The FICCI-EY report ‘Playing by New Rules’ which was recently launched found that the Media and Entertainment (M&E) sector registered a Rs 1.38 lakh crore (US$18.9 billion) revenue in 2020 which is a 24 per cent decline, taking revenues back to 2017 levels. Digital and online gaming were the only segments which grew in 2020 adding an aggregate of Rs 2,600 crore. Infact online gaming was the fastest growing segment in the M&E sector in 2020 as it grew 18 per cent in 2020 to reach Rs 77 billion.

Here are the key findings of the online gaming segment:

- Continuing as the fastest growing segment of the M&E sector for the fourth year in a row, the segment grew by 18 per cent. Contributing factors towards the growth are work from home, school from home and increased trial of online multiplayer games during the lockdown.

- Online gamers grew by 20 per cent to reach 360 million in 2020 from 300 million in 2019 and are expected to reach 510 million by 2022.

- Transaction-based game revenues grew by 21 per cent on the back of fantasy sports, rummy and poker.

- Casual gaming revenues grew by seven per cent, led by in-app purchases.

- In-app purchases grew 15 per cent in 2020 while advertisement revenues grew by eight per cent.

- Growth in casual game revenues was enabled by increased downloads of online games – App Annie estimates that 80 per cent of all entertainment app downloads in 2020 were gaming apps.

- 86 per cent of games by Indian publishers included advertisements, as compared to an average of 73 per cent for global games.

- In addition, the work-from-home and school- from-home nature of 2020 led to sales of 18 million personal PCs and laptops in 2020 which increased access to games for a large number of students and professionals, which in turn enabled the growth of mid-core gamers from 40 million to 80 million.

- PC makers like Lenovo expect gaming PCs to comprise 15 to 20 per cent of their consumer segment revenues compared to 10 to 12 per cent earlier for India.

- Hyper casual was one of the fastest growing genres of mobile games globally, accumulating 10 billion installs across the top 1,000 such titles in 2020.

- Ease of simply downloading and playing these games without requiring time to understand the rules of the game and a simple game interface kept users engaged.

- Indian casual gamers spent up to 80 per cent of their time in playing hyper casual games in 2020.

- The gaming segment is expected to reach Rs 155 billion by 2023 at a CAGR of 27 per cent to become the third largest segment of the Indian M&E sector.

- Transaction based game revenues increased from Rs 52 billion in 2019 to Rs 63 billion in 2020. One key factor which led to growth of transaction-based gaming was the growth in India’s digital payments ecosystem.

- Indian online transaction-based gaming players are expected to grow from 80 million in 2020 to 150 million by 2023.

- In India the average transaction-based revenue per customer has risen from Rs 167 in 2016 to Rs 640 in 2020.

- Due to lack of live sporting events, many online gamers explored card-based games. Several online tournaments were held across these games to build awareness and identify talent for international participation. Rummy grew 21 per cent and poker grew 24 per cent respectively in 2020 though some Indian states banned play of such online games.

- Fantasy sports grew 24 per cent in 2020 despite the absence of major Indian sporting events for five months during 2020, primarily on the back of the IPL Season 13 held in the last quarter of 2020.

- Fantasy sports user base is currently 100 million and is expected to reach 150 million by the next IPL5. India has become the fifth largest fantasy sports market in the world and has matured with the entry of several players, some of which are: 11wickets, Guru11, Dream11, CricPlay, Fancode, Fanmojo, Halaplay, Fancy11, MyTeam11, Fanfight.

- Where Digital media drove deal activity with 53 per cent, gaming secured 35 per cent.

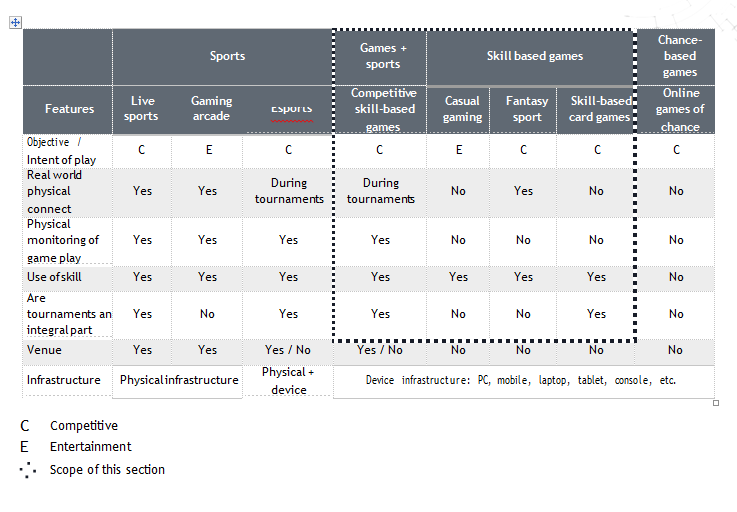

- The gaming segment will grow across all its verticals from, esports, fantasy sport, casual gaming and other games of skill, but revenue growth will be led by mobile-based real-money gaming applications across these verticals.

