FICCI Frames 2012 kick started with the inaugural of FICCI KPMG Report on the Media & Entertainment industry. The inaugural session was conducted by Karan Johar, Co-chair, FICCI Entertainment Committee; Senator Chris Dodd, Chairman, MPAA; Prithviraj Chavan, Hon’ble Chief Minister, Maharashtra; Shri Uday K Varma, Secretary, Ministry of Information & Broadcasting; Uday Shankar, CEO, Star India & Chairman, FICCI Broadcast Forum; Jehil Thakkar, Head, Media & Entertainment Practice, KPMG; Dr Rajiv Kumar, Secretary General, FICCI & Sonam Kapoor.

FICCI Frames 2012 kick started with the inaugural of FICCI KPMG Report on the Media & Entertainment industry. The inaugural session was conducted by Karan Johar, Co-chair, FICCI Entertainment Committee; Senator Chris Dodd, Chairman, MPAA; Prithviraj Chavan, Hon’ble Chief Minister, Maharashtra; Shri Uday K Varma, Secretary, Ministry of Information & Broadcasting; Uday Shankar, CEO, Star India & Chairman, FICCI Broadcast Forum; Jehil Thakkar, Head, Media & Entertainment Practice, KPMG; Dr Rajiv Kumar, Secretary General, FICCI & Sonam Kapoor.

The KPMG report revealed that Indian Animation, VFX and post production industry achieved estimates revenues of INR 31 billion in 2011, a robust growth of 31 percent over 2010. Backed by a robust business environment for animation and VFX content in movies, 2D or 3D conversion projects which provided the impetus not anticipated before, demand for local animated TV serials, licensing and merchandising of popular characters, etc. The rising dollar in the second half of the year is also supported this growth.

As compared to a growth of 9% in 2010, the industry grew by 12% in 2011 and is estimated to grow at a CAGR of 16% during 2012-16. Television continued to dominate the work executed by Indian Animation studios and this trend is expected to continue in the near future.

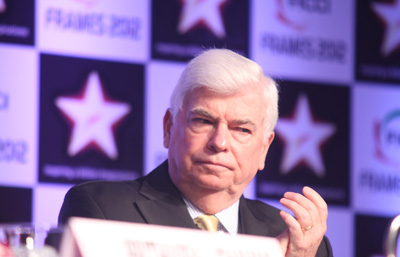

Chris Dodd at the inauguration shared, “The art of storytelling is timeless. But now film and TV has occupied an important place as the medium of storytelling. India sells the highest number of movie tickets. No other country comes close to it”.

Chris Dodd at the inauguration shared, “The art of storytelling is timeless. But now film and TV has occupied an important place as the medium of storytelling. India sells the highest number of movie tickets. No other country comes close to it”.

After the spectacular success of Avatar in 2009, the animation industry continued to receive a boost in 2011 – four animated movies featured in the list of Top 20 movies at the US box office.

In the US, animated family films were all the rage in 2011 attracting kids and adults. In the Indian scenario, whilst there has been a thrust in the owned content segment in the television space, we are yet to see similar traction in main stream Indian cinema. There were movies in the pipeline at the start of 2011 but there were no major releases in 2011. This is primarily because of the lack of distribution partners and the gestation period being far more than the production of as live action feature film. Combined with this is the fact that cost of production being high, the movie cannot be made for Indian market alone and it has to have the capacity to appeal to international audiences.

Animation services have grown at a CGAR of 14% over 2008-11. Overseas production houses like Walt Disney, IMAX and Sony are increasingly outsourcing portions of animation and special effects to India. ‘Puss in Boots’ marks the first time DreamWorks have relied on Indian animators to help produce a full-length feature film. The Bangalore animation studio has become an increasingly important piece of DreamWorks’ production pipeline. Additionally, companies are sourcing animation from India for commercials and computer games.

Animation services have grown at a CGAR of 14% over 2008-11. Overseas production houses like Walt Disney, IMAX and Sony are increasingly outsourcing portions of animation and special effects to India. ‘Puss in Boots’ marks the first time DreamWorks have relied on Indian animators to help produce a full-length feature film. The Bangalore animation studio has become an increasingly important piece of DreamWorks’ production pipeline. Additionally, companies are sourcing animation from India for commercials and computer games.

