Games are playing a pivotal role in our society as the pillar of entertainment, social connection, and relief. Gaming has been easing the lockdown woes of millions during the COVID-19 pandemic. Consumers are spending more time gaming than ever, and the gaming market has seen unprecedented levels of engagement in the first half of 2020.

The lockdown measures across the world have accelerated—and even catalysed—the growth in the games market. Ten years ago, younger generations were leaving behind traditional media for social media. Today, they are leaving behind social media for the more interactive experiences that gaming offers. Playing games has always been an inherently social experience, and this year, the World Health Organisation officially promoted video games as a recommended social activity during the pandemic. Market Research firm Newzoo has launched a new report 2020 Global Games Market Report which shares :

- Mobile gaming (including both smartphone and tablet) remains the largest segment in 2020, with revenues of $77.2 billion and growing +13.3 per cent year on year. The fastest-growing mobile gaming ecosystems are in emerging markets in the Asia-Pacific region and the Middle East and Africa. However, the Americas, Europe, and China will also enjoy strong growth. There will be 2.6 billion mobile gamers in 2020, of which just 38 per cent will pay for games

- On PC, browser game revenues will continue to decrease as more gamers convert to mobile gaming. In 2020, browser revenues will decline -13.4 per cent year on year. Downloaded/boxed PC games will generate $33.9 billion this year. PC games will generate $36.9 billion in 2020, making it the third-largest segment.

- Engagement and revenues on console are set to grow due to the lockdown measures, at least in the short term. COVID-19 is also having adverse effects on console gaming, as physical distribution, massive cross-company collaboration, and certification are a significant part of console game development. These factors, along with the continued shift toward the games-as-a-service business model, will drive 2020’s console game revenues to $45.2 billion, growing at +6.8 per cent year on year.

- The current console generation of Xbox One and PlayStation 4 is coming to an end this year, meaning the installed base for these consoles is at its highest. The Nintendo Switch continues to be successful. Console is 2020’s second-largest segment, growing +6.8% year on year to $45.2 billion.

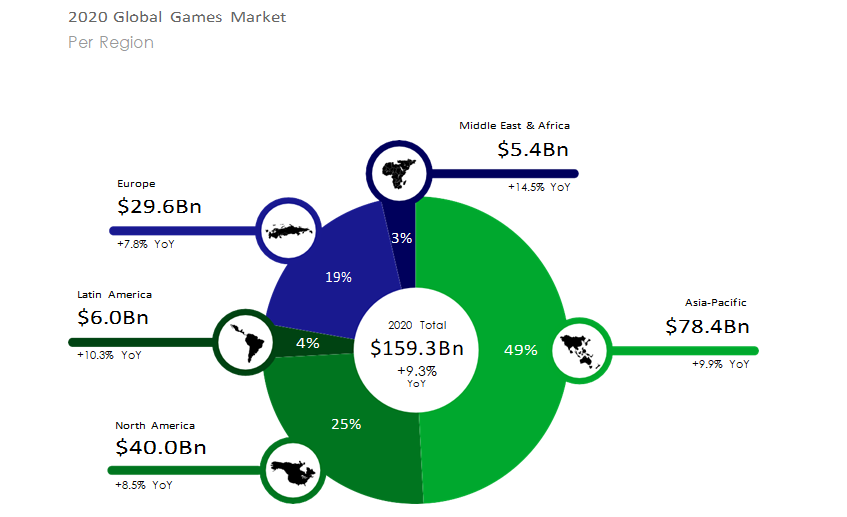

- Markets in the Asia-Pacific region will generate $78.4 billion in 2020, up +9.3 per cent year on year, accounting for almost half of all global game revenues which is 49per cent of the global games market.This represents a year-on-year growth of +9.9 per cent.

- In 2020, the Middle East and Africa region will grow the fastest year on year, up +14.5 per cent from 2019.

