The rise of mobile gaming in India has paved the way for startups that are disrupting the country’s gaming industry. Over the last couple of years, the mobile gaming industry has witnessed major growth in terms of the new games being created, profit and the shift of public interest on the side of gaming.

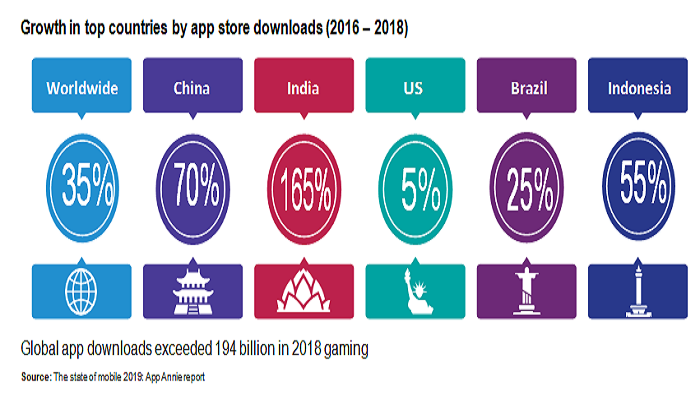

We can’t deny the fact that behind the growth story of the mobile gaming industry and mobile gaming start-ups, digital revolution has been the primary contributor. The factors underlying the digital revolution in the gaming industry includes the growing penetration of smartphones with bigger screens, improved display-pixel ratio, low data cost, improved bandwidth, growth in micro-payments and the rise in disposable income.

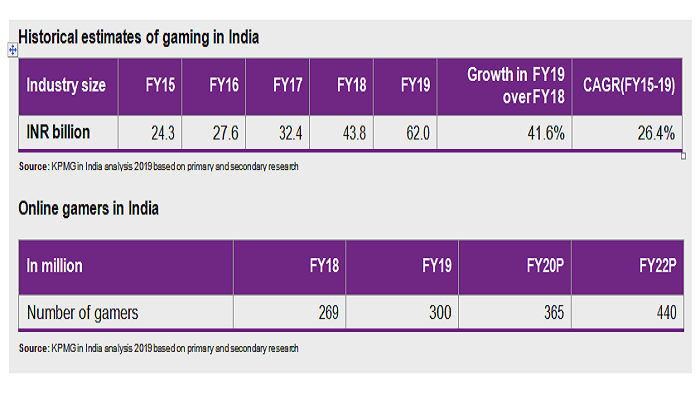

These factors have led to an increase in the number of online gamers in India over the years.Today online gaming in India is a Rs 62 billion robust market with an estimated 300 million gamers in 2019 as per the KPMG report India’s Digital Future.

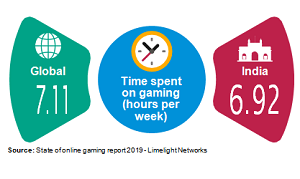

Today the user engagement on gaming platforms has scaled to newer heights. Soon it is expected to approach the global average. Today nearly one third of the gaming population is above 35 years of age with the younger audience continuing to hold the lion’s share. In addition to that, more and more female audiences are attracted to gaming compared to the times before. Not only that, female gamers are far surpassing male gamers in certain genres says the report.

Today the user engagement on gaming platforms has scaled to newer heights. Soon it is expected to approach the global average. Today nearly one third of the gaming population is above 35 years of age with the younger audience continuing to hold the lion’s share. In addition to that, more and more female audiences are attracted to gaming compared to the times before. Not only that, female gamers are far surpassing male gamers in certain genres says the report.

The rise of the mobile gaming has spurred on the console and PC game publishers to launch their popular games in mobile version.These games meet the requirements in terms of quality and experience while offering the convenience of the mobile device.Taking example of multiplayer battleground game, PUBG which was originally a PC game, was brought to mobile phones in March 2018 and as on May 2019, the game has crossed 200 million downloads globally, on all mobile operating systems and, has amassed over 30 million daily users.

Xigma Games founder, designer and developer Himanshu Manwani expressed,“The social features are on the rise and multiplayer opens option to players to play along with their friends. For some it has been about socializing with friends while playing an online match for others it has been about competition to top leaderboards charts. Mobile gaming market will continue to grow and social features and multiplayer options will play pivotal role to drive growth of mobile market.”

PUBG has played a huge role in evangelising even the most casual gamers to deeper and complex gameplay. Today Indian market is becoming more and more open to different types of games and the top charts on Google Play is another great example. Following the PUBG tradition, Fortnite, Asphalt Legends, Alto’s Odyssey, COD (Call of Duty) and more have rolled out their mobile versions and it has been widely accepted on mobile platforms. Given the scale and progress that a mobile platform offers, the lighter versions of games continue to attract eye-balls and increase user-engagement. Moreover, publishing games on mobile has helped developers and publishers alike in a variety of ways, thereby propelling the mobile gaming business further into esports.

