Investment firm Maple Capital Advisors has dropped a report titled ‘Gaming – India Story’ which says that the Indian gaming industry is currently valued at $930 million and is expected to grow at 41 per cent annually. By 2024, the gaming industry in India is set to be valued at $ 3,750 million, it added.

“In India with over 570 Mn people on the internet and over 85 per cent of which are on mobile, gaming and streaming has been a popular form of internet engagement. In these locked downtimes, we see this consumption has grown at least 20-30 per cent despite a significant impact on live sports, a big driver of fantasy sports gaming..” Maple Capital Advisors managing director Pankaj Karna said.

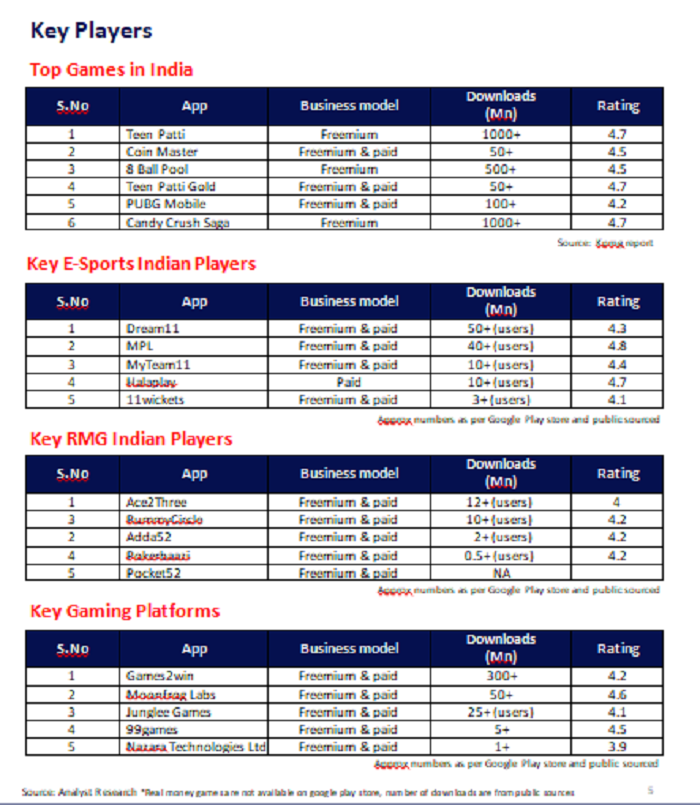

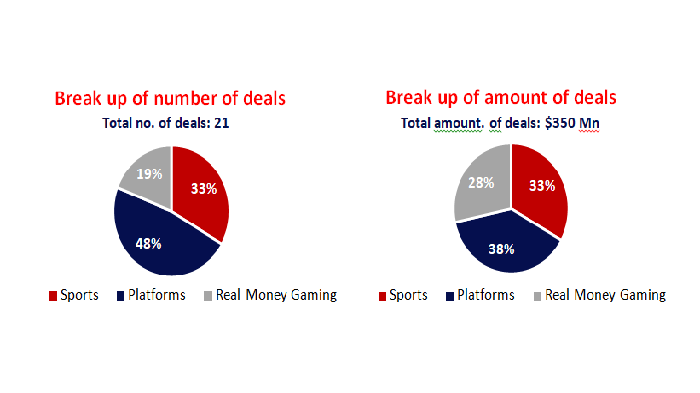

India’s online gaming industry has already attracted $350 million in investments from venture capital firms between 2014-2020. India is the second-largest market worldwide for app downloads.

“With growing internet penetration, compelling economics, usage statistics, and increasing ecosystem of entrepreneurs and developers focusing on this space we expect good growth in investments which are likely to at least double in this space in the next 1-2 years,” he added.

This increase will be fueled by the growth of digital infrastructure which includes 5G connectivity and a substantial rise in quality and engaging gaming content, it said.

