A handful of sports fans believe fantasy sports are those scoured box scores in newspapers which kept track of scoring by hand. Fantasy sports has faced a tumultuous decade before the passing of the Unlawful Internet Gambling Act (UIGEA) in 2006. Shortly after the passing of UIGEA, daily fantasy sports became marketable, and after several years, it has accounted for tremendous growth worldwide. However, the uncertainty of the legal terms and lack of knowledge among players has clouded the industry.

In fantasy sports, it is still a debate whether it is a ‘game of skill’ or the ‘game of luck’ and it is never-ending. The fantasy sports genre has received an exponential growth over the past few years as variations in the model might be one of the factors which kept the players engaged. In the genre there are two models which are offered by the operators, one is ‘free to play’ and another one is ‘pay to play’. In the free to play model, users can play free contests depending on the operator it may or may not have cash prizes associated with it. Whereas in pay to play users pay an entry fee to participate in paid contests where operator charge a service or platform fee of 15 to 25 per cent from the total pool before winnings disbursal.

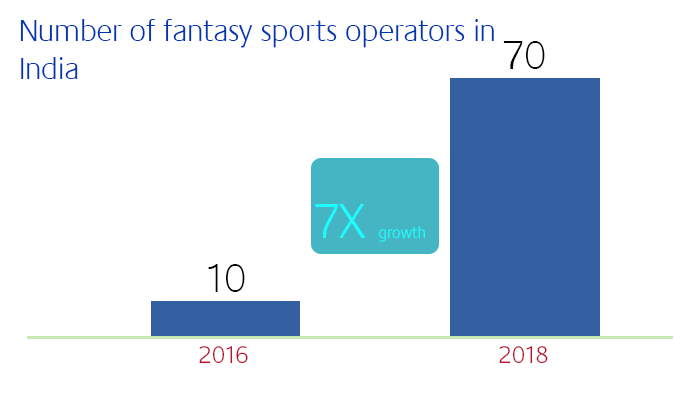

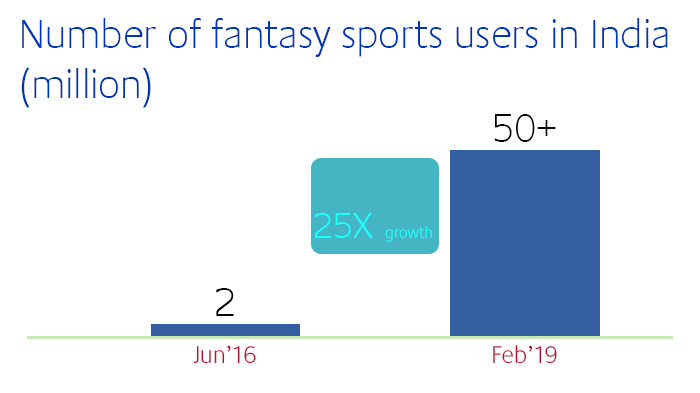

The recent KPMG report, ‘the evolving landscape of sports gaming in India’ states that 2018 has witnessed seven times more growth in the number of fantasy sports operators in India. Apart from that, the number of fantasy sports users are increasing day by day as it witnessed 25 times growth in million from June 2016 till February 2019. There are many factors responsible for the growth of fantasy sports in India.

Growth in digital infrastructure: The digital infrastructure of the country has witnessed exponential growth. Some reasons behind such growth are – increasing smartphone affordability and penetration and expansion of the internet user base and declining of the data price. Thus according to the report, the internet subscribers grew from 368 million in September 2016 to 560 million in September 2018 which has helped fantasy sports gaming to penetrate in the digital gaming space smoothly and swiftly.

Rising investor participation: The fantasy sports gaming rose in popularity mark drastically over the years. One of the primary reasons behind it is that the platforms also offer content in vernacular languages which have increased the engagement numbers in a couple of years. Thus leaders from Tencent to Nazara are also investing in fantasy sports gaming. Around five to six early-stage investments have been made in this space over the past couple of years.

The emergence of sports leagues: According to the survey 72 per cent of the respondents consider fun and excitement of the sports fan is the primary reason which is driving the fantasy sports gaming in India. 74 per cent of the respondents play fantasy sports one to three times a week with the majority playing once a week. Since there is a wide audience in India and everyone has a distinct preference for the sports gaming thus, multiple sports leagues have sprung up in the recent past, including those for kabaddi, football, basketball and volleyball.

Enhanced clarity around legality: The Punjab and Haryana High Court has affirmed that fantasy sports game Dream11’s format as ‘a game of skill’ and not as a ‘game of luck’. As per the ruling of the High Court of Punjab and Haryana in the case of ‘ Shri Varun Gumber in opposite to Union territory of Chandigarh and others in 2017 ‘ the element of skill’ is the predominant influence on the outcome of the Dream11 format of fantasy sports game. Although another appeal against the Punjab and Haryana High Court’s decision was filed in Supreme Court, it was dismissed by the court. This clarification of the legal status of the fantasy sports format as offered by Dream11 has helped in boosting the overall fantasy sports market in terms of a more significant number of platforms entering the market with similar setups and also leading to widespread user adaptation.

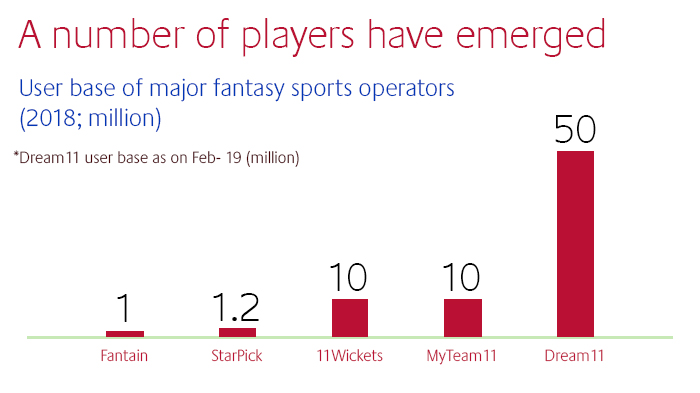

These factors are being cited as reasons on why the number of players has also emerged, along with the increasing number of platforms. As per February 2019 records, Dream11 is leading with a user base of around 50 million followed by MyTeam11, 11wickets maintaining the user base neck to neck with 10 million, StarPick 1.2 million, Fantain 1 million.