KAM Summit 2022 hosted multiple interesting sessions at Sahara Star, Mumbai. One of them was a detailed report titled Global Streaming Platforms: A New Window for Animation by OMDIA senior principal analyst (digital content and channels) Tim Westcott. He focussed on streaming in the TV and online video landscape, the importance of animation to online video, how much animation is being originated by streamers, followed by a close-up on the key players and a quick review of the streaming services in India in the end.

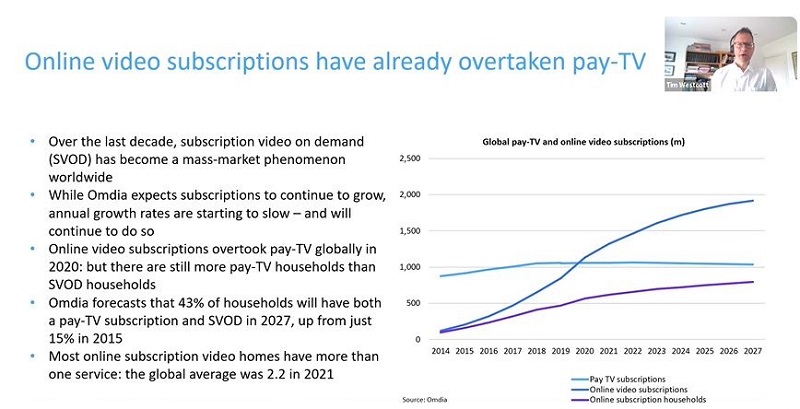

The report highlighted how online video subscriptions have already overtaken pay-TV. Over the last decade, subscription video on demand (SVOD) has become a mass market phenomenon worldwide. Online video subscriptions overtook pay-TV globally in 2020, but there are still more pay-TV households than SVOD households. India forecasts that 43 per cent households will have both a pay-TV subscription and SVOD in 2027, up from just 15 per cent in 2015. Most online subscription video homes have more than one service; the global average was 2.2 in 2021. While India expects subscriptions to continue to grow, annual growth rates are starting to slow – and will continue to do so.

Westcott then drew attention to the fact that soon online ad revenue will outgrow subscription and TV advertising. In this maturing market, online video advertising revenues will grow more quickly than subscription, and will be the largest revenue source in 2027. Ad-supported online video revenues will grow from $148B in 2021 to $361B in 2027, a CAGR of 16 per cent. Traditional TV advertising revenue totaled $159B in 2021 and is forecast to be $160.2B in 2027, a decline in real terms. He mentioned that ad-supported online video will overtake TV advertising revenue this year.

Did you know that Disney now has more subscribers than Netflix? Well, growth for Disney+ has been quicker than expected, and in Q2 2022, Disney (with Hotstar, Hulu, and ESPN+ included) reported more online subscribers than Netflix. However, Disney’s online subscribers revenues were $5B in Q2 2022, compared to $7.9B for Netflix.

Discussing how important is animation to online video, Westcott’s report said that most of the leading US on-demand services offer animation, either targeting children or adults. However, Disney+ is far more animation-focused than others; some 35 per cent of the titles in the Disney+ catalog in Q2 2022 were animation. This, compared to 12 per cent Netflix and HBO Max, 10 per cent for Peacock, six per cent for Paramount+ and five per cent for Amazon.

When it comes to dissecting the amount of animated content in on-demand services, here is what the study showed: AVOD service Tubi was a leader in terms of volume, with 1,523 animation titles in Q2 2022. Crunchyroll (now owned by Sony) offered just under 1,400 anime titles. Netflix was just ahead of Disney+ with 539 animation titles. Tubi was also the leader in terms of theatrical animation titles, with 262, but Disney+ is isn’t far behind too. Netflix has 77 animation movies, similar to the 69 available on Amazon.

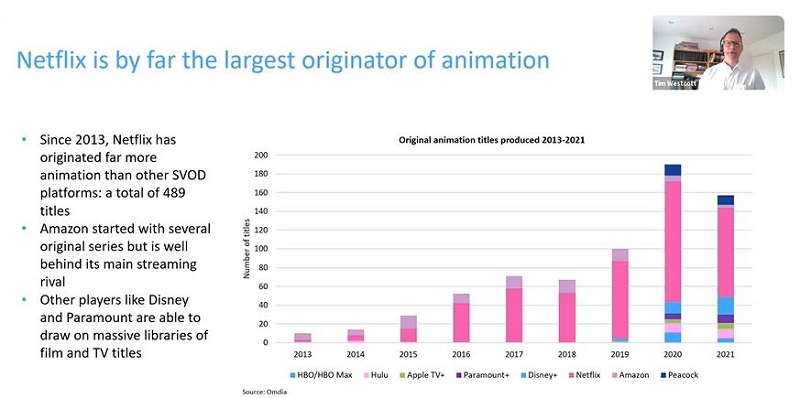

Westcott mentioned how most animation in on-demand services is not original. Apple TV has the smallest catalog of the SVOD services, but the highest proportion of original animation. Tubi has the largest animation offer but none of its titles is original to the AVOD service. Netflix, without a library to draw on, also has a high level of origination, and for Amazon the share is less than five per cent. This does not, of course, take away from the fact that Netflix is by the far the largest originator of animation. Since 2013, Netflix has originated far more animation than other SVOD platforms: a total of 489 titles. Amazon has started with original series, but is far behind its main streaming rival.

OMDIA’s report would have been incomplete without a close-up on key players. It declared Netflix as the powerhouse of streaming animation. Since 2013, Netflix has originated 489 animation titles, including 95 in 2021 alone. Children are the main target audience for animation with 384 kids-based titles produced to date. Disney+ mostly produces animation in-house and is an aggressive opponent to Netflix in particular. Disney’s combined services now have more subscribers than Netflix, but so far Disney+ has done very limited production outside the US. Westcott stated that Amazon has a selective approach when it comes to original investment and often targets markets which are key for retailers, such as India. He added that at Annecy 2022, Amazon Prime Video head of animation and family programming Melissa Wolfe said they are looking for anything “appealing to a 16-and-up at the moment.” And, of course, HBO Max has its animation plans scaled back after the Discovery merger and it would be interesting to see what kind of content they dive into from here on.

Westcott’s last segment showed a few observations and predictions about streaming services in india. OMDIA’s report stated that Disney+ Hotstar is well ahead in the Indian SVOD market, with just under 40 million subscribers at the end of 2021. Amazon Prime Video has 7.3 million and is ahead of Netflix with 6.2 million. OMDIA has reduced its forecast for Disney+ Hotstar following its loss of IPL streaming rights from 2023 to Viacom18. However, they expect the platform to remain the largest player, thanks to its offerings of original content and plans to increase production in languages other than Hindi.

The report further said that children’s content is not a key driver of subscribers in India. Westcott also pointed out that there is room for growth in Indian production for the international platforms. International platforms have ramped up local production in India, but so far there have been few animation projects. So, let us hope to see more Indian production houses collaborate with platforms to bring out superlative animated content in the future.