Lumikai, India’s pioneering gaming and interactive media VC fund, released new consumer research from its State of India Gaming Report 2022, in collaboration with Amazon Web Services (AWS).

The new research is the most comprehensive primary study on Indian gamers ever conducted by surveying over 2,240 smartphone users across multiple demographics and geographics.

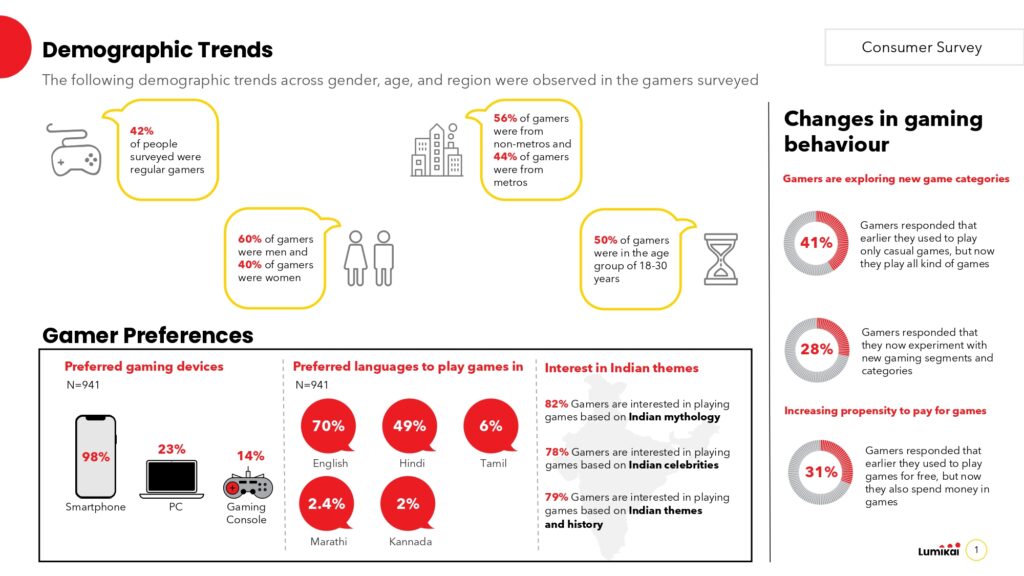

India’s gamer demographics demonstrate a diversity of play styles and geographies

Of the people surveyed, 98 per cent play games on smartphones, with 23 per cent playing on PCs/laptops and 14 per cent on gaming consoles.

56 per cent of gamers surveyed came from non-metros, while midcore and hardcore categories provide the highest percentage of metros users at 53 per cent and 59 per cent respectively. 60 per cent of gamers surveyed were men, with 40 per cent being women. Relaxation is the top motivator for gamers with over 50 per cent, followed by making money (13 per cent), killing time (12 per cent), and socialising (11 per cent).

While 70 per cent of the gamers surveyed preferred the English language, other languages preferred were Hindi, Tamil, Marathi and Kannada.

Indian gamers spent on average 8.5-11 hours per week on gaming, women more than men

Indian gamers spent an average of 8.5 – 11 hours per week on gaming, with women on average spending more time per week playing games (11.2 hours/week) as compared to men (10.2 hours/week). Average time spent per week is highest in mid-core (3.4 hours/week; an example of a mid-core Game – is BGMI, Clash of Clans) followed by hardcore and real money games (RMG) (3.3 hours/week; examples of hardcore games – DOTA 2, Genshin Impact).

The survey revealed that 48 per cent of non-gamers chose casual games (examples of casual games – Ludo King, Candy Crush) as their most preferred game category to play in the future, with 35 per cent of gamers acknowledging that they have increased their time spent gaming in the last 12 months.

