People across the globe are spending more time than ever playing games while sheltering in place, with an estimated 2.7 billion users set to spend $77.2 billion on mobile games in 2020. A new report from global app marketing platform Adjust charts the rise of a gaming app genre uniquely poised to benefit from this growth – hyper casual. This game genre consists of lightweight, addictive games that are instantly playable and infinitely replayable. The report analysed advertising campaign datasets across hyper casual games from Unity, the real-time 3D content creation platform which offers a premium global advertising inventory and network.

The reports findings show that hyper casual games saw tremendous growth on mobile in the first quarter of 2020, with app engagement and downloads all jumping to record highs. The report draws on data from the top 1,000 and all apps tracked on the Adjust platform, and hyper casual ad campaigns across Unity’s network between Q4 and Q1 2020.

Key findings include:

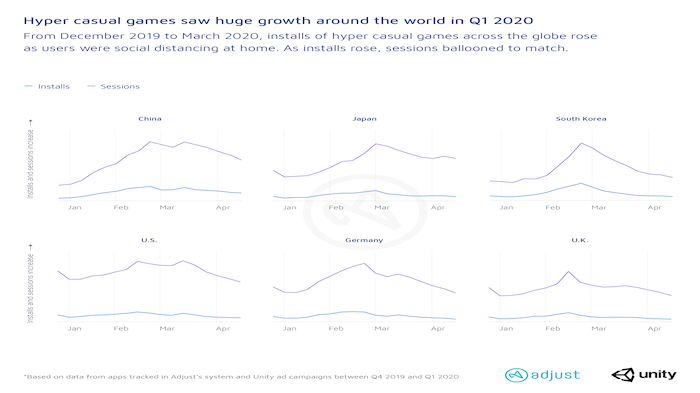

- Installs more than doubled globally. More than 103 per cent from December 2019 to March 2020. The highest increase was observed in China, which grew 3.5x in the same four months.

- App sessions ballooned to match, as users spent more time playing the games they downloaded.

– Sessions grew 72 per cent in March globally.

– China led the pack with a 300 per cent increase in sessions between December 2019 and March 2020, while Korea registered a 152 per cent increase.

– Sessions in Japan and Germany rose by 137 per cent and 69 per cent, respectively.

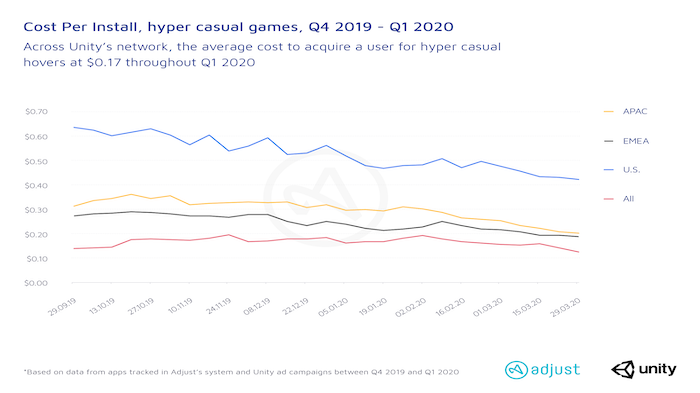

– On the lower end of growth, U.S. sessions increased by 35 per cent, and rose 34 per cent in the U.K. Because hyper casual users in the US are already heavy gamers — contributing to 15 per cent of the global sessions based on an average from December 2019 to April 2020 — the increase was not as large. - Attractive Cost Per Installs (CPIs) are everywhere. While overall CPIs decreased 35 per cent by the end of March, the cost of acquiring hyper casual users in the U.S. is more than double that of EMEA ($0.19). Nevertheless, marketers can expect the highest conversion rates (17 per cent) from the US, the gold standard of hyper casual mobile gamers. At the same time, costs in APAC declined sharply, at around $0.20. Globally, CPIs are much lower, averaging $0.17 in Q1 2020. This is likely attributed to the impact of much lower CPIs in LATAM, specifically countries such as Brazil and Mexico, where large and eager user bases can’t get enough of these games.

Hyper casual games combine simple mechanics and minimalistic design, resulting in highly engaged users, who are more likely to accept and engage with advertisements. Because of users’ openness to ads, hyper casual games have been able to build a unique business model for mobile gaming, relying on ad monetization for 95 per cent of their revenue.

“Hyper casuals cleverly blend the best ad experience and most engaging mechanics to appeal to the broadest category of players. In doing so, they have redefined the traditional models around user acquisition and ad monetization. Because of the short-lived appeal of each of these games, users are continuously driven to the next app within a company’s portfolio — creating a snowball effect, as users roll and grow the company’s user base,” said Paul H. Müller, co-founder and CTO of Adjust.

“Hyper casual games have been voraciously consumed as of late due to more people staying inside with COVID-19, and that in turn has created fierce competition for the attention of these engaged users.Understanding the metrics and mechanics behind this genre allows developers to set their user acquisition targets and related monetization strategies up for success, particularly during the new reality we all live in. This report and our work with Adjust guides buyers in understanding how to harness Unity’s massive ad platform in this very profitable moment for mobile gaming,” said Unity Technologies head of global advertising sales Agatha Hood

As a result, hyper casual developers have become masters of ad effectiveness. They boast exceptionally high click-through and install rates at an average 22 per cent and 14 per cent, respectively.