BENGALURU: For FY-2014, Prime Focus Limited (Prime Focus) reported a PAT of Rs 33.04 crore as compared to a loss of Rs (-20.31) crore in FY-2013. Forex loss of Rs (-9.02) crore, non-cash reversal of deferred tax during the quarter are some of the factors that have added to the loss in Q4-2014 of Rs (-7.16) crore to Prime Focus as compared to a profit of Rs 10.33 crore in Q3-2014 and a profit of Rs 12.44 crore in Q4-2013.

BENGALURU: For FY-2014, Prime Focus Limited (Prime Focus) reported a PAT of Rs 33.04 crore as compared to a loss of Rs (-20.31) crore in FY-2013. Forex loss of Rs (-9.02) crore, non-cash reversal of deferred tax during the quarter are some of the factors that have added to the loss in Q4-2014 of Rs (-7.16) crore to Prime Focus as compared to a profit of Rs 10.33 crore in Q3-2014 and a profit of Rs 12.44 crore in Q4-2013.

During FY-2014, Q4 is the only quarter that has reported an operational loss and a forex loss. Between Q1-2014 and Q3-2014, the company had reported a forex gain of Rs 38.23 crore, much more than the PAT reported by the company during the entire fiscal. The Q4-2014 forex loss reduced overall forex gains by the company in FY-2014 to Rs 29.21 crore.

Note: (1) Rs 100 lakh = Rs100,00,000 = Rs 1 crore = Rs 10 million.

Note: (2) The results in this report are standalone.

Let us look at the other figures reported by Prime Focus for FY-2014 and Q4-2014

Prime Focus reported Total Income from Operations (Op Inc) of Rs 834.89 crore in FY-2014, up 9.54 per cent as compared to the Rs 762.16 crore in FY-2013. Op Inc in Q4-2014 at Rs 236.60 crore was 10.69 per cent more than the Rs 213.76 crore in the immediate trailing quarter Q3-2014 and 20.17 per cent more than the Rs 196.90 crore in Q4-2013.

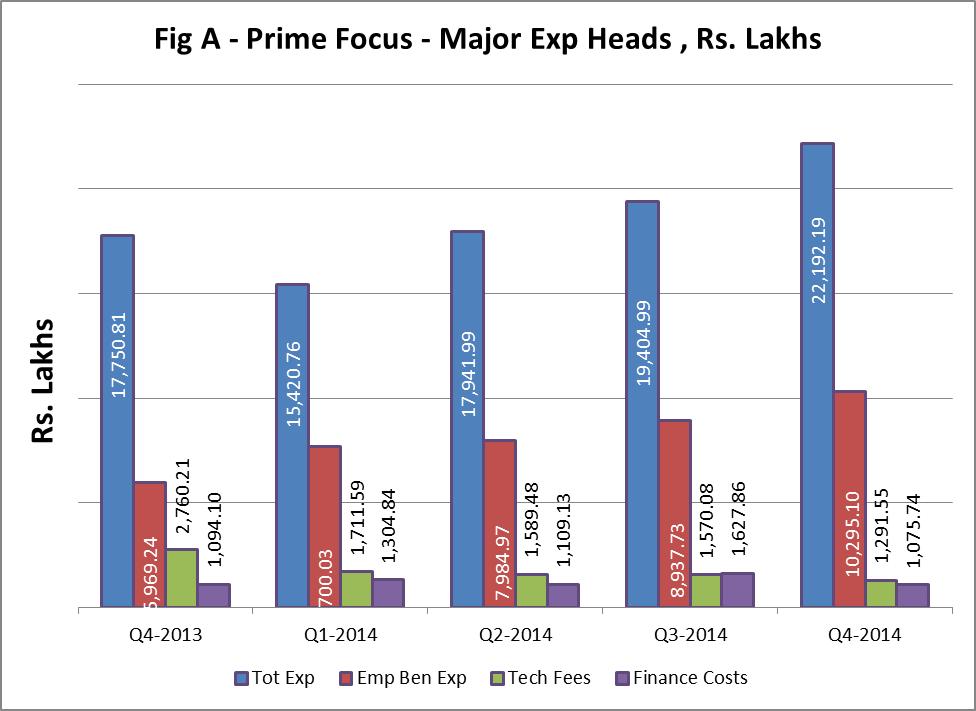

Fig A shows Prime Focus major Expense Heads (Exp Heads) in Rs. Lakhs – Total Expense (Tot Exp), Employee Benefit Expense (Emp Ben Exp), Technician’s Fees (Tech Fees), and Finance Costs.

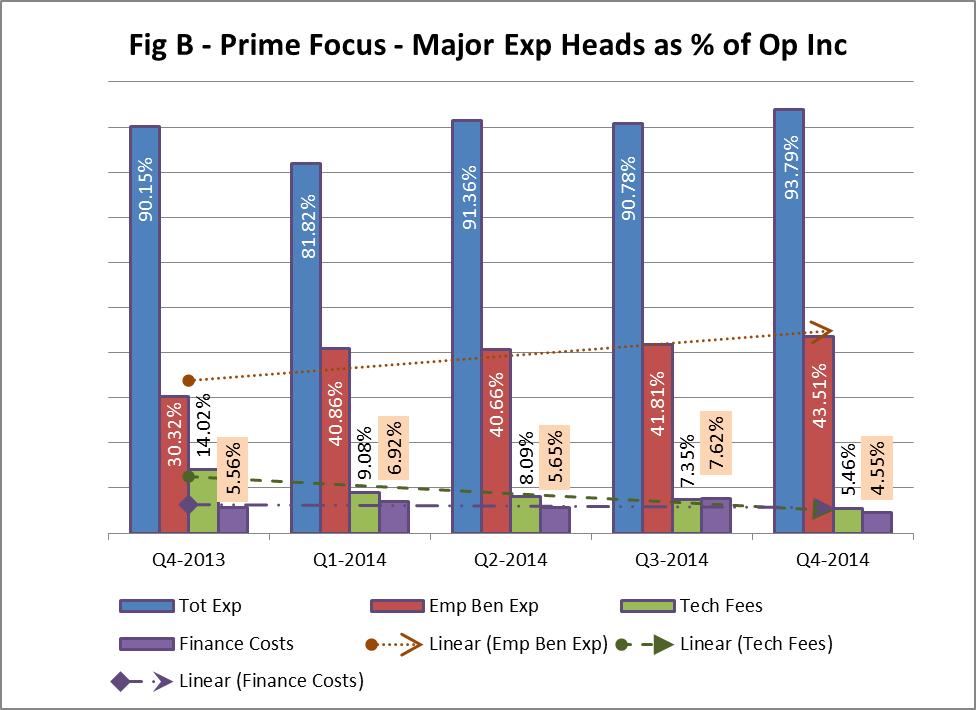

Fig B shