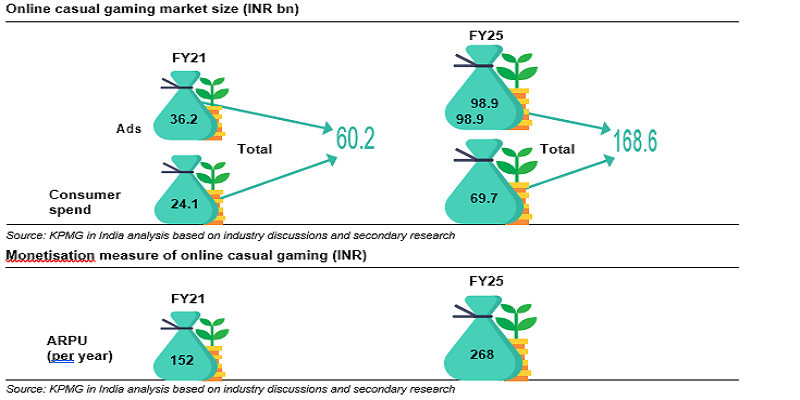

The Indian online gaming market has seen an incredible growth not just in the number of gamers but also in user engagement levels. According to the recent KPMG report Beyond the tipping point – A primer on online casual gaming in India, from ~250 mn gamers at the end of FY18, the numbers of gamers in India grew to ~400 mn by the mid of FY20, the second largest base of online gamers in the world after China. Online casual gaming sub-segment in India stood at a size of Rs 60 billion in FY21 and is projected to grow at a CAGR of 29 per cent over FY21-25 to reach a size of Rs 169 billion.

Here are the key highlights:

- As of 2021 there are 420 million users in casual games, 92 million users RMG card and casual based, 60 million users RMG card and fantasy sports.

- The online gaming segment in India was estimated at Rs 136 billion in FY21 and is projected to grow at a CAGR of 21 per cent over FY21-FY25 to reach a size of Rs 290 billion.

- Of the total size, the online casual gaming sub-segment is the most significant one and stands at Rs 60 billion in FY21, accounting for ~44 per cent of the total online gaming revenues

- In terms of users, the online casual gaming sub-segment, at 420 million gamers in FY21 accounted for ~97 per cent of the total gamers in India and is expected to maintain this share by FY25 going ahead.

- Currently at 423 million as of 2021, the Indian gaming user base to increase to 657 million by 2025 and market size to spike upto Rs 290 billion by 2025 which is currently at Rs 136 billion.

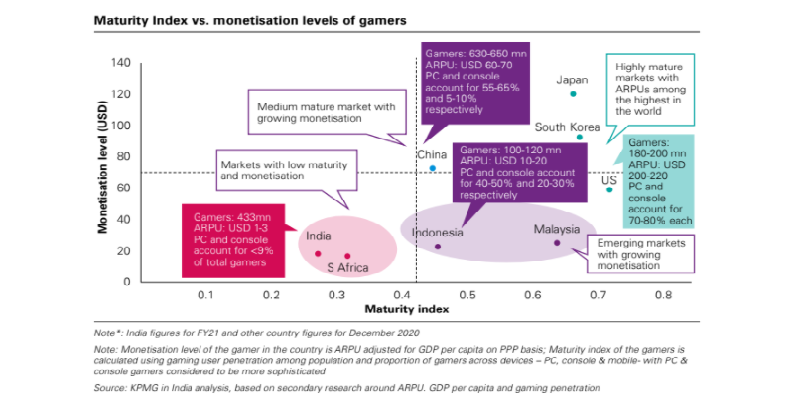

- The segment is significantly under indexed on monetization with lower ARPUs as compared to the gaming markets such as Indonesia, Malaysia and South Africa, which are comparable in terms of the per capita GDPs.

- Top 10 downloaded games (Google Play Store) as of April 2021 are Ludo King, High Heels, Carrom Pool: Disc Game, Garena Free Fire, Xtreme Boat Racing 2019, Hill Climb Racing, Join Clash 3D, Howzat Fantasy Cricket, Temple Run 2, Subway Princess Runner and so on.

- Over the last four to five years, Indian studios have significantly evolved in terms of operations and have expanded their user reach by entering new genres. Several top Indian studios have also shown success in key genres like board, action and RPG, gaining top spots in terms of user base and downloads on the Google Play Store. The top ten Indian Gaming studios are as follows: Gametion, Games2win, Octro, Moonfrog, Reliance games, Gameberry, Blacklight Gaming, JetSynthesys, Nazara Technologies.

- As compared to global markets, online gaming in India is young and at a nascent stage but is among the fastest growing gaming markets in the world. India, while having the world’s second highest number of gamers, is significantly under indexed on monetisation with lower ARPUs as compared to even the developing gaming markets such as Indonesia, Malaysia and South Africa and so on. Some of the reasons for this under-indexation of India in terms of ARPU are as below:

- Relatively lower maturity of casual gaming as a segment with the recency of the digital revolution and low PC and Console penetration

- Significantly lower GDP per capita of India as compared to mature gaming markets

- Lack of purchase price parity for game pricing (India vs. developed markets) by major studios

- Historical negative perception of gaming in India

- Absence of overt government support historically to the gaming ecosystem

- With India’s movement up this maturity curve, the monetisation and as a result, ARPUs are likely to increase significantly on the back of increased user penetration with young gamers adopting gaming, rising disposable incomes, increased propensity to spend on gaming as a form of entertainment and higher time spent on gaming.

- India had the highest game downloads in the casual mobile gaming segment in the world (excluding China) in 2020 with Q1-Q3 2020 downloads standing at 7.3 billion accounting for 17 per cent of the global mobile game downloads (approximately 43 billion, excluding China) during the same period.

- Monthly active users for top 100 mobile games in 2020 spiked 630-670 million, eventually reduced post lockdown to 480-520 million but tapered off at a higher average than pre-COVID times (425-475million) indicating that the increased adoption of gaming witnessed was not just during the lockdown.

- Key growth drivers and lever: Increasing penetration of smartphones, growing internet penetration, young population, adoption of digital payment methods and so on.

- With a move up the gaming maturity curve for India, consumer spends; led by In App purchases (IAPs) are likely to see strong growth in the next three to four years.

- With pricing of IAPs adjusted to Purchasing Power Parity (PPP), localisation of content, social aspects of gaming, and emerging opportunities around multi gaming platforms being able to devise monetary rewards, the consumer spends around online casual gaming is likely to see improved traction.

- The key evolving themes of the sector are as follow:

- Cloud gaming: With the proposed launch of 5G services, cloud gaming has the potential to transform the gaming experience for a mass of users, taking device capabilities out of the picture. This is especially important for markets like India, with limited capacity to invest in hardware. The projected cloud gaming revenue to spike to $12 billion at 25 per cent CAGR.

- Esports: Over the next five years, the esports segment is expected to grow rapidly due to increased interest from brands for sponsorship, publishers to promote games and entry of new players across the value chain ranging from organisers to participating teams. The Indian esports sub-segment is expected to grow by CAGR 27 per cent over FY21-25 to reach a size of Rs 5.7 billion.

- Game development outsourcing can help resolve many challenges pertaining to cost, talent and time to money.

- Artificial Intelligence in casual gaming: AI is being extensively used across game development (using AI generated storylines), player engagement, interactive experiences across gameplay, and personalization of each gamer’s journey with games.

KPMG in India partner and head of technology, media & telecom Satya Easwaran commented, “Our report – Beyond the tipping point – A primer on online casual gaming in India aims to simplify the multilayered ecosystem of the world’s second largest online casual gaming user geography. Poised at a 3X growth in revenues between FY21-25, we have been privy to the keen interest from corporates and investors who want to ride the incredible wave of opportunity that the business of online casual gaming has to offer.Having seen rapid growth in the last five years on account of the growth in digital infrastructure in the country coupled with the availability of leading titles, India’s online gaming segment is now a serious business with India’s gaming market being overwhelmingly mobile first.”

KPMG in India partner and head, M&E Girish Menon added, “The online casual gaming sub-segment in India has emerged as the largest in terms of consumption amongst overall online gaming, with close to 420 million gamers engaging in online casual gaming in FY21. Online casual gaming saw its tipping point in 2020, with consumption and engagement at an all time high. The growth potential of this sub-segment is immense, with improved monetisation helping the growth of the developer and publisher ecosystem, resulting in the likely emergence of players of scale. Both consumer spends and advertising based monetisation, which is unique to India, are likely to see strong traction, with India’s movement up the maturity curve and supply of world class titles, the uptake of rewarded/incentivized ads and localisation of gaming titles being the key enablers.

Further, with the emergence of ecosystem enablers such esports and game streaming, online casual gaming is likely to appeal to the masses and professionals alike.Lastly, with technologies such as cloud gaming on the anvil and the adoption of latest AI/ML led technologies, online casual gaming in India is serious business, both for the players in the ecosystem as well as the investors. We envisage the online gaming segment to be amongst the largest segments of the M&E industry in India in the years to come, garnering a share of both the time, and the wallet of the Indian digital billion”.