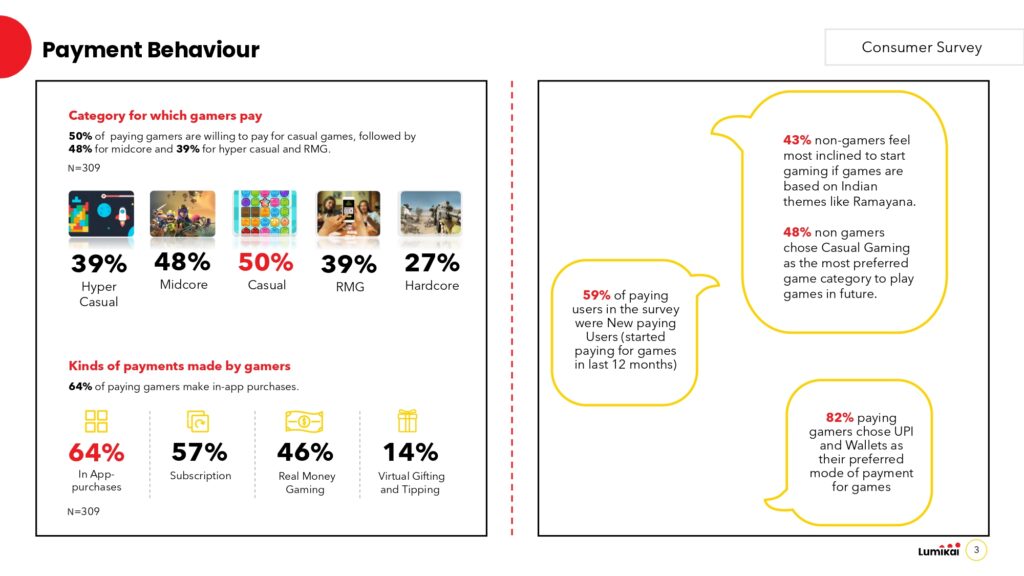

What drives paying gamers to make purchases?

The report highlights that 64 per cent of paying gamers make in-app purchases, followed by subscription payments at 57 per cent. 59 per cent of payers have started paying for games in the last 12 months. The trend further shows that 50 per cent of paying gamers are willing to pay for casual games, followed by 48 per cent for mid-core and 39 per cent for hyper-casual and RMG. Though 45 per cent of paying gamers are incentivised by the potential to make money, willingness to pay is also driven by new content/levels (43 per cent) and better in-game items (44 per cent).

Play Indian: 80 per cent of Indian gamers are keen on Indian-themed games

An interesting highlight of the report is that in the Indian gaming community, Indian-themed video games are becoming more popular. 82 per cent of gamers are interested in playing games based on Indian mythology, and even 43 per cent of non-gamers are more inclined to start gaming if games are based on Indian themes like Ramayana. 79 per cent of gamers are interested in playing games based on Indian themes and history, whereas 78 per cent gamers are interested in playing games based on Indian celebrities.

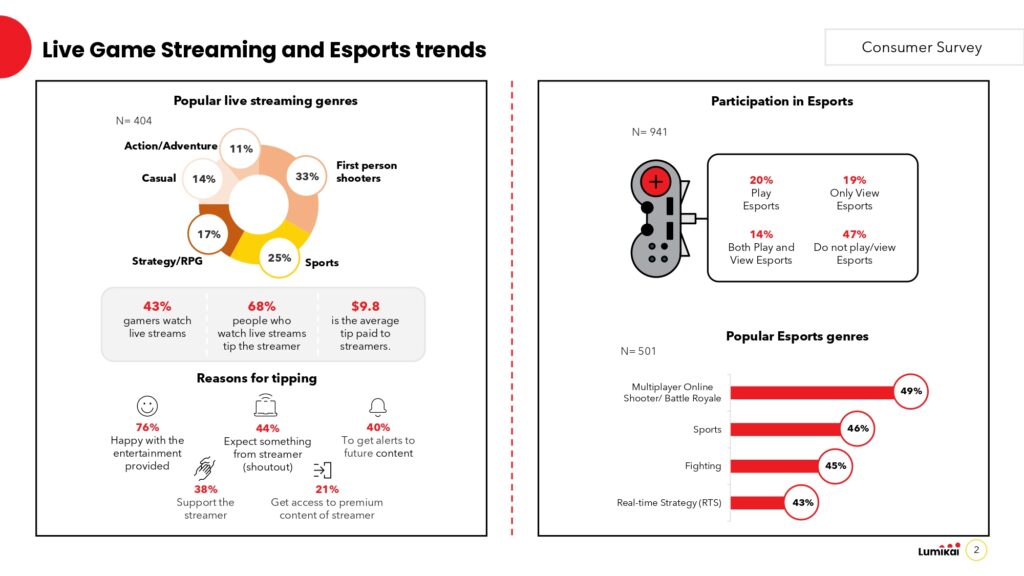

Popular Esports Genres

The most popular esports genre is multiplayer online shooter/Battle Royale, with 49 per cent of the surveyed people preferring it. The other genres are sports (46 per cent), fighting (45 per cent) and real-time strategy (43 per cent).

E-sports industry in India: The emergence of a gaming colossus

The report highlights that the Indian e-sports industry grew to $40 million in 2022 and is expected to reach $140 million by 2027 at a CAGR of 32 per cent. The number of e-sports players in India grew 4x from 0.15 million in 2021 to 0.6 million in 2022, and is expected to grow 2.5x over the next five years to reach 1.5 million by 2027. Esports revenue at $0.04 billion is a small segment currently but is fast growing at 32 per cent CAGR through to 2027.