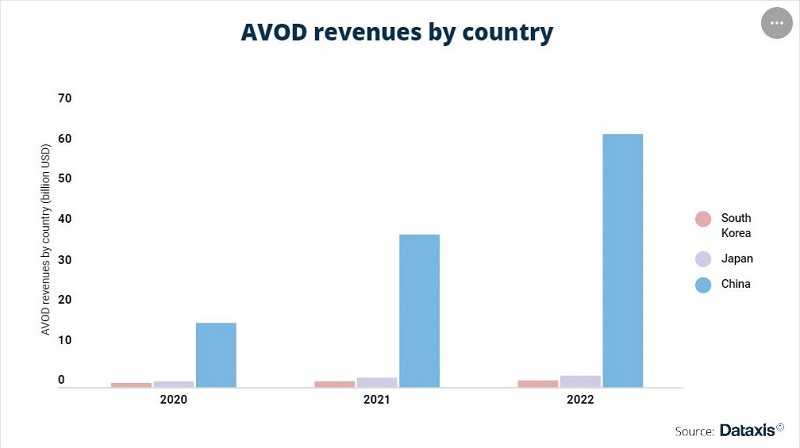

In the three largest markets of East Asia, AVOD has experienced strong growth over the last few years. A recent study by Dataxis revealed that the fastest growing market is China.

In reflection to the recent launch of ad-supported tiers by global streaming players, one may assume this illustrates a pay content fatigue for consumers. In addition, this trend could also stem from a traditionally strong FTA TV consumption which is reviving. It will be interesting to note, what is the most advanced market and what can be the possible explanation for it.

The rise of overall AVOD revenues seems to prove consumers increasingly prefer to watch ads to avoid subscription fees.

The Chinese market has proved to be the fastest growing. The report says, AVOD players have generated CNY 409 billion ($63 billion) in 2022, up from CNY 246 billion in 2021 ($38 billion) and CNY 116 billion ($16 billion) in 2020. In comparison, the Japanese market has almost doubled over the same period, from JPY 162 billion ($1.5 billion) to JPY 311 billion ($2.9 billion) in 2022. In South Korea, growth has been more moderate. Revenues generated by AVOD platforms amounted to KRW 1930 billion in 2022 ($ 1.7 billion), up from KRW 1320 billion ($1.1 billion) in 2020. China is not only the fastest growing, but also by far the largest market, even when weighing the population of the three countries.

The study further highlights:

AVOD does not only react to SVOD and TV consumption trends: At first glance, it seems like China is simply one step ahead of Japan, which is in turn ahead of South Korea. As a matter of fact, the differentiated rhythms of growth match the different SVOD markets’ maturity states. To start with, the Chinese SVOD market is saturated – most platforms have lost subscribers at Q4 2022. The overall number of subscribers has even decreased from 385 millions at Q2 2021 to 375 million at Q2 2022. Japan and South Korea will not reach this state soon, as they both still experience strong SVOD growth.

However, this does not mean that the rise of AVOD is fueled only by pay content fatigue. Conversely to the SVOD market, the pay TV market does not match the AVOD rise. It is still slowly but steadily growing in China and South Korea, reaching 583 million and 31 million subscribers respectively.

The ADEX as a harbinger: everybody bets hard on AVOD- Although China, Japan and South Korea do not experience similar maturity stages in the different segments of the audiovisual content industry, advertisers are betting on AVOD in all of them. This can be measured by analysing the share of advertising expenditures (ADEX) spent on the digital industry. Ranking the three countries from least to most digitised, Japan is first, with only 44 per cent of total ADEX being spent online in 2022, up from 36 per cent in 2020. Despite traditional media still dominating this market, the growth of video digital advertising is dynamic. The total sum spent on video ADEX surged from JPY 386.2 billion (22 per cent of digital ADEX) to JPY 590 billion (24 per cent) in 2022, and is forecasted to reach JPY 685.2 billion next year. The South Korean advertising market is much more dependent on the digital industry, which represents 59 per cent of total ADEX in 2022. In addition, it is always more displayed on mobile devices, which now capture over 80 per cent of total ADEX. Finally, these two phenomena are even more observable in China. Digital advertising is the paramount way to reach customers and weighs 80 per cent of total ADEX, while mobile devices capture 89 per cent of it.

