The Indian VFX industry has been gradually climbing up the ladder with adaptation of world-class techniques and innovative technology. The content creators are upping their storytelling with marvelous VFX advancements. Statistics by the recent FICCI EY report confirm the exponential growth of India’s M&E space with VFX and post production facilities moving up the value chain.

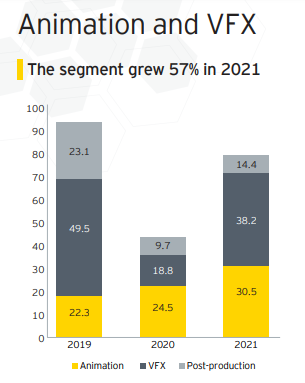

In 2021, the Indian VFX sector grew by 103 per cent to reach Rs 38.2 billion, while post-production grew by 49 per cent to reach Rs 14.4 billion.

The key factors that contributed to the growth are:

1) OTT platforms sourced more Indian content at global quality

The production audit team of EY estimated that over 2,500 hours of original content was produced for OTT platforms in India, up from around 2,000 hours in 2019, and this is expected to reach 3,500 hours by 2024. The quality of Indian content has found resonance with customers across the globe, and therefore has automatically led to higher quality standards.

Earlier, five per cent to eight per cent of a show’s production budget was for VFX, which has now increased to 15 per cent – 20 per cent of the production budget, whether for films or episodic content.

2) Forced work-from-home ended up becoming an advantage for studios

In 2020, Indian studios introduced work from home and hybrid pipelines, which got advanced using cloud and other technologies, and got stabilized and artist friendly by the end of 2021.This led to more Indian studios setting up shop internationally and international studios opening their branches in India.

But the key benefit was enhanced efficiency as these measures enabled studios to become more efficient. Larger studios that got appointed as the main VFX studios for a project were thus able to take bigger pieces of work, and in turn they could sub-let the work to smaller studios all over the country, leading to job creation.

3) Domestic demand revival spurred post production

Direct to OTT film releases, higher quality OTT content and recovery in broadcast content demand led to the recovery of post-production revenues from domestic markets. Altogether, 75 to 85 per cent of the revenues of this segment were from domestic projects, where film production still lags pre-pandemic levels.

4) The multi-language release formula led to increased volumes

Platforms like Disney+ Hotstar, Netflix, Zee5, MX Player and Amazon Prime Video are releasing content in seven to 10 different Indian languages. This is giving a fillip not just to audio post-production business, but also dubbing, titling, sub-titling, promo creation etc.

In addition, international platforms like Amazon Prime Video, Zee5 and Netflix are releasing Indian films in several foreign languages —a trend which should continue given the success seen by these products with international audiences. Regional movies that were released in many countries played a vital role in the growth of the local post-production industry along with broadcast and audio localization.

Pertaining to VFX, the report further mentions that there has been an increase in the adoption of real-time technology/virtual production. Their survey reveals the following points:

a) Indian studios have started adopting virtual production and in the next two to three years, virtual production will become a far more common practice.

b) It is expected that around 50 per cent of Indian animation and VFX studios will adapt to real-time technology/ virtual production by 2025. Bigger studios have already started using software like Unity and Unreal in their pipeline. For smaller studios, this could be a challenge because of the kind of investments involved in implementing these technologies, and will probably be used for specific projects.

However, India needs to up its game in virtual production to stay relevant in the global content marketplace —education and training are necessary for the sector to achieve its growth potential.

Jointly the animation, VFX and post-production sector is expected to reach Rs 180 billion by 2024.

Key drivers of growth will include:

- Increased demand for higher-quality domestic film and episodic content

- Content crossing language barriers — nationally and internationally

- Increased adoption of virtual production and rising VFX budgets for content

- Increased offshoring of projects to India as the global content economy expands with new OTT platforms.

However, the key risk remains availability of quality talent, for which much needs to be done around training and upskilling.