The Indian app market continued to grow in international market this year. With 2020 seeing a marginal decline in top apps from China partly due to geopolitical climate and Indian apps made for almost 40 per cent of the app market in the country, according to recent AppsFlyer report The state of App Marketing in India 2021.

Due to geopolitical tension, the government has banned several apps of Chinese origin a few months back which includes both gaming and non-gaming apps. Initially, gaming apps like Mobile legends Bang Bang, Clash of Kings were banned and sooner Dawn of Isles, Warpath, Mafia City, Arena of Valor, Soul Hunters, Mobile Legends: Pocket, and MARVEL Super War joined the banned apps list. The ban of the gaming apps has surprised the gaming industry but when the announcement of PUBG Mobile and PUBG Lite ban happened along with 118 more Chinese apps amid geopolitical tensions in Ladakh, has made the Indian PUBG Mobile fans upside down. As PUBG Mobile was a wildly popular game in India, with close to 33 million active PUBG players in India and 13 million daily users according to reports. During the ban, the Ministry said it has received many complaints from various sources including several reports about the misuse of some mobile apps available on Android and iOS platforms for “stealing and surreptitiously transmitting users’ data in an unauthorised manner to servers which have locations outside India.”

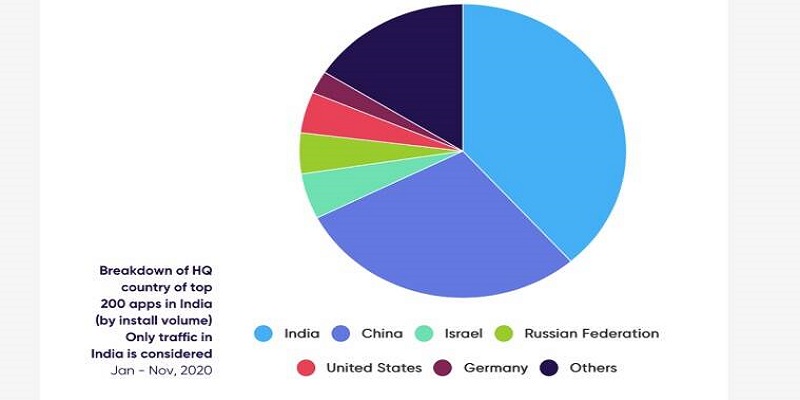

Slowly to fill the emptiness of the banned apps Indian apps came to the rescue and today, the Indian app market is dominated by apps of Indian origin including mostbet app. According to the report, the Chinese are still second in place on the overall list and the U.S, Russia, Israel, Germany aim to acquire it, says the report. 2020’s three month COVID-19 lockdown took a toll on the investment and there has been a resulting reduction in non-organic installs (NOI ). As video content was reaching new heights OTT players started investing in content creation and distribution as video consumption was reaching new heights. In particular, they have seen a surge in mobile consumption amongst consumers of tier two, tier three, tier four cities, particularly for entertainment and gaming apps.

Uttar Pradesh took the top spot on the NOI charts back from Maharashtra. NOI are defined as app downloads taking place as a result of any marketing activity. One of the drivers of increase in NOIs is also because of the surge in the gaming sector along with news and entertainment reveals the report. Due to pandemic NOI growth in gaming hit 15.65 per cent in 2020 which was at 14.13 per cent in 2019. While NOI in gaming showed a slight uptick this vertical nevertheless demonstrated strong user growth driven primarily, but because of a plethora of affordable smartphones with cheap data plans , new app launches, as well as localised games that focused heavily on rewards to entice and attract players was possible says the report.

Indian users prefer apps that take up less space and are faster to use and that over 50 per cent of the uninstalls occur within the first day of the installation itself. For the average app, overall retention rates across verticals fell this year by 12 per cent. The gaming vertical with 14.59 per cent enjoyed the fastest time to fast purchase often converting a user within the first 10 mins. In app purchase in gaming did well in lockdown between March and June at 13.04 per cent and during October it spiked up to 15.9 per cent because of the Indian festive season. Also, the uninstall rate for gaming are quite high, on day one of installation itself, 51.14 per cent the app gets uninstalled by end of the day (like other verticals)and by the end of 30 days, 100 per cent uninstallation takes place. This reflects that gaming consumers are getting bored with repeated content and that is why the demand for games is always high. The report also states that less storage on devices can also be a major reason.

With the retention rate of gaming is reducing like all other sectors it is crucial for marketers to adjust their retention strategies, shifting the focus in re-engaging existing users in order to improve LTV. 58.05 per cent in gaming brands are remarketing strategies( with game upgrades, new drops, camo, character, maps, modes and so on) to progress. Gaming apps running remarketing campaigns increase by 16.01 per cent.

Also the report states that marketing frauds remain a serious issue and is certain to mount back as soon as marketing budgets recover and gaming remains one of the most affected verticals which includes bot, install hijacking, device farms followed by click flooding .