In China, social media dominates the market- The mobile prevalence of the ADEX is most profitable to social media platforms, which are commonly accessed through smartphones. On top of streaming pure players that also manage a paid subscription offer such as iQiyi, WeTV (also known as Tencent Video) and Bilibili, social networks spearheaded by Douyin (TikTok) and Kuaishou (Kwai) have captured a substantial share of the pie and are now the two leaders of the Chinese AVOD market, both in terms of monthly active users (MAU) and revenues.

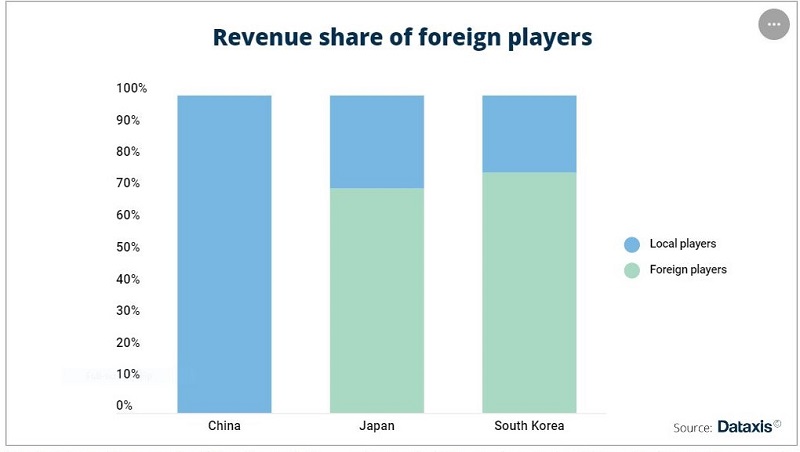

In Japan and South Korea, video-sharing platforms lead a highly internationalised market: The market structures are quite different in South Korea and Japan, firstly because in contrast to China, global players have access to them and have established a strong foothold. These include tech players and their subsidies (Facebook Watch, Twitch) as well as the two aforementioned Chinese social networks.

In Japan, YouTube (68 million MAU) has been the uncontested market leader for years after Niconico Douga, its local equivalent, started losing momentum in the late 2000s, and now concentrates around half of the total AVOD revenues. Its main contenders include Abema TV, which has been cashing in mostly on sports rights, Gyao!, which belongs to Yahoo! and recently announced its impending termination, and most notably TVer. Alongside public broadcaster’s own initiatives, five of them have launched that service in 2015 and it has since then been expanding fast.

In contrast, YouTube is only the second most popular service in South Korea where local tech company Naver dominates the market with Naver Now (formerly Naver TV). Similarly to Japan, all the main broadcasters (SBS, KBS, MBC, YTN, TV Chosun…) have launched their own platform, and additionally partnered with Naver to have an individual gateway on the front page of the website.

China has it all, Japan and South Korea not yet: To conclude, only China gathers all the necessary conditions for AVOD to reach a significant scale. The SVOD market is becoming saturated as households have much lower purchasing power than in Japan and South Korea. Advertisers have been heavily investing in online campaigns for years, thus giving a head start to pure players and paving the way for SVOD players to easily launch an ad-supported tier. They have shifted to mobile advertising very early on, thus fostering a favourable environment for social media.

Furthermore, Chinese regulation prevents foreign players from entering the market and broadcasters have not succeeded in delivering a strong value proposition. The combination of both elements strongly reduces the competition intensity for private Chinese players.

In contrast, Japan and South Korea only tick some of the required boxes for AVOD to become as prevalent. Nonetheless, they can leverage their specific strengths (strong FTA and tolerance to advertising in Japan, soon saturated pay TV market and highly digitised and mobile-oriented ADEX in South Korea) to catch-up with China’s dynamic and experience similar growth.

Source: Dataxis Report