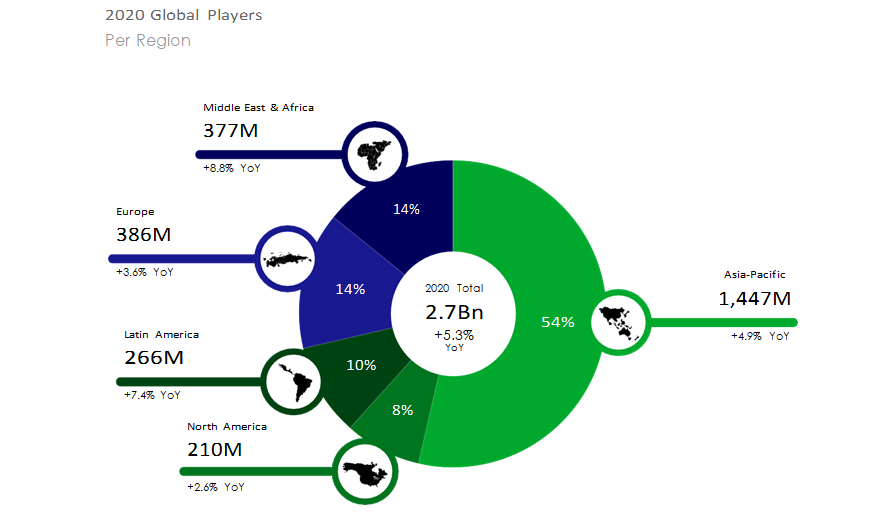

- By the end of 2020, there will be a total of 2.7 billion players across the globe, an increase of more than 135 million from the previous year. The Asia-Pacific region, with 1.4 billion gamers, will account for more than half (54 per cent) of all players worldwide.

- The year 2023 will mark a major milestone for the global games market. That year, the total number of players will surpass the three-billion mark, representing a CAGR (2015-2023) of+5.6 per cent. Naturally, growth markets are adding more to this player growth than more mature markets.

- The top 50 public game companies generated revenues of $124.5 billion in 2019, an increase of +5.3 per cent from 2018’s $118.2 billion. In 2019, the 50 companies alone accounted for 85 per cent of the entire global games market. Tencent again held on to the coveted #1 spot. In 2019, Tencent doubled down on targeting overseas markets while it monetised Chinese users via PUBG Mobile (called Game for Peace in China). Tencent’s strategy paid off, its year-on-year growth rate increasing to +10 per cent in 2019. Across the ranking, other Chinese companies—including NetEase and Perfect World—enjoyed similar returns to form after 2018’s nine-month-long licensing freeze.

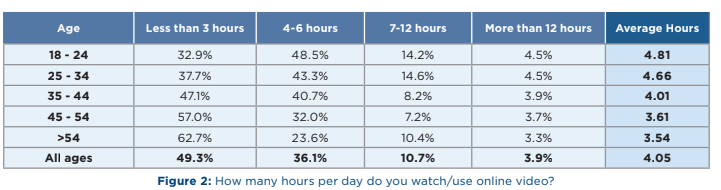

In India demand for entertainment has boosted interest in esports, video games, online auctions and online gambling to fill the void. As live sports events restart without fans in stadiums, this is an opportunity for live video coverage to experiment with new formats to make up for lack of crowds at the event.In a recent report “How Video is Changing the World” of Limelight Research shows huge surge in streaming in India during COVID-19 period as fans of esports can participate in event commentary along with the live in-arena audience or connect with closed ones over gaming session. Realtime live video opens up new business opportunities in sports, gaming, auctions, and more by making live viewing a more interactive social experience.

In India demand for entertainment has boosted interest in esports, video games, online auctions and online gambling to fill the void. As live sports events restart without fans in stadiums, this is an opportunity for live video coverage to experiment with new formats to make up for lack of crowds at the event.In a recent report “How Video is Changing the World” of Limelight Research shows huge surge in streaming in India during COVID-19 period as fans of esports can participate in event commentary along with the live in-arena audience or connect with closed ones over gaming session. Realtime live video opens up new business opportunities in sports, gaming, auctions, and more by making live viewing a more interactive social experience.