- A nodal agency is required to implement responsible gaming guidelines, as well as monitor areas like minor game play, security, data protection, content guidelines and training.

- Gaming consumption shifted post the pandemic where 39 per cent respondents think the consumption rate is much more than before, 11 per cent thinks it is less than before and 50 per cent thinks it is the same as before.

- Gamification linked to sporting events, reality shows, and marquee content were popular on e-commerce platforms, with several brands opting for these non-traditional online advertising options.

- Indians downloaded 9.2 billion game apps in 2020, comprising 80 per cent of entertainment app category downloads.

- Media and entertainment, including news, books, music, video and gaming, contribute to over 75 per cent of data consumption in India.

- Usage of gaming apps have increased by 10 per cent in 2020 as 57 per cent played games compared to 47 per cent in 2019.

- As the number of connected smart televisions grows to approximately 40 to 50 million by 2025, 30 per cent of content consumed on such screens will not be broadcast content, but gaming, social media, short video and content products specifically created for this audience by television, print and radio brands.

- Games saw the highest growth in app downloads in 2020 with 9,261 million gaming app downloads for both android and iOS. In 2019, it was 5,622 million gaming app downloads.

- Ludo King topped the top 10 gaming apps in 2020 with highest DAU and MAU rate however in terms of revenue, Free Fire gaming app topped the chart. Top 10 gaming apps as per DAU, MAU and revenue are as follows:

- In India, 19 games across 18 publishers contributed towards top-10 rankings across downloads, monthly active users and consumer spend.

- Action oriented games remained the most popular in the top-10 rankings across all three parameters DAU, MAU and revenue.

- Esports grew by 12 per cent in 2020.

- Growth was impacted due to the ban on Chinese apps which included PlayerUnknown’s Battlegrounds Mobile (PUBG), which was India’s favorite esports app till it was banned.

- 2020 saw a 90 per cent growth in the number of people playing esports compared to 2019.

- Esports in India saw viewership double to 17 million in 2020 as it became available across 14 broadcast platforms.

- Global gaming firms, such as Activision, Garena and Supercell, which publish Call of Duty, Free Fire and Clash of Clans, are lining up to invest in India’s esports ecosystem after PUBG Mobile had to exit late last year due to the Indian government’s clampdown on Chinese or China- associated apps.

- Watching online gaming on platforms like Twitch and YouTube become more popular in 2020.

- YouTube Gaming revealed that 2020 was its biggest year ever, with 100 billion watch-time hours — double the number of hours watched in 2018 — across over 40 million active gaming channels.

- Indian streamers such as MortaL, Dynamo Gaming, Sc0ut, Total Gaming, Gyan Gaming and SOUL Regaltos now also feature among the top live streamers by number of views.

- Indian gaming start-ups have taken note of this trend and companies such as Loco, Doofy and Rheo have ventured into the live game streaming segment offering daily, weekly and monthly subscription packages.

- 57 per cent of respondents got tired of their games within three months.

- 36 per cent of respondents watched live game streaming; 35 per cent of whom spent over an hour per week.

- 28 per cent of respondents had participated in one or more fantasy leagues.

- While just one per cent had already subscribed, 28 per cent of respondents were willing to evaluate game subscription platforms.

- 85 per cent did not want to pay to play where as 15 per cent are willing to pay to play.

- Esports teams grew more than 3.5x in 2020 across all competitive level games. Esports players almost doubled in 2020 across all competitive level games

- Prize money of the esports tournaments crossed Rs 150 million in 2020 and it is expected to cross Rs 250 million in 2021.

- Number of international esports teams in India is expected to double in 2021.

- Women audience in esports is on the rise. 36 per cent of respondents watched live game streaming; 35 per cent of whom spent over an hour per week.

- 71 per cent prefer multiplayer games and 59 per cent prefer single player games.

As of 2020, it is estimated that there are over 400 gaming start-ups in India and the growth was witnessed across the paradigm,from hyperlocal casual gaming to esports. However the report suggests regulatory uncertainty needs to be resolved through policy clarity for the gaming segments to achieve its potential. Also future growth will be driven by IoT gaming, smart sports clothing, health gaming, gamification of traditional media and 5G-led innovations across cloud gaming, cross-platform gaming, e-commerce gamification, AR and VR games.