Universal’s parent company Comcast has reported earnings on Thursday, with NBCUniversal among the final legacy media companies competing for audiences and relevance.

NBCUniversal’s streaming and theatrical efforts have shown signs of progress in the first half of 2023. Its flagship streaming platform Peacock — while still the smallest of the major streamers in terms of subscribers and content demand — hit a record high in US demand share for streaming original content in Q2 2023, and has grown its market share for three consecutive quarters.

On the film side, Universal’s Oppenheimer is the latest in a strong theatrical run for the legacy company. This builds on the momentum from the first half of the year with movies such as M3GAN, Cocaine Bear and The Super Mario Bros. Movie all over-performing expectations. In fact, Universal has the most in-demand 2023 theatrical slate with US audiences, according to Parrot Analytics Movie Demand data. This should help drive new customers to Peacock in the second half of the year as the films become available on the platform.

The WGA (Writers Guild of America) and SAG-AFTRA (Screen Actors Guild-American Federation of Television and Radio Artists) strikes will impact all players in the industry differently, but Peacock may be poised to survive a prolonged work stoppage by leveraging two key NBCUniversal TV assets: Bravo and NBC’s Sunday Night Football. This type of content is unlikely to be impacted by the strikes, and these series may gain audiences as consumers run out of new scripted series to watch.

Peacock originals continue to rise

- While Peacock is still the smallest of the major media backed streaming services, it is also showing the most consistent growth in market share. Peacock Originals hit another record high demand share in Q2 2023, accounting for 3.7 per cent of US demand for streaming original series.

- Peacock is the only major streamer to grow its originals demand share with US audiences for the past three consecutive quarters.

- Eight Peacock Originals averaged Outstanding demand with US audiences in Q2 2023 — meaning they were each in the top 2.9 per cent of shows across all platforms during that time. This was up significantly from five series in the Outstanding category in Q1 2023, helping to push the streamers originals to new heights.

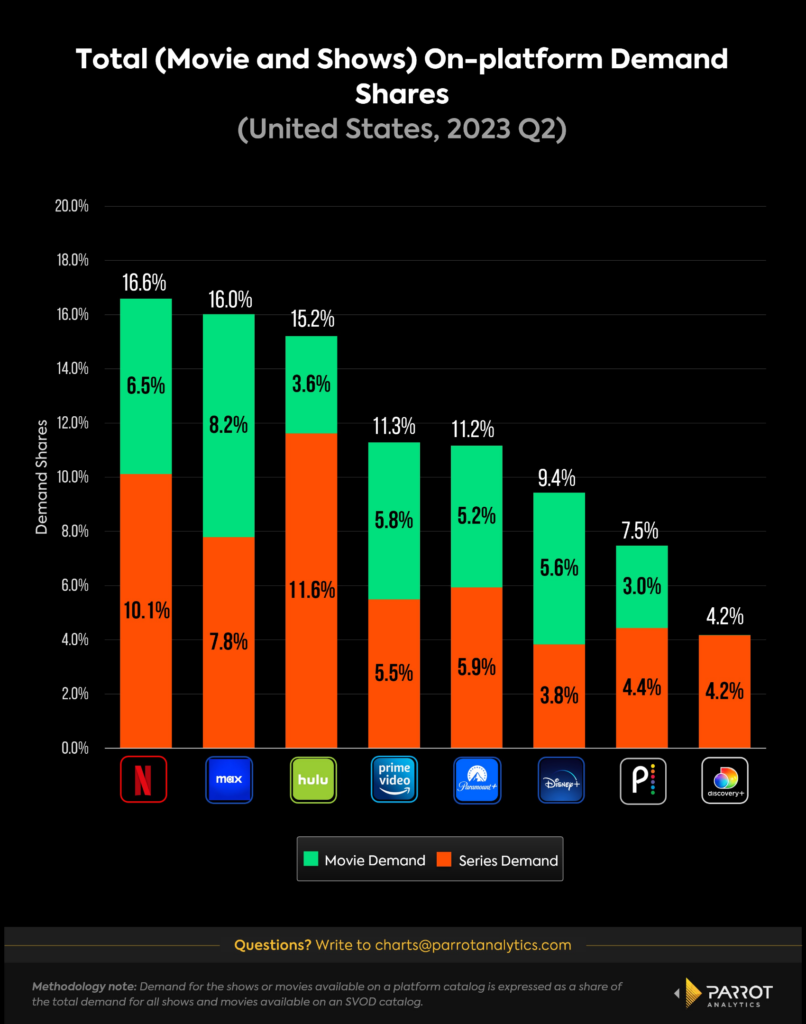

- This chart shows how mature and competitive the US streaming industry has become, with just 2.9 percentage points separating second place from sixth place.