The overall retail market in India is projected to grow at a CAGR of 12% from USD 456 billion (2010) to USD 789 billion (2015) of which organized retail is projected to expand at CAGR of 31%.

Growth Drivers: Some of the key growth drivers for the animation industry in India are:

- Possibility to leverage cost arbitrage

- Growing Internet and mobile penetration leading to alternate platforms for content creation

- Increasing domestic market consumption

- Education

Challenges: Some of the key challenges faced by the Indian animation industry include:

- High Studio set up cost

- Lack of government support

- Increasing domestic market consumption

PotentialThe global animation and gaming market is expected to grow from USD 122.20 billion in 2010 to USD 242.93 billion by 2016. This represents a CAGR of 13% from 2011 to 2016. In comparison, the Indian animation industry is estimated to be INR 11.30 billion which is a small percentage of the world animation market. This gives the industry by a CAGR of 16% and will be INR 23.97 billion by 2016.

VFX & Post Production

In 2011, the VFX and post production industry in India too witnessed a healthy growth of 45% over 2010 to reach INR 19.70 billion. The VFX market in India is still at its nascent stage and there is a lot of scope and opportunity for growth in this market, both in terms of quality of the work and the amount of work being delivered.

It is estimated that as much as 10% of movie budgets are devoted to the VFX. There is no dearth of competency – Indian companies have worked on Oscar- winning movies like The King’s Speech and the BBC TV Series – The Deep.

Currently, industry insiders estimate that around 70% of Indian big budget films are using VFX. Among the high profile films of late that used VFX extensively are Chandni Chowk to China (1,500 VFX shots), Aladin ( 1,600 shots) , Blue ( 800 shots), Guzaarish (350 shots) and Enthiran ( 2,000) shots.

Jehil Thakkar during the unveiling shared, “Next 5 years are going to be transformational!”

Gaming

The Indian gaming sector achieved revenues of INR 13 billion in line with last year’s forecasts

However, estimates and projections, from this year onwards exclude grey market PC and console software sales which would have futher increased revenue.

Console gaming remained the largest segment by value in 2011, given large ticket sizes of gaming hardware and software and achieved about INR 7.3 billion of revenue in 2011, excluding sales of hardware and software imported in the grey market. Video game consoles are underpenetrated at approximately 2 percent of urban television households in India35, relative to worldwide penetration rates of 13 percent of households36. As penetration deepens, the market for legitimate console gaming hardware and software is expected to continue to grow at a CAGR of 26 percent to reach INR 23 billion37 by 2016.

Mobile Gaming

The mobile gaming market generated revenues of about INR 4.3 billion in 2011, growing 55 percent from last year.

It is anticipated that the segment will grow at a 31 percent CAGR to INR 16.6 billion in 201634, driven by the increase in mobile internet users. While this growth is significantly higher than the overall media and entertainment industry in India, it does not match the expected growth in mobile users. This is primarily due to greater difficulty in monetizing Off-Deck content, as users have a much larger choice of good quality free content available to choose from.

Online PC gaming

The online PC gaming segment achieved estimated revenues of INR 870 million in 2011. The sector is expected to grow steadily at a 41 percent CAGR to reach INR 4.9 billion in 2016, driven by growth in broadband penetration, enabling delivery of richer gaming content.

Packaged PC Gaming

The legitimate packaged PC games market is estimated at INR 381 million in 2011. This is expected to grow 18 percent annually to reach INR 870 million by 2016, driven by PC penetration.

Set-top box gaming

Set top box based gaming content is currently offered by Airtel, Tata Sky, Dish TV, Reliance BIG, Hathaway and Den. However, the selection of content is limited and uptake has been low, generating revenues of approximately INR 350 million in 2011. Going forward, the set-top box gaming segment is expected to grow 25 percent to over INR 1 billion by 2016, driven by increasing digital cable penetration. ARPUs are expected to remain stable over this period.