The tenth edition of ‘Crisis Consumption on TV and Smartphones’ report has been jointly released by BARC India and Nielsen Media today, 9 July. The report shows that the kids sector has grown by 2 per cent in the first half (H1) of 2020 (week one to week 26) than 2019 in the shares of genre viewership. It now stands at 8 per cent from 6 per cent in 2019. [Week 26 – 27 June to 3 July]

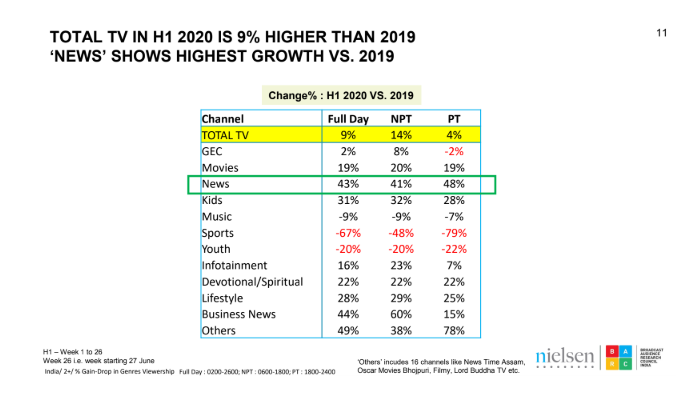

Total TV viewing in kids sector in H1 2020 has seen significant change, in comparison to 2019, as Full Day TV viewing stands at 31 per cent, NPT (Non Prime Time) TV consumption is higher at 32 per cent than the last year, as well as pre-COVID period and PT TV (Prime Time) consumption is 28 per cent more than the past year.

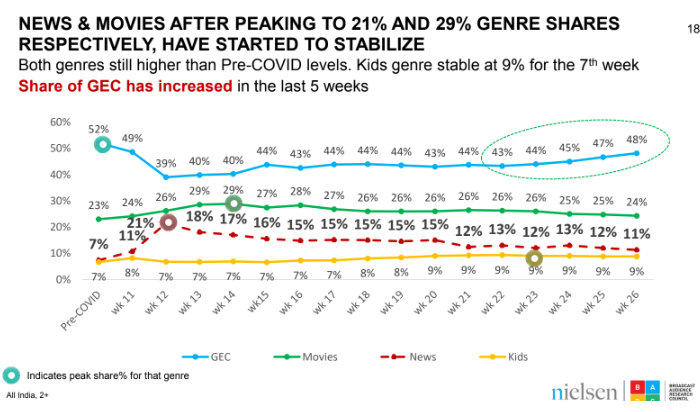

In terms of genre shares, kids genre stands at 9 per cent in week 26, stable for the last six weeks (beginning from week 20), which is a 2 per cent increase from 7 per cent, than the pre-COVID period (11 January to 31 January).

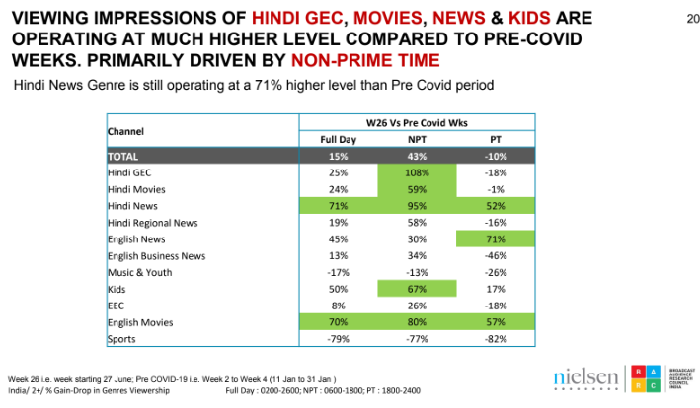

The viewing impressions of the sector is operating at a much higher level compared to the pre-COVID period, primarily driven by NPT (6 am to 6 pm) which is 67 per cent higher in week 26 (27 June to 3 July) as schools are closed due to the rise in positive cases and ongoing lockdown. Full day viewing impression is 50 per cent higher and PT (6 pm to 12 am) stands at 17 per cent more than pre-COVID times.

These numbers are going to stay similar for the coming weeks if not increase as the possibility of schools reopening is blur till August 2020.

In week 26, Nick continues to be on top in the ‘Top 5 Channels’ list followed by Hungama, POGO, Sonic and Disney Channel in respective order.

Motu Patlu in Octopus World tops the ‘Top 5 Programmes’ category followed by Bheem Ban Gaya Superstar, Motu Patlu : Superheroes vs Alien Ghost, Motu Patlu : Kyurem Ka Muqabla and Rudra vs The Forces of Nature.

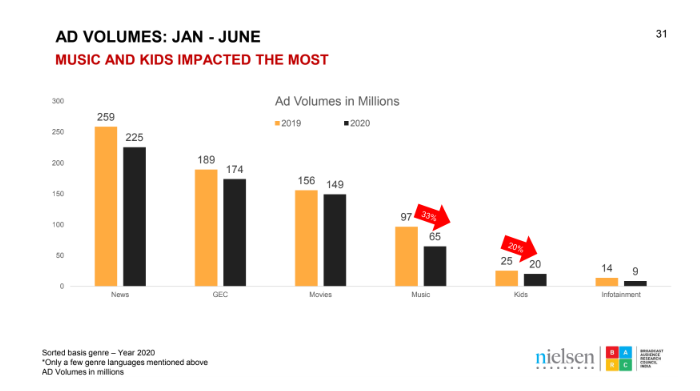

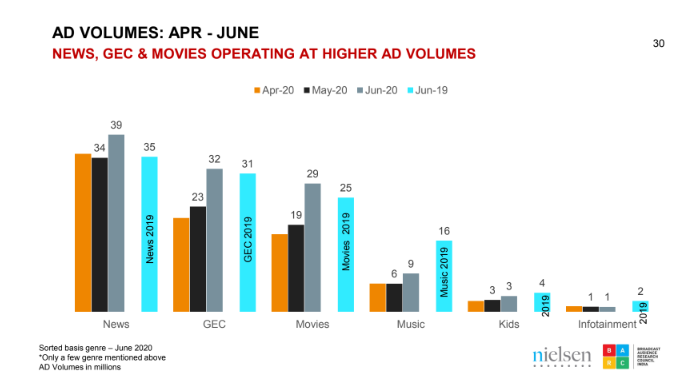

Advertising (Ad) volumes in the kids sector has seen a drop, from four million(mn) in 2019 to three million in 2020, as of June. It’s the most impacted sector in H1 2020 (January to June) besides Music, as Ad volumes have seen a decline of 20 per cent than 2019 – from 25 mn to 20 mn.