Mumbai based mobile gaming company Nazara Technologies, is expected to raise $50 million through the private equity route.

A number of private equity investors are interested in Nazara given its strength as a profitable venture, as per a VCCircle report. The firm’s valuation is expected to be 7-8 times its annual revenue of Rs 300 crore.

Founded in 2000, Nazara gained traction when it changed course in 2003 to make games for mobile phones. In 2006 and 2007 it raised around $3 million from WestBridge Capital.

Nazara founder and CEO Nitish Mittersain has revealed that discussions are currently going on and that he wouldn’t be able to comment on the fundraise at this point in time.

“Nazara is the dominant player in mobile gaming and is growing both its top and bottom-line. All I can say is that we are happy shareholders,” WestBridge Capital MD Sandeep Singhal, told VCCircle.

Nazara floated a Rs 10 crore seed fund to back ventures in the gaming space in mid 2014. This led to it investing Rs 4.2 crore in Bangalore-based social gaming startup HashCube Technologies along with other existing investors like Blume Ventures, Indian Angel Network, ah! Ventures San Francisco based entrepreneur Perry LaForge.

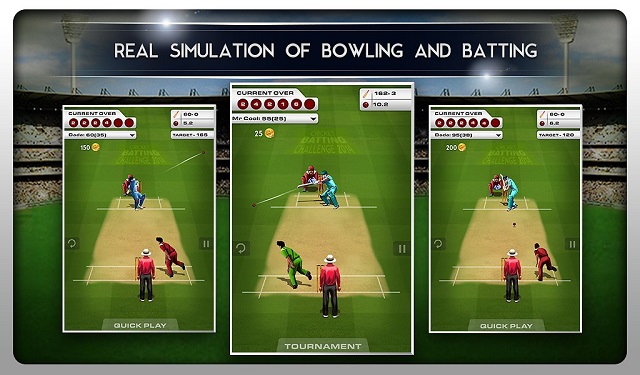

The company also tied-up with CSE to develop, distribute and market games around cricketer Virat Kohli for three years. The deal allows Nazara exclusive rights to create games around the cricketer on mobile, web and DTH platforms.

According to a recent report by FICCI-KPMG 2015, the mobile gaming industry in India is expected to touch Rs 2,620 crore by 2019, with a year-on-year growth of 20 per cent due to the smartphone penetration in the country. From Rs 820 crore in 2013 to Rs 1070 crore in 2014, the mobile gaming market is one of the exciting segments in the country.