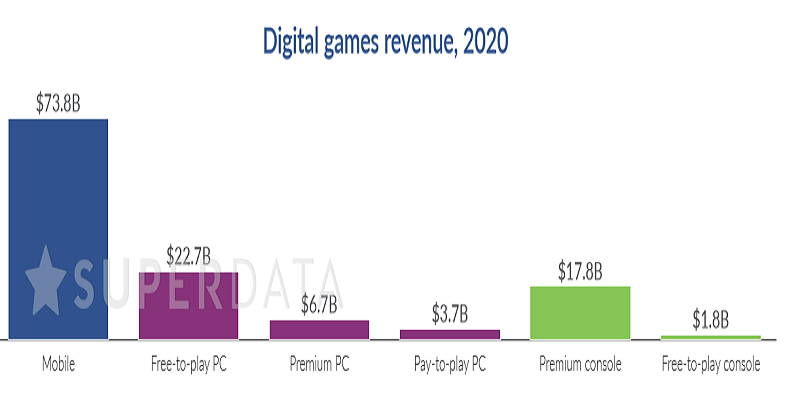

It is true that without gaming and interactive media, the covid-19 pandemic led lockdown would have been more difficult. Therefore the year 2020 has seen a tremendous surge in gaming and interactive media sector as many find these mediums as the key to connect with their dear ones as virtual is the new social. Superdata, a Nelsen Company, has rolled out report ‘2020 year in Review of Digital games and interactive media’ which states that, games and interactive media earned $139.9 billion in 2020 of which mobile games earned $73.8 billion, PC games earned $33.1 billion and console $19.7 billion Gaming Video Content earned $9.3 billion and XR is $6.7 billion .

Key findings of the report are as follows:

- The games and interactive media industry grew 12 per cent year-over-year.

- Over half of US residents (55 per cent) played video games as a result of the first phase of COVID-19 lockdowns. Consumers turned to games as other forms of entertainment like watching professional sports and going to movie theaters became unavailable.

- The premium games market grew 28 per cent in 2020 as the segment had multiple blockbuster releases throughout the year. Highly-anticipated single-player games such as DOOM Eternal, The Last of Us Part II and Cyberpunk 2077 helped drive earnings. The performance of sports franchises like FIFA and NBA 2K was also up year-over-year even after the return of televised sports.

- Free-to-play games once again generated the vast majority (78 per cent) of games revenue, with Asian markets accounting for 59 per cent of free-to-play earnings. Hardcore mobile games appealed to players in Asia. Honor of Kings and Peacekeeper Elite, both Tencent titles, each generated over $2B during the year.

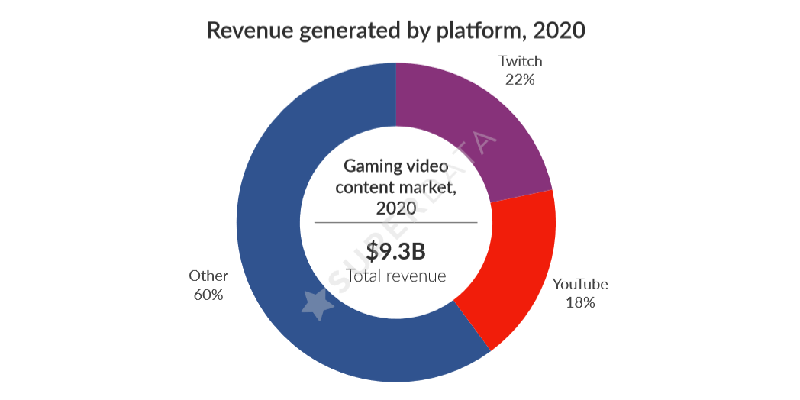

- Gaming video content (GVC) became a $9.3B industry in 2020, reaching 1.2B viewers. Alongside the standard fare of competitive titles, social games, brand crossovers like Fortnite X Marvel and public figures like Congresswoman Alexandria Ocasio-Cortez earned top views. GVC also helped Among Us become one of the most popular games ever.

- Virtual reality (VR) game earnings jumped 25 per cent year-over-year to $589M in 2020. The release of Half-Life: Alyx, a rare VR-only title from a major gaming franchise, reinvigorated interest in the technology among hardcore gamers. Additionally, the untethered and budget-friendly Oculus Quest 2 headset attracted everyday consumers to VR.

