Nazara Technologies has witnessed 84 per cent jump in consolidated revenue at Rs 454.2 crore for financial year 2020-21, over the previous fiscal, driven by strong growth momentum in segments like gamified learning and esports as per Nazara’s financial report released today.

As of 31 March 2021, Nazara has diverse business segments with revenue generation happening across gamified learning, esports, freemium and telco subscription.

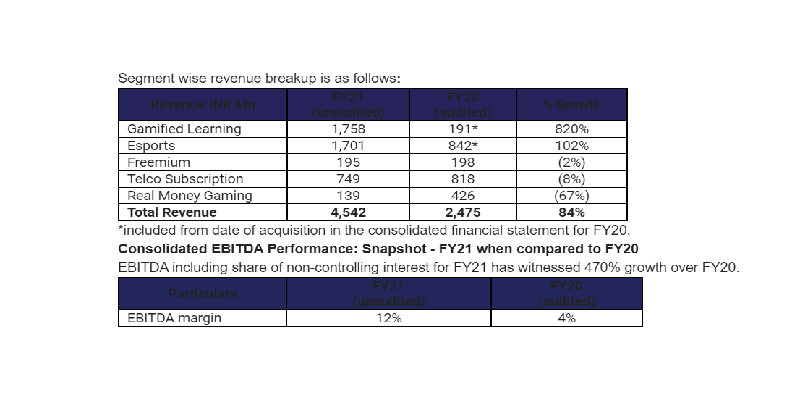

The company has delivered consolidated revenue of Rs 4,542 Mn (unaudited) in FY21 which is 84 per cent growth over FY20 (Rs 2,475 Mn). Gamified learning and esports segments have not only demonstrated strong growth momentum in FY21 but have also laid the foundation for predictable growth on account of proven user engagement and retention KPIs in gamified learning and multiyear media licensing and game publisher agreements in case of Esports.

Here are the key insights

- Kiddopia gamified app for two to six-year-old kids with subscription paid by parents has contributed 39 per cent of revenue in 2021

- In esports through Nodwin, Sportskeeda with business model of premium exclusive content / (Media rights licensing) and brand sponsorships (ads shown on the platform) have contributed 37 per cent of revenue in 2021

- Freemium game WCC has contributed four per cent of revenue through ads and virtual items purchased within the games in 2021

- Telco subscription businesses where players subscribing to curated game packs and payment collected through telecom operator channel has contributed 16 per cent of the revenue in 2021

- Halaplay, Qunami skill based real money gaming where platform fee collected from the skill games played on the platform has contributed four per cent of the revenue in 2021

The gamified learning segment registered 820 per cent growth in revenue, growing from Rs 19.1 crore in FY20 to Rs 175.8 crore in FY21. Similarly, esports segment revenue more than doubled to Rs 170.1 crore in FY21, from Rs 84.2 crore in the previous fiscal. Revenue from freemium, telco subscription and real money gaming stood at Rs 19.5 crore, Rs 74.9 crore and Rs 13.9 crore, respectively in FY21.

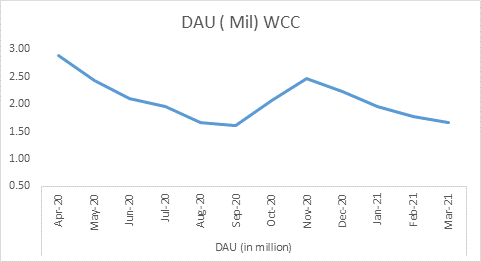

WCC (World Cricket Championship) is a cricket simulation game franchise on mobile and is played for ~46 minutes / day by over 15 Mn monthly active users. The game has a very strong franchise among the mid core gamers who love the virtual sports simulation genre and gets over 100,000 downloads every day organically and without any marketing spends.WCC revenues were flat in FY21 on account of drop in advertising rates in India due to COVID. Nazara expects growth in WCC to come from in-app purchases of virtual goods and WCC3 – the latest version of the game launched in July has been designed for enhancing in-app purchase conversion rates. Sports fantasy witnessed disruption in FY21 on account of lack of live matches in the first half of FY21 and regulatory turbulence triggered by legislative ordinances passed in few of the large states banning real money gaming operations. The lack of stability in the regulatory framework lead to Nazara taking a strategically cautious approach in this vertical till further clarity emerges.

WCC (World Cricket Championship) is a cricket simulation game franchise on mobile and is played for ~46 minutes / day by over 15 Mn monthly active users. The game has a very strong franchise among the mid core gamers who love the virtual sports simulation genre and gets over 100,000 downloads every day organically and without any marketing spends.WCC revenues were flat in FY21 on account of drop in advertising rates in India due to COVID. Nazara expects growth in WCC to come from in-app purchases of virtual goods and WCC3 – the latest version of the game launched in July has been designed for enhancing in-app purchase conversion rates. Sports fantasy witnessed disruption in FY21 on account of lack of live matches in the first half of FY21 and regulatory turbulence triggered by legislative ordinances passed in few of the large states banning real money gaming operations. The lack of stability in the regulatory framework lead to Nazara taking a strategically cautious approach in this vertical till further clarity emerges.

“We have therefore pivoted to a product driven growth strategy versus an aggressive customer acquisition spends led strategy and the team is focused on enhancing existing as well as bringing new product features to differentiate ourselves in this segment. As Nazara is operating in high growth business segments such as gaming, gamified learning and Esports, we will continue to drive profitable growth while prioritising growth over profit maximisation at this stage so that we can achieve and maintain market leadership in the segments we operate in,” said the report.

Shares of Nazara are currently priced at Rs1689 as per Upstock, the company listed on 30 March, are up by more than 50 per cent from the IPO price of Rs 1,101 apiece.