Big investment happened in this duration

Some of the big investments include $100 million investment in Dream11 by Tencent and Steadview Capital (2016), $41 million investment in Mobile Premier League by Sequoia and Times Internet (2019), and $20 million in Paytm Games by One97 and AG Tech holdings (2020). Some of the big investments include $100 million investment in Dream11 by Tencent and Steadview Capital (2016), $41 million investment in Mobile Premier League by Sequoia and Times Internet (2019), and $20 million in Paytm Games by One97 and AG Tech holdings (2020).

Current Scene:

Current Scene:

The gaming industry is skyrocketing due to lockdown. Apart from that digital infrastructure and cheap devices has helped people to consume more gaming content. Today there are over 400 gaming startups in India and with more than 500 million smartphone users as of December 2019, mobile gaming has taken the lead by tapping 85per cent share of online gaming in India. Thus it is pretty evident that several gaming developers are going to capitalise on the increasing number of smartphone users. The report highlights that the three key segments of online gaming are – Real Money Games (RMG), Mobile-centric/casual games and fantasy sports. With more than 500 Mn smartphone users in India as of December 2019, mobile gaming has taken the lead by tapping 85per cent share of online gaming in India. Evidently several gaming developers are going to capitalise on increasing number of smartphones users, ease of use and strong penetration.

COVID-19 Impact

Online gaming companies are seeing a spurt in traffic as firms go into shutdown mode triggered by Covid-19 scare. Working professionals and students have turned to online games for entertainment and social connect.

Between the weeks of 10 to 16 February 2020 and 16 to 22 March 2020, online gaming websites visits or apps have been increased by 24 per cent. Engagement, as measured by time spent on gaming sites or apps, increased by 21 per cent during the same time period.

Games2Win : The platform saw increase in daily users from 1.1-1.2 Mn people earlier to 1.5 Mn people now

WinZO Games: The platform saw a surge of three times in online traffic on its games

Hitwicket: The platform saw increase in user numbers by 10-15 per cent over the past few weeks

Gamerji : The platform used to have 12,000-15,000 play on an average on their platform every day; now, the numbers range between 40,000 and 55,000

Traditionally south based user-base has seen diversification to NCR, Kolkata and Gujarat in the COVID period.

Traditionally south based user-base has seen diversification to NCR, Kolkata and Gujarat in the COVID period.

However, Dream11, MPL and other fantasy sports gaming players have seen a major hit due to curb of IPL and other live sporting events.

Dream11: Games have either been cancelled or postponed and users are expecting money to be refunded.

MPL: Offers over 40 games across categories. Fantasy Sports users have been active on other games on their platform. Games like World Cricket Championship, Archery, Quiz, are seeing increased traction.

Baazi Games: As no live matches are happening, fantasy games have come to a standstill. But the other two verticals, namely poker baazi and rummy baazi have seen 8 per cent to 10 per cent surge in traffic recently.

Trends that shaping gaming ecosystem:

According to the report here is what shaping the gaming ecosystem:

- Games with Multiplayer formats helps in engaging more than one third of India’s gamers which providing them an opportunity for social interaction and a sense of achievement over other gamers. These type of players are more likely to pay for games and make in-app purchases.

- The sector is attracting talent across value chains. With chat options available in games, real money involved and tournaments being held, therefore more people are considering gaming as their career.

- The sector has caught investor’s eyes and global giants like Alibaba, Tencent have invested and see great potential in coming future. Investors feel India has an untapped market in gaming which is yet to evolve, hence start ups have seen good VC traction.

- While fantasy sports is the most loved gaming segment, local companies have come up with Indian games like rummy and teen patti. Gamers are engaging in casual as well as heavy games, giving local developers an opportunity to develop in multiple languages and pre-load these games on handsets.

- Overall, all platforms have seen a surge in number of impressions and downloads but their revenue from advertisements has substantially reduced as many advertisers have withheld advertisements in this period.