“As new building platforms emerged on mobile it provided more freedom for developers to monetize with in app purchases and ads in game. Digital distribution changed the complete landscape and it made possible for even smaller teams to create and publish games. Mobile esports is now a huge deal with skill gaming on the rise we are seeing huge influx of new players on the platform and there is no stopping,” Manwani elaborates.

Following the same route, comes the fantasy sports segment in India, which has gone through a massive transformation

since the last two decades of its launch. Indian fantasy sports platforms accounted for 80.62 per cent of all investments until Q1-2019. According to My11Circle head of business, Saroj Panigrahi, fantasy sports is playing a critical role to shape India’s gaming scene. Being the sports nation, India will continue to attract investments in the game of skill sector. The reason behind it is “the fan, which is the core of any sport. Fantasy is able to create a newer fan for different sport in India be it cricket, football, kabaddi. Investors understand this and support this creation of a new ecosystem. Yes, we are a very young nation in term of sports penetration; this is growing in the next decade” he expressed. The rise of the fantasy sports has actually transformed and has pushed in the growth story of the gaming industry.

Over the year 2019, the rush of game developers with the zeal of creating unique games has increase. Thus many boutique studios/start-ups have formed with an aim to create and feed the game-hungry audience in the industry. At present, the more challenging part in gaming business is to maintain the retention, because when audience get bored with the content they look for better options at the Playstore.

While the publishers of the existing popular games are constantly working towards in-game updates, gaming start-ups are aiming to create more and more new games. This trend has inspired the budding developers to follow suit and apply the learnings in their start-up business.

“For majority of users in India, mobile has been their first gaming platform, mobile devices brought in huge influx of new users and introduced them to gaming. Users who never played games before are now readily playing games just because of feasibility of these devices and it is helping overall gaming business ,” Manwani said.

There are several reasons why the industry weather is favourable for gaming start-ups to set their business and to drive the growth story of the country.As a matter of fact, the task of mobile game development can also be achieved with smaller teams given the favourable climate in terms of revenue, lesser entry barrier and bigger scope for market and a ton of opportunities in line whereas the same can not be said about PC or console game development. Thus gaming start-ups in India are increasing with rising numbers.

Not just creating games, but today gaming start-ups are acing the race of improvising and churning out fresh gaming content and reaching almost the same benchmarks set by the western counterparts. Giving the picture of the Indian gaming startup scenario, Pocket League’s co-founder Karan

Khairajani said that today “the quality of games in general coming out of India has improved significantly. Whether it’s from indie developers, or from big publishers, there are truly world class games being developed here, for both India and Western Markets. Lot of the guys I started out with in the industry have ‘levelled up’ in terms of the quality they are producing.”

Speaking of the mobile gaming rush, big players like Square Enix who earlier wrapped up the India business without publishing a single game are back. Square Enix has a call for action in India by setting its Bangalore office recently. This time they are aiming to explore the mobile gaming space by targeting the interested audience.

“A lot of big western publishers are investing more and more in the market, and understanding the user psychology better,” said Khairajani

While free-to-play games continue to dominate, there has been a noticeable development and increase in popularity of freemium models, where a gamer either makes an in-app purchase for an additional boost or to move further in the game. In India, 28 per cent gamers are now willing to make an in-app purchase for an additional boost and points in their gaming experience as per KPMG report. It is the casual gaming segment however, largely ad- supported, which is witnessing this change. Expectedly, gamers from an older demographic have a higher propensity to spend on games. Also, growth in fantasy sports and other real money gaming platforms has likely accelerated monetisation even further.

”Earlier, the intent to spend on games by Indian users was almost non-existent but this is slowly changing. Real-money gaming has also contributed greatly in driving growth and increasing average spends per user. When users spend on real-money gaming platforms, they can expect cash-prizes instead of digital goods. It’s immensely helping in building spending habits in games,” said Khairajani.

Between 2014 and Q1 2019, the total venture capital funding in Indian gaming startups was $337 Mn. The investment in Indian gaming startup is growing at a CAGR of 22per cent, among the gaming startups the top funded startups are Dream11 with $100 Mn in total funding, followed by Smaaash Entertainment with $82.6 Mn in funding and Nazara Technologies with $79 Mn. In addition to that, Alibaba-backed digital payments start-up Paytm and Hong Kong’s AGTech Holdings launched a gaming platform Gamepind; Youzu launched local casual strategy games last year. Vietnam-based StomStudio also partnered with mobile game publisher Gamesbond to create mobile games in India.

Aiming for the year 2020, there are many gaming companies coming up in India and are growing tremendously compared to five years back.“The numbers of VC-backed gaming startups have increased too and it’s helpful for the entire ecosystem that money is being invested in the space. Whether it’s through competition or by identifying gaps in the market, many of our Indian gaming companies are producing great content to entertain the Indian consumers.”

If India maintains the growth story of mobile gaming industry in the upcoming years at the same pace, we are sure that the days are not far when India will dominate the global scoreboard!