On platform demand share

- While demand for original content drives subscription growth, library content is key for customer retention, an increasingly crucial element of all streaming strategies as the market matures and consumers are offered more choice and easier ways to cancel than ever.

- The total catalog demand share data is a good indicator of which SVODs consumers are most likely to use as a default ‘streaming home.

- Peacock’s total catalog demand share grew sat at 7.5 per cent in Q2 2023, down slightly from 7.6 per cent last quarter, but ahead of the 2022 average of 7.1 per cent.

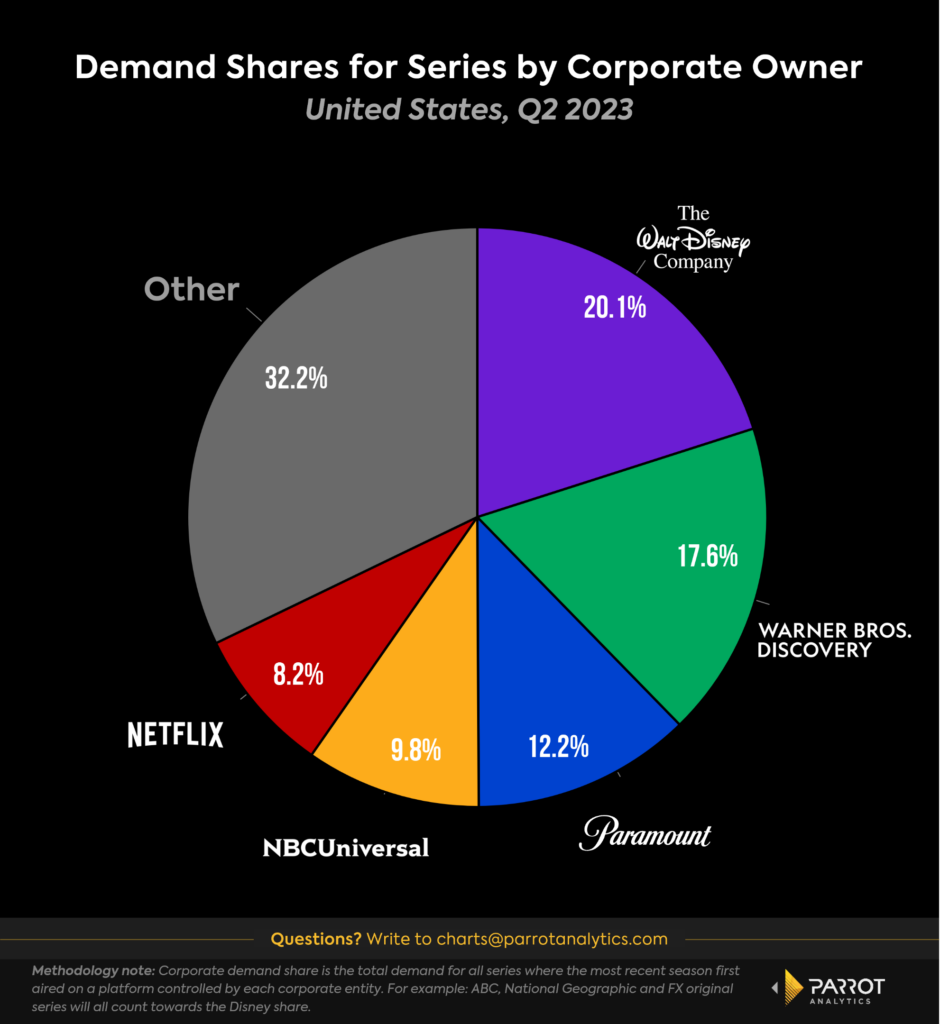

Corporate demand share

- Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms, and can effectively help value a conglomerate’s legacy and library content in aggregate.

- NBCUniversal-originated series accounted for roughly one tenth of all US TV demand in the first quarter of 2023. This makes it the fourth largest corporation when it comes to TV demand ownership in the US.

- This 9.8 per cent share is highly valuable to Comcast, as CEO Brian Roberts considers either offloading NBCUniversal or acquiring Paramount or Warner Bros. Discovery in the coming years. Either combination of assets would create the largest media conglomerate in terms of US corporate demand share.

- Combining the TV assets of NBCUniversal and Warner Bros. Discovery in particular would account for over a quarter of all US TV demand — 27.4 per cent corporate demand as of Q2 2023. This would launch the combined company well ahead of Disney (20.1 per cent) as the biggest player in TV demand.