- Game earnings were up just six per cent year-over-year in January and February, but rose to 14 per cent for the rest of the year. As COVID-19 lockdowns took effect worldwide in March, game spending took off and never let up.

- Free-to-play games earned 78 per cent of digital revenue in 2020, but premium title revenue grew faster, rising 28 per cent vs. nine per cent. North America and Europe together accounted for 84 per cent of all premium games revenue.

- Individuals actually spent more time on mobile games even as they remained sedentary. Over two in five consumers (43 per cent) spent more time playing mobile games in the spring compared to just eight per cent who spent less time. Similarly, over one in four consumers (28 per cent) spent more Qme playing console games and nearly one in five (18 per cent) played more PC.

- Young adults turned toward games as a direct result of COVID-19. Among consumers ages 18 to 24, 66 per cent played more console games, 60 per cent played more mobile games and 55 per cent watched more gaming video content on sites like Twitch or YouTube.

- Shipping delays and closures of local games businesses pushed gamers to purchase digital goods instead of discs and cartridges. Spending on game downloads went up among over one in four adults (27 per cent) who spent money on video games compared to 29 per cent of adults who spent less on physical game purchases.

- Roughly one in four (27 per cent) US residents used games to stay in touch with friends and loved ones or socialise with new people. Online games such as Call of Duty: Warzone and Animal Crossing: New Horizons became early hits in 2020 thanks in part to their ability to help gamers socialize virtually.

- The mobile market saw 10 per cent growth in 2020 and accounted for 58 per cent of the total games market.

- Despite lockdowns and reduced commuting, mobile earnings did not fall as a majority of mobile players (62 per cent in the US) already use mobile devices as their primary gaming platform. Mobile gamers in North America and Europe continued to play mainstay titles like Pokémon GO or Candy Crush Saga. In Asia, mobile continued to be the platform of choice for many hardcore gamers and titles like Free Fire performed bigger than ever in 2020.

- The free-to-play segment continues to thrive in Asia. Asia generated 59 per cent of total worldwide free-to-play earnings. Companies based in Asia published six out of the top 10 titles, with Tencent titles Honor of Kings and Peacekeeper Elite each breaking over $2B in total revenue.

- Premium console earnings grew 28 per cent year-over-year, by far the biggest growth of gaming segments measured. Life simulation game Animal Crossing: New Horizons became one of the biggest hits in 2020, breaking the console record for premium launch downloads. It overtook Call of Duty: Black Ops IIII by selling 5.0M digital units during its March 2020 launch. (pic top 10 premium titles)

- The audience for gaming video content (GVC) grew 18 per cent to reach 1.2B people in 2020. Social and party games became hits as mainstream audiences looked for substitutes for social interaction and entertainment. Twitch streams helped battle royale platformer Fall Guys: Ultimate Knockout become a breakout hit in August, selling 8.2M units on PC.

- With concerts cancelled, musicians performed inside online games to bring music to their fans. Travis Scott performed a digital concert in Fortnite to great success. Across five concerts, the event attracted over 45M views, with an average minute audience of 4.7M. In November, Lil Nas X performed a concert in Roblox, gathering over 33M views across the event.

- Public figures that include celebrities and politicians are making a splash in games media. Congresswomen Alexandria Ocasio-Cortez and Ilhan Omar streamed Among Us alongside popular Twitch streamers, attracted a 358K average minute audience.

- Overall VR headset shipments fell 15 per cent in 2020, but sales of standalone devices grew 19 per cent during the year. The standalone Oculus Quest 2 is driving VR adoption among mainstream consumers.

- VR game revenue was up 25 per cent year-over-year largely thanks to the release of Half-Life: Alyx. As a VR-exclusive entry in a major franchise, Half-Life: Alyx rejuvenated interest in the technology among hardcore gamers. The PC game sold 1.9M digital units in its first six months and generated more revenue on its own than all PC VR games combined in 2019.

- Supply issues held back pandemic-fuelled growth in VR spending. 71 per cent of US VR headset owners spent more time on their devices than in the past due to COVID-19.