The year 2015 was a seminal year in a many ways for the Media and Entertainment (M&E) industry. A year that sparked excitement and renewed hope but at the same time a year in which reality came to roost. The year 2015 could turn out to be a cusp of year for the Indian animation and VFX industry.

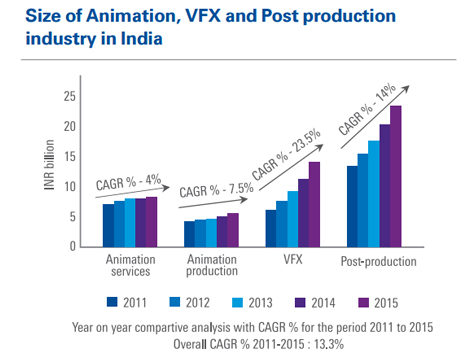

The size of the animation, VFX and post production has grown tremendously from 31 per cent CAGR in 2011 to 51.1 per cent in 2015. Currently India has nearly 300 animation, 40 VFX and 85 game development studios with more than 15,000 professionals working for them. While the Indian animation industry witnessed no major box office releases during the year, short films such as Chhaya, Fateline and Chakravyuha won appreciation locally as well as internationally.

The size of the animation, VFX and post production has grown tremendously from 31 per cent CAGR in 2011 to 51.1 per cent in 2015. Currently India has nearly 300 animation, 40 VFX and 85 game development studios with more than 15,000 professionals working for them. While the Indian animation industry witnessed no major box office releases during the year, short films such as Chhaya, Fateline and Chakravyuha won appreciation locally as well as internationally.

Demand for locally produced animation shows continued to grow in 2015. Broadcasters now realise that locally made content, though costlier, has great potential in the long run as seen in successful series of ‘Chhota Bheem’, ‘Motu Patlu’ and few others. The report states that in 2015, animation content imported from U.S.A. had the largest share, followed by Japan. However, local content has seen a shift as it contributes approximately 16 per cent of the total shows (third largest contributor) from 13 per cent in 2014.

There have been collaborative animation services also taking place with DQ Entertainment and Method Animation, U.K. who have joined hands to co-produce TV series 5 & IT, and Sphere Origins, animation studio HopMotion and Colors have joined for the new animated show Chhoti Anandi.

One of the key developments for the AVGC industry, is the fact that government has finally stepped in to improve the training and job facilities in these industries. The Karnataka Government has come up with initiatives in the Karnataka AVGC Policy including setting up a Centre of Excellence for promoting AVGC education in the State, The Maharashtra Government has also come up with a number of provisions in its IT/ITeS policy to promote the AVGC sector and will be setting up a Centre of Excellence with state-of-the-art facilities. The Telengana Government is also actively promoting the AVGC sector eg. the announcement of the incubation centre IMAGE (Innovation in Multimedia, Animation, Gaming and Entertainment) in Hyderabad.

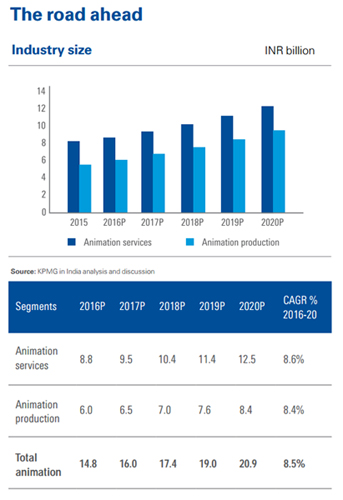

The report predicts that the animation industry that’s currently estimated at Rs 14.8 billion is bound to increase to Rs 20.9 billion by 2020. With the changing mindset of the audience, animation has the potential to become one of the most sought-after mediums for entertainment and storytelling in India but this would need a strong push from the government in the form of incentives, and an evolved mindset and approach of the creators.

