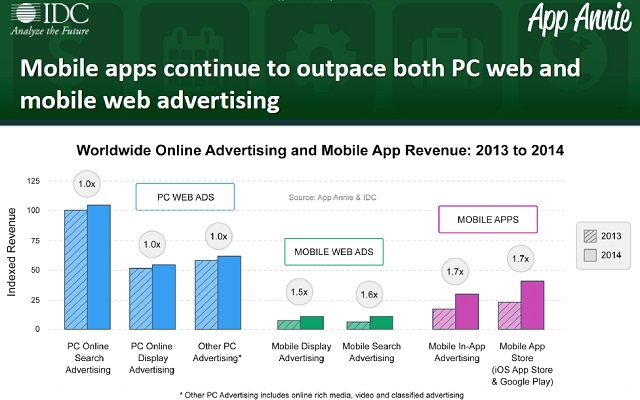

Monetising through in-app advertising and various app stores has seen a significant growth than other mediums according to the recently released App Annie – IDC joint annual report. The report titled Mobile App Advertising and Monetisation Trends 2013-2018: Freemium and In-App Ads Expand Their Lead highlights that mobile app revenues are beginning to displace other forms of monetisation, including mobile browser and PC-based advertising, and freemium and in-app advertising models driving the majority of growth among various business models.

“App Annie has tracked the growth of the mobile economy since its infancy, and we’re really starting to see publishers hit their stride with mobile in-app revenue growing 1.7x last year,” said App Annie CEO and co-founder Bertrand Schmitt. “The continued innovation in mobile apps, monetisation models and mobile advertising have driven significant growth in freemium and in-app advertising revenues. The space has matured significantly and publishers have the required ‘know-how’ to monetise off the significant app usage they’re generating.”

The Mobile Advertising and Monetisation Spotlight 2013-2018: Freemium and In-App Ads Expand Their Lead explores a variety of trends and helps publishers and others in the app ecosystem understand the consequences they may have on tomorrow’s business decisions.

Some key takeaways from the report include:

# Freemium drives mobile app revenue growth: Freemium app revenues grew by over 70 per cent, while paid and paidmium app revenues declined by 19 per cent and 24 per cent, respectively. The maturity and general success of the freemium model are clearly evident in freemium’s dominance of direct app revenue models. Mobile app revenue per device (including advertising) is projected to grow 2.5x by 2018.

# Mobile in-app advertising is set to overtake online search advertising: Mobile in-app advertising revenue also grew by 70 per cent, outpacing both mobile and PC browser-based ads. By 2018, spending on mobile in-app advertising alone (in the 10 key countries measured*) will be greater than spending on online search advertising, today’s digital advertising juggernaut.

# A lot of different freemium techniques which align best with each app and its user base are mentioned with monetisation based on the ‘Usage’ of the app – where one can make the app free to use for a limited number of time and pay for using the app after the limit is exhausted. Examples of this kind of app is the New York Times app which allows only a certain number of articles that can be read each month and to read more one has to pay.

‘Free trial’ allows the app to be used for certain amount of time after which one has to pay to use the app. Example for this is Whatsapp messenger where one has to pay the app developers after the one year free service to use the app after the time period.

‘Functionality’ is one of the many ways where one pays for virtual items, speed-ups and content. Best examples for this category is casual game Clash of Clans and Skype. ‘User Experience’ is ad-supported or pay more to remove ads from the apps. New Words with Friends is using this freemium technique to its best use.

And the last one is the combination of all and Evernote is the excellent example of using the functionality and usage techniques.

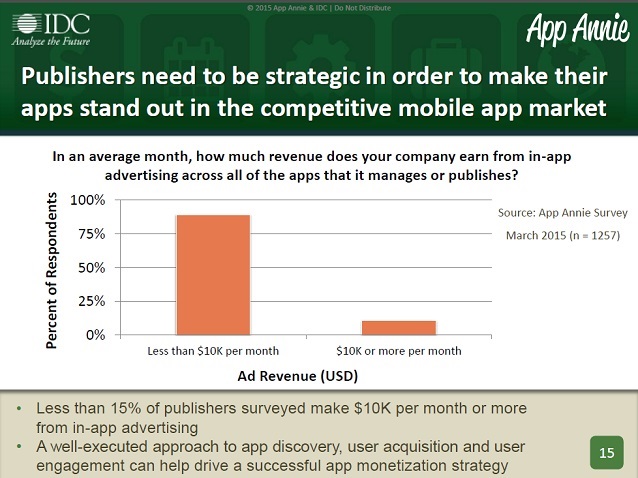

# Publishers are now open to paid advertising within their apps and the percent has grown from 42 per cent 2013 to 49 per cent in 2014. But, publishers must consider aspects like user experience to strike the right balance between monetising through app stores and monetising through in-app advertising. Less than 15 per cent of publishers surveyed make $10,000 per month or more from in-app advertising. A well-executed approach to app discovery, user acquisition and user engagement can also help drive a successful app monetisation strategy.

# Finally, geography matters and it’s not one-size-fits-all across countries; revenue generated through app stores versus in-app ads widely varies across countries. India brings in 70 per cent of its app revenues via in-app ads while Japan makes more money via app stores (81 per cent). The US and Japan are the largest markets for mobile app revenue, but emerging markets such as Brazil,India and Russia are projected to quickly grow through 2018.