Streamers and gaming influencers around the globe have loyal followers ranging from tens to tens of millions. Audiences and streamers are interdependent. While the live streamers and gaming personalities entertain the audiences, help them improve their gaming skills, audiences serve them as a source of passing out information beyond gaming. According to a YouGov report The power of gaming Influencers , among global influencer followers of any type, 59 per cent trust the brand recommendations and advice given by influencers – and this increases to 66 per cent amongst those who follow gaming influencers.

Here are the key findings of the report

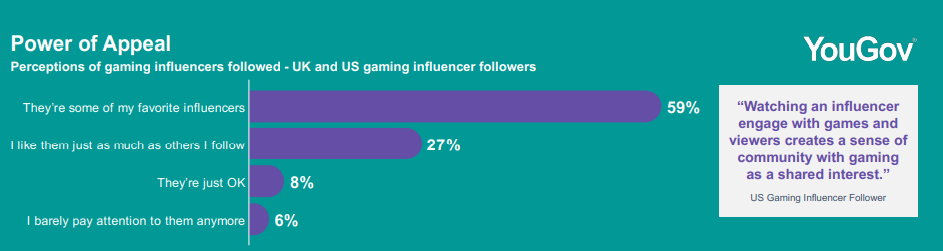

- 59 per cent of followers follow their influencers because they are their favourite influencers

- Here are the reasons why audience follow influencers especially from the gaming category-

86 per cent follow because of good sense of humour

79 per cent for the personalities

70 per cent overall entertainment value

65 per cent for the games they play

45 per cent for the skills

24 per cent for fan community

23 per cent for the cause the influencers support

11 per cent for looks and physical appearance

14 per cent others - Whilst humor and personality makes the fans come back, it’s commonly the games these influencers play that initially attract followers to notice and engage with them. Although nearly all followers personally play the same game titles played by their favourite influencers to some degree, their level of commitment to this is variable. Nearly half indicate that they play the same games as their idols because they are their favourite games (44 per cent), but almost the same proportion suggest that these games are just part of a broader set of titles they personally play.

- 59 per cent of influencer followers across 17 markets surveyed trust the brand recommendations and advice given by influencers.This is even higher among those following gaming influencers, increasing to 66 per cent – suggesting that, on average, gaming personalities offer more potential upside for brands vs. the average global influencer.

- In India 91 per cent of gaming influencer followers trust influencer recommendations, and 80 per cent as across influencers as a whole.

- 71 per cent game influencer follower use ad blocker while surfing on the the internet

- Based on analysis of Twitch Chat text, one of the most talked about brand categories on the platform is Food and Beverages, with G FUEL, Pepsi and Doritos registering the top mentions in Twitch Chat globally over the past year and others are Coca Cola, Nutella, Oreo, Fanta, Sprite, Red Bull, Cheetos.

- In the US, it seems that there are more Twitch users than the general 18 to 34-year-olds to purchase both beverages (52 per cent vs. 42 per cent) and snack foods (47 per cent vs. 42 per cent) in the next 30 days.

- Looking at current and historical purchase behaviors from YouGov Profiles, 34 per cent of US Twitch users are current purchasers of Oreos (past 30 days), 35 per cent higher than general 18 to 34-year-olds, and more than twice the rate of competitor, Nabisco.

- Over 40 per cent of Twitch users reported hearing something positive about the Oreo brand in the time period directly following the Pokémon collaboration; this was significantly higher positive buzz versus 18 to 34-year-olds over the same period. This directly resulted in rising positive impressions of the brand versus the Twitch audience in the months of September and October

- 72 per cent of gaming content streamers have used an online/app-based food delivery service in the past three months, vs. 67 per cent of 18 to 34-year-olds and only 51 per cent of the broader US adult population.

- The 25 March launch of the Chipotle Challenger Series allowed Chipotle to maintain high purchase rates among game streamers through early April. As this event’s impact waned, so did the sales among the gaming content audience. However, shortly after the 12 July launch of the second CCS in 2021, Chipotle purchase rates reached an annual high of nearly 20 per cent of game streaming viewers, outpacing broader 18 to 34-year-old consumers. Bringing the brand back in front of gaming content fans allowed Chipotle to build on the success they had already achieved earlier in the calendar year.