The report predicts that the animation industry that’s currently estimated at Rs 14.8 billion is bound to increase to Rs 20.9 billion by 2020. With the changing mindset of the audience, animation has the potential to become one of the most sought-after mediums for entertainment and storytelling in India but this would need a strong push from the government in the form of incentives, and an evolved mindset and approach of the creators.

The year 2015 was an explosion for the Indian film industry as VFX heavy films like Baahubali, Bajirao Mastani, I, Dilwale, Bombay Velvet, Bajrangi Bhaijaan, Baby just to name a few.

VFX is making its presence felt in films of all genre be it action, comedy or romance and irrespective of scale, be it small, medium or big budget movies. Other regional films too are now using it effectively, for instance the Marathi film ‘Mitwa’ used total of 325 VFX shots.

Coming off a flat year in 2014, the film industry returned to a healthy growth of 9.3 per cent in 2015. Bollywood is constrained by the slow pace of screen growth and also has been facing increased competition from Hollywood and regional content. As per the report, wider reach in distribution expansion to non-DCI compliant screens has opened up a significant portion of the audience to Hollywood content. Also, increase in the number of franchise films helped expand the market. Better performance at the box office by regional films has also resulted in increased budgets and marketing spends.

Beyond movies, Star Plus, Zee TV, Sony, &TV, Life OK and SAB have launched more shows that require the proficient use of VFX for adding better quality to viewing experience. In 2015, few shows that successfully used this technology include Chakravartin Ashoka Samrat, Maharakshak Devi with about 250 VFX shots which include chroma shots, 3D modeling, 2D animation and matte paintings. Other shows that use VFX are Star Plus’s Siya Ke Ram, Colors’s Naagin and a more recently launched show Janbaaz Sindbad.

The year 2015 saw quite a bit of quality outsourcing work done by Indian studios. Chronicles of the Ghostly Tribe, a Chinese action adventure film, was completed by Prime Focus World’s Mumbai VFX team. Moving Picture Company (MPC) delivered most of the major visual effects work on X-Men Apocalypse out of its facility in Bengaluru.

The year 2015 saw quite a bit of quality outsourcing work done by Indian studios. Chronicles of the Ghostly Tribe, a Chinese action adventure film, was completed by Prime Focus World’s Mumbai VFX team. Moving Picture Company (MPC) delivered most of the major visual effects work on X-Men Apocalypse out of its facility in Bengaluru.

Considering the incentives provided by the government, the trend of Hollywood and other developed countries outsourcing VFX projects to low-cost ones has been significantly on the rise. This has adversely affected VFX artists in developed countries and to counter this situation, the governments of countries such as Canada are offering grants, labour tax credits and subsidies to domestic companies engaged in VFX work to help them retain artists as well as in their expansion efforts.

Although not as popular as the VFX industry internationally, VFX Industry in India is gaining popularity. The movie making value chain has undergone a metamorphosis and it is indeed encouraging to see that mainstream Indian filmmakers plan their production schedules to accommodate the VFX component of the film.

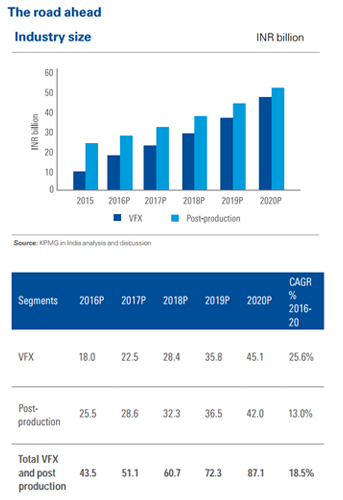

Currently the VFX industry is estimated to be of Rs 43.5 billion and will get a significant increase by 2020 and is estimated to grow up to Rs 87.1 billion. While the industry will get a boost after the release of a few big films, the television space is also not to be underestimated. The mobile and internet gaming area although still not big enough, should also see accelerated growth in the next couple of years. It is expected that digital will drive growth, and innovation will be the key which will be driven by creative expression.

Complete FICCI FRAMES Coverage