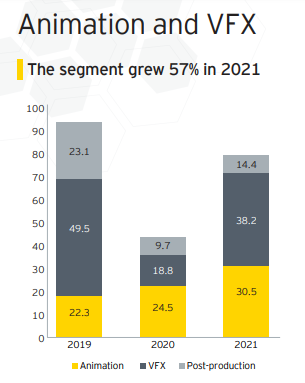

The Indian animation industry is growing fast and with an increasing number of animated series and features being produced in India, it has attracted global audiences and many of India’s works were distributed globally. The demand for animation expanded with the increase in kids broadcasting viewership, availability of low-cost internet access, and growing popularity of OTT. According to the FICCI EY March 2022 report, the animation sector has grown by 24 per cent and the animation and VFX industry is expected to reach Rs 180 billion by 2024.

Here are the key highlights of the report

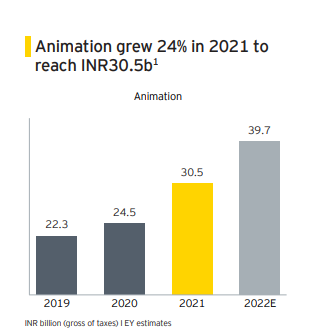

- EY estimates that the animation sector will grow to 39.7 per cent in 2022 from 30.5 per cent in 2021. The sector grew by 24 per cent in 2021 to reach Rs 30.5 billion.

- The animation and VFX segment is expected to more than double in three years till 2024 to Rs 180 billion.

- During the pandemic, the kids’ genre viewership grew about 30 per cent and co-viewership with parents also increased. This increase in viewership has brought in many new advertisers including e-learning platforms, e-commerce, personal care and FMCG brands like Hershey’s, 99 Pancakes and more.

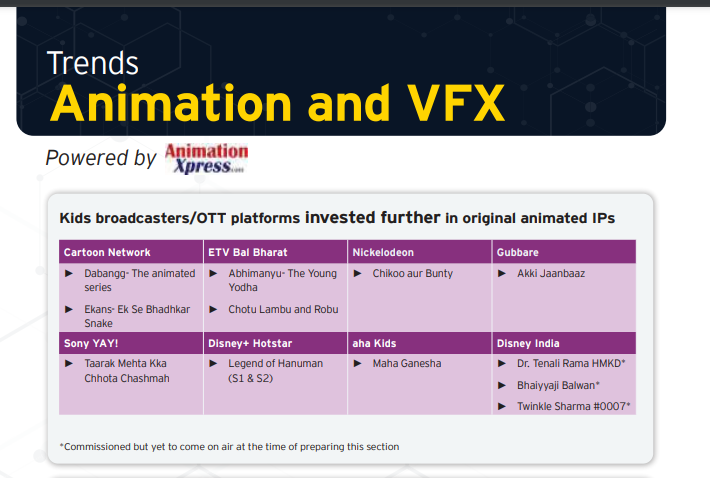

- To cater the demand of fresh and variety content among the kids sector, many broadcasters opted to acquire new original local animated IPs and channels reached regional markets. To join the race of original IPs, the new channels like ETV Bal Bharat launched with two new IPs Abhimanyu – The Young Yodha and Chotu Lambu and Robu. IN10 Media Network’s Gubbare also launched their first IP Akki Jaanbaaz.

- After the successful Green Gold Animation’s Mighty Little Bheem on Netflix, more OTT platforms continued to invest in Indian animated IP. Indian studios like Graphic India launched The Legend of Hanuman season one and two on Disney+ Hotstar, Green Gold also tied up with aha Kids platform for the show Maha Ganesha.

- The year witnessed the acquisition of many comic book characters which will eventually be turned into animated series, films or shorts. Diamond Comic’s Chotu Lambu stories were adapted into animated series for ETV, and Cosmos-Maya acquired more IPs from the library of Lotpot Comics.

- Due to pandemic, the live-action production had gone down and many advertisers switched to animated content which proved to be cost effective. Companies like Cred, Google Pay, Kissan, 7up, Fevistick, Glance App and Munch switched to animated content for their commercials.

- As the demand for animated content increased across platforms, both in broadcast and in digital avenues like OTT, social media, video streaming etc., it led to renewed interest in the segment. NewQuest acquired a controlling interest in Cosmos-Maya, with the transaction value over $90 million. Japanese animation studio Polygon Pictures also launched its wholly owned subsidiary in Mumbai.

- In 2021, we witnessed the emergence of new revenue streams like NFTs, metaverse. Indian studios like Toonz Media Group along with the blockchain R&D company GuardianLink launched the world’s first fully integrated NFT design lab known as Toonz NFTLabs. Graphic India along with gaurdianlink.io launched the Chakraverse limited-edition NFT collection. Paperboat is also looking forward to NFT and blockchain games with their partners Fantico and Vistas.

- Many Indian animation studios like Charuvi Design Labs and Gamitronics Studios started using gaming engines for their production which helped them cut the cost of animation production.

Animation will enter physical and virtual worlds at scale

- Augmented reality and related growth in the advertising sector has brought animation into the physical world, with advertisements now using augmented reality to engage with consumers from their TV screens, OOH billboards etc.

- Brands are also enabling trial of products (cosmetics, fashion, cars and the like) in virtual environments across social and e-commerce apps.

- Smartphones with XR related capabilities as well as tools provided by short video platforms have led to the growth of videos with augmented animated content,which has grown at scale VR glasses and numerous metaverse

Future Trends

- 50 per cent of Indian studios will adapt to real-time/virtual production in the next two to three years.

- Metaverse and NFTs will be the new real estate.

- More studios to open inhouse training programs.

- Institutes to open in tier-2, tier-3 cities to hone the creative talent available there.