With the economy showing steady signs of recovery, India’s advertising community continues to place their faith in television, indicates BARC India’s latest THINK report titled ‘TV Ad Volumes Insights – The Mid-Year Analysis’.

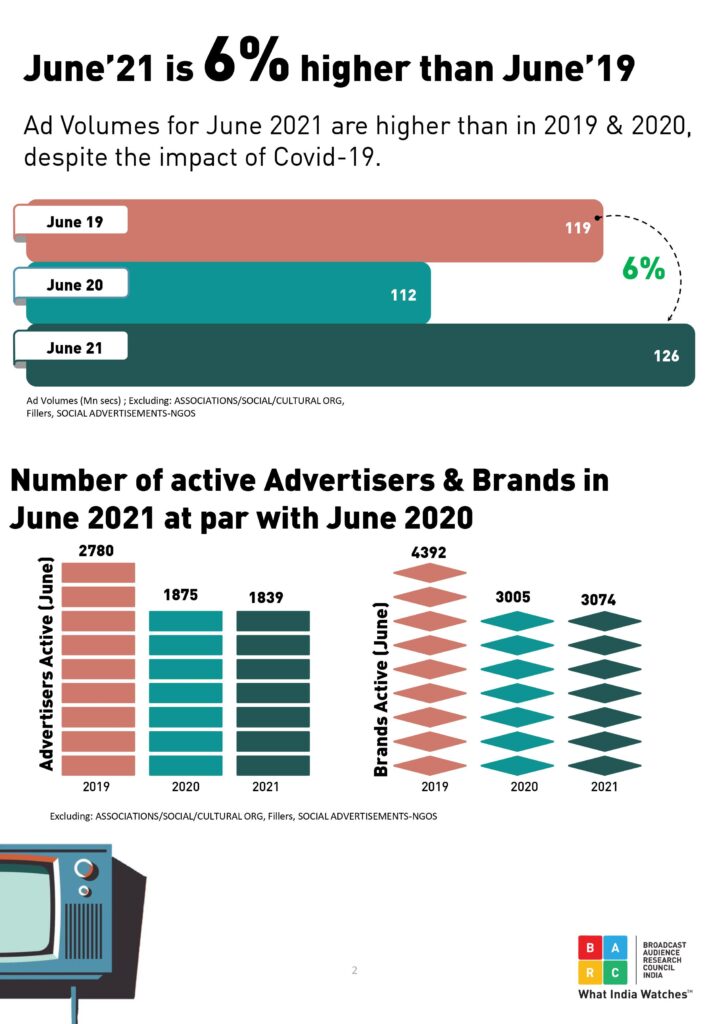

Committed to measuring what India watches TM, BARC India’s latest report indicates, Ad volumes registered in June 2021 is the highest if compared to the same period for 2019 and 2020 despite the impact of the second wave of COVID-19.

With a six per cent growth in Ad Volumes over June 2019, June 2021 saw a total of 1839 advertisers and 3074 brands advertise on television. H1 2021 too witnessed higher growth with 12 per cent and 37 per cent increase in Ad volumes if compared to 2019 and 2020 respectively.

BARC India head of client partnership and revenue function Aaditya Pathak said, “Ad volumes for H1 2021 is promising and encouraging for the industry as a whole. The number of active advertisers and brands are also picking pace. There is a sharp increase in Ad volumes from the top three advertisers and while FMCG continues to dominate by share, e-commerce category continues to see strong growth year on year. The auto sector has also made a comeback despite the impact of the second wave. Data for the first half of 2021 reinstates that while new advertisers have turned to television for widespread reach, existing ones continue to increase their attention to the medium.”

