India’s OTT market is growing with leaps and bounds with increasing number of players and content that’s keeping the audience video hooked.

According to Kantar’s report on OTT services, India is soon going to hold prominent place among the top global OTT markets. The report brings together learnings from TGI, WAM and a study done among 5000+ OTT users.

It covers urban audience as well as tier two and three for the 15 – 55 age demographic. The report suggests that the video OTT market in India, which primarily comprises content streaming services, is likely to be ranked among the top 10 markets globally in the very near future.

Important observations are :

- Usership numbers for OTT and players using the Web Audience Measurement Panel.

- Understanding OTT usership behaviour and preferences using the custom study among OTT users .

- Covers usership information in terms of frequency , time spent , content preferred, drivers and barriers for using the platform/players, pain points while using the platform.

- Profiling cross media information from TGI : Answering the five-W question on OTT – what is the detailed profile of OTT users, free vs. paid users, brand users.

- Understanding the attitude and behaviour of OTT/players from TGI.

- Understanding their lifestyle and purchase habits.

- Cross media habits : Overlap between television and OTT .

- Extent of overlap, profile of dual users, differences in viewership etc.

Kantar MD and chief strategy officer Kantar South Asia Hemant Mehta said, “In the last two years, the rise of OTT as a medium of entertainment has been anything but stupendous! Our study shows that with older age groups (35+ years), women and consumers from lower social classes are flocking to OTT platforms, and the medium is now truly becoming a mass medium. Aiding this move is the wide range and choice of content being made available in the local languages. Today, OTT consumption is redefining prime time and the role of television at home, as the bulk of viewing on OTT platforms is now taking place at home.”

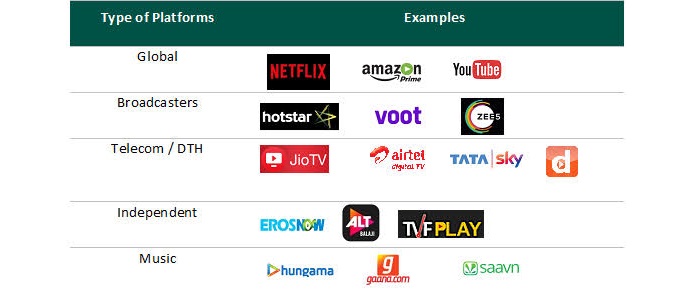

In a fiercely competitive market of 30 existing players, the dominant players include Disney’s Hotstar, Amazon Prime Video, Zee5, Alt Balaji, MX Player, Eros Now, Viacom18’s Voot and Sony LIV. A recent PwC report projects the Indian OTT market value to reach $1.6 billion by 2023.