Content creation has flourished in recent years, and the significance of visuals remains as prominent as ever. However, the global visual effects industry is undergoing substantial disruption due to several transformative factors, including the rapid rise of artificial intelligence. The lingering effects of the Covid-19 pandemic, compounded by the Hollywood writers’ strike and rising production costs, have further shaken the industry. These challenges are reshaping the landscape of visual effects in ways that will be felt for years to come.

The FICCI EY Report, launched on 27 March 2024, unveiled that the Indian Media and Entertainment (M&E) sector has reached a total value of Rs 2.5 trillion (US$29.4 billion). This represents a growth of Rs 81 billion from the previous year, marking a 3.3 per cent increase. However, growth slowed down from 8.3 percent in 2023, due to falling subscription revenues, and a global decline in animation and VFX work outsourced to India. The sector contributed 0.73 per cent to India’s GDP in 2024.

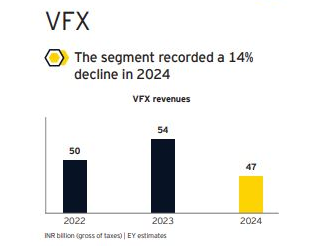

The report reveals that the animation, VFX and post-production segment contracted by nine percent, reaching Rs 103 billion in 2024.The VFX segment recorded a 14 per cent decline in 2024.

Here’s an overview of what took place in 2024:

- Global factors impacted demand

- The global VFX segment experienced a reset in 2024 as production volumes fell by 10 per cent in 2024, reducing VFX demand across the Americas (24 per cent), EMEA (7 per cent) and APAC (15 per cent).

- The slowdown caused by the strikes and market disruptions in 2023 persisted through 2024. Greenlighting of projects and production resumed at a slower pace than anticipated, reflecting a fundamental shift in the industry’s operating dynamics.

- OTT platforms scaled back aggressive content spending, with annual growth slowing to just two per cent compared to pre-2022 levels:

- Financial constraints, such as declining profitability, rising costs and market saturation, forced platforms to adopt a more cautious approach.

- Renewals of successful franchises were prioritised over riskier new originals, with investments focusing on broad-appeal content to maximise ROI.

- These factors collectively reduced the volume of international VFX projects outsourced to India.

2. Domestic VFX market grew

- While the global VFX market struggled, the domestic segment offered some resilience, keeping Indian studios active despite revenue growth remaining muted due to lower-paying domestic projects.

- The Indian VFX market expanded with increasing adoption in films and episodic content:

A. Heeramandi: The Diamond Bazaar: 1,200 VFX shots by FutureWorks

B. Kalki 2898 AD: 900+ shots by DNEG and ReDefine17

C. Fighter: 3,500+ VFX shots by ReDefine

- Experts believe that the use of additional VFX is now systemic and will continue in 2025. High-budget domestic films currently allocate up to 30 per cent of their budgets to VFX, while mid-budget projects spend around 15 per cent.

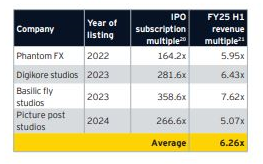

3. VFX studios leveraged IPOs

- In a resetting environment, where VFX was traditionally seen as a difficult sector for private funding, IPOs emerged as the preferred route for capital infusion.

- In the last two years, four VFX studios which listed through SME IPOs achieved subscription multiples exceeding 200, with FY25 H1 average revenue multiples averaging 6.26.

4.Studios embarked on global expansion

- Phantom Digital Effects finalised an agreement to acquire a majority stake of 80 per cent in America based Tippett Studio.

- Basilic Fly Studio obtained a 70 per cent stake in London’s VFX studio One of Us.

- Digikore Studios prepared to launch a cloud-based metaverse marketplace for virtual production sets, complementing its current library of 250 virtual production sets for films, TV and photography.

As per the report, the animation, VFX and post-production segment can reach Rs 147 billion by 2027 as India cements its position as the content back office of the world. The future outlook (VFX Segment):

1.Global content budgets will rebound

- Global programming spend is expected to grow by 5.3 per cent in 2025, reaching US$206 billion globally. North America is expected to lead this resurgence with a 6.7 per cent increase, signaling renewed confidence in content investment and profitability.

- The resurgence of streamers’ budgets in 2025 will be propelled by Netflix, Disney+ and Prime Video:

A. Prime Video’s ad tier reached 200 million users globally.

B. Netflix’s ad tier has 70 million monthly active users, and it plans to double ad revenue in 2025.

C. Industry consolidation and bundling (e.g., Disney+, Max, Hulu) are reducing churn and increasing predictability, enabling greater content reinvestment.

- The VFX opportunity on experiences is growing, covering areas like stage-craft, virtual events, theme parks and holo-concerts. This requires a different skill set from what is readily available in India, but is an area which we expect will see increased growth in the years ahead.

- For India to succeed in the global market, the focus on customer experience – across quality and reliability – will be crucial.

2. National and state initiatives will drive growth and talent development

- The central government approved National Centre of Excellence (NCoE) will position India as a global AVGC-XR hub, attracting foreign investments.

- The 2024 interim budget allocates Rs 1 trillion for 50 year interest-free loans to foster technological research and innovation.

- Karnataka’s newly introduced Kitven Fund-4 offers Rs 200 million for AVGC startups, boosting innovation and entrepreneurial growth.

- Karnataka and Kerala have released their new AVGC policy. Kerala’s AVGC-XR policy targets 250 companies, 50,000 jobs and 10,000 trained professionals by 2029.

- Telangana government will establish a skill university to empower youth with industry-relevant AVGC training.

3. AI will lead innovation in animation and VFX

- Industry discussions indicate that AI will significantly automate manual processes like rotoscopy and compositing within one to two years.

- In three to five years, AI could generate significant portions of full-length films, including effects, backgrounds and character animations.

- A legal framework for AI adoption is expected, enabling studios to confidently integrate AI into content production workflows.

- While AI will replace traditional roles, it will create opportunities for new positions like prompt engineers and AI tool specialists,

- Companies that are now adopting AI for efficiency improvement (time savings) will integrate AI into quality enhancement and production within a year.

- Adoption of AI in areas such as cleaning, colouring, compositing and other currently manual areas can have a significant impact on outsourcing to India, which could impact jobs.

To read the EY FICCI 2025 report titled Shape the future: Indian media and entertainment is scripting a new story, click here.