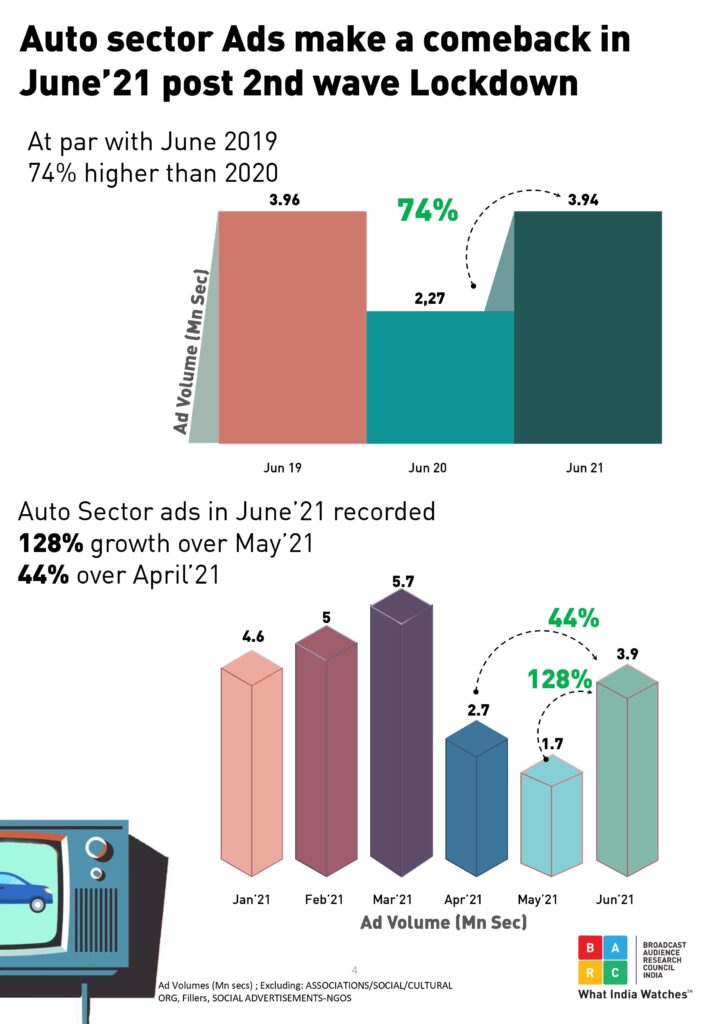

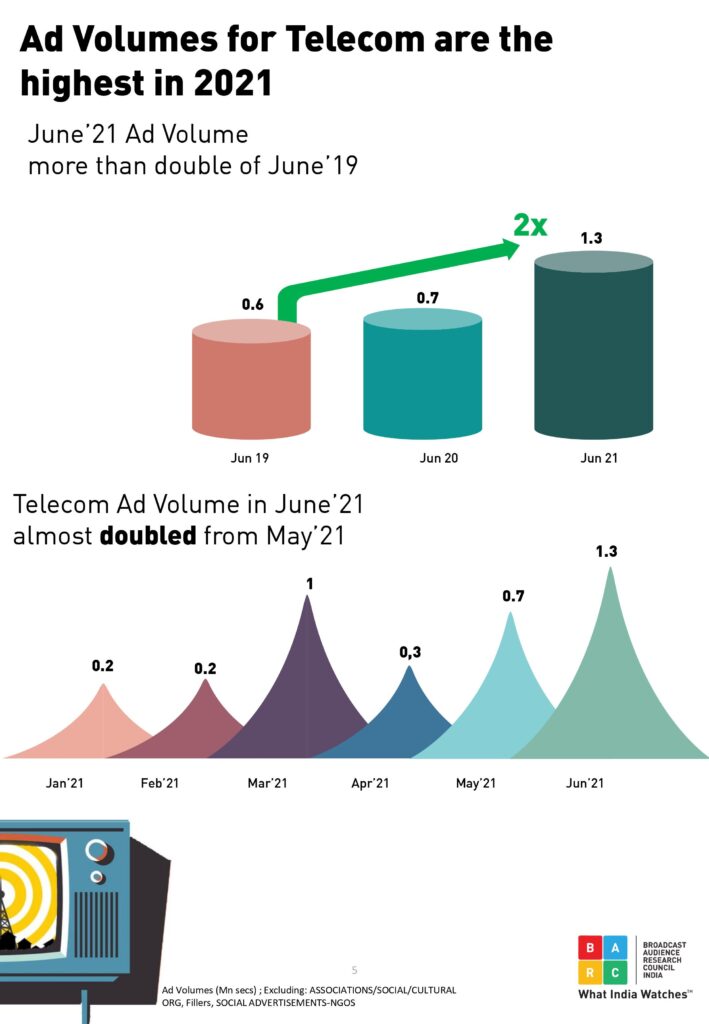

After a dip in June 2020, the auto sector made a strong comeback in June 2021 by registering a growth of 74 per cent. With 3.94 mn seconds in June 2021, the auto sector is at par with the ad volumes it registered in June 2019. More impressively, the sector achieved 128 per cent growth over May 2021. Likewise, Ad volumes for the Telecom sector almost doubled in June 2021 over May 2021 and have registered double growth in June 2021 over June 2019.

With 15.4 mn seconds in June 2021 alone, ad volumes for the E-commerce sector have registered a whopping growth of 56 per cent when compared to June 2019. Currently, at all-time high, the category constitutes a 12 per cent share in the total ad volume pie.

FMCG continued to lead the share in H1 2021 with 566 mn seconds, a growth of 40 per cent over H1 2019. The building sector registered 30.7 mn seconds of Ad Volumes; a 24 per cent growth in H1 2021 versus H1 2019. Ad Volumes for BFSI sector grew by seven per cent over H1 2019 with 14.5 mn seconds in H1 2021.