masters Series.

Collegiate esports IP College Rivals onboarded CrepDog Crew as its merchandising partner. CrepDog Crew is a clothing and accessories brand which is a popular brand among the Genz audience. Apart from this, College Rivals onboarded JioGames as media partner, Nostra as associate partner, Glance as a smart lock screen partner and Philips as styling partner.

Skyesports partnered with brands like Flipkart, AMD, Red Bull and Zebronics. The tournament organiser tied up with the smartphone brand Tecno to organise four seasons of the Pova Cup throughout the year.

For Skyesports Championship 5.0, the organiser’s broadcast partner Loco introduced a VIP feature, making viewers pay to watch the BGMI tournament. “This was a risk and the first time it was happening in the Indian esports industry, but thanks to the value of our IP, a lot of people bought the VIP subscription and tuned into the competition,” Nandy shared.

Evolution in Indian consumers’ perception of esports

Watching game streaming and viewing esports is now growing as an alternate entertainment next to digital content consumption. And with that, the perception of Indian consumers towards esports is also evolving.

“Few years back, the esports and gaming scene was restricted to gaming cafes. Now it is open to the entire world and streaming played a crucial role in it. Streaming made gaming and esports very much mainstream. It has helped build a new generation of content creators,” said Ampverse India country head Ashwin Haryani.

“Perception of Indian consumers towards esports has changed drastically. Today’s Indian consumers take gaming seriously. They watch live streams of people playing online games, attend LAN events. One of the best examples is the recent BMPS which took place in Gujarat where more than 20,000 people attended the event,” he added.

But monetising Indian esports for consumers who are used to watching the tournaments for free is a challenge, said Nandy. “Currently, the only way to do it is through advertising revenue which tends to be less, considering that the average age of an esports viewer is 20 years. Thus, building esports communities and holding them for the years to come is important for effective monetisation.”

“Our experiment with the Loco VIP showed that esports viewers will pay if there is enough incentive for them to do so. Obviously, this doesn’t mean that we lock all our IPs behind a paywall. We are still figuring out the best way to tackle this,” Nandy shared.

“Overall viewership is certainly higher than in 2022, but individual games are seeing a fall in esports viewers when compared to the past few years,” he further shared. “This isn’t a worrying trend though, as it indicates a market correction from inflated pandemic values where everyone was stuck in their homes with limited options for entertainment that brought more people to esports.”

Improvements in event quality

Ampverse India’s Haryani shared the technological and production improvements implemented by his organisation:

- Developed a communication ecosystem with multiple channels including WhatsApp, email and Discord for strong, effective and efficient support and information channel

- The playbook and structure of College Rivals was revamped and customised compared to traditional esports events, to create an exciting and inclusive event for all college students across India.

Challenges in organising events

From technical issues to sponsorships, tournament organisers faced multiple challenges through the year, but implemented innovative strategies to resolve them:

- Technical challenges: Ensuring a seamless online experience for participants, including minimal latency and technical glitches.

Solution: Organisers invested in robust server infrastructure, collaborated with tech experts to optimise online platforms and conducted regular technical rehearsals.

- Sponsorship and revenue: Though the popularity of esports has grown drastically, there are many factors that affect the sponsorships and revenue streams for esports tournaments.

Solution: Organisers explored virtual sponsorships within online game environments; and used digital marketing to engage sponsors and maintain revenue streams.

- Cheating and fair play: Ensuring fair play and preventing cheating in the absence of on-site monitoring

Solution: Enhanced anti-cheat measures, monitoring tools and mechanisms for reporting suspicious activities were implemented.

- Player well-being: Balancing the competitive spirit with the well-being of players.

Solution: Tournaments implemented strict schedules, breaks and guidelines, and integrated educational initiatives on responsible gaming and well-being.

What’s in store for 2024?

For Ampverse India, the first quarter of 2024 is significant as the grand finals of College Rivals take place in the first week of March. The finals will be a fusion of esports, gaming, music and fashion, with the presence of influencers and industry experts.

“After that, we will soon announce the second season of College Rivals. We are bringing more IPs this year, many of which will be women-centric,” Haryani said.

Skyesports has announced its 2024 Counter-Strike 2 roadmap with a US$1 million prize pool featuring six LAN events. “Our Counter-Strike roadmap will also feature teams from North America and Europe, signifying our expansion to new markets,” Nandy stated.

Apart from that, the company will focus on games like Real Cricket, BGMI, Pokemon Unite, and more, taking its total prize pool to more than US$2.5 million.

With increased interest in esports viewership and brand awareness on the rise, there is no stopping esports tournaments to go full throttle in 2024.

This marks the third segment of our comprehensive year-end review on the Indian esports industry.

Read part 1: Indian esports teams’ triumphs in 2023: Victories, brand collaborations, and elevated fan engagement

Read part 2: Indian esports sector in 2023: Challenges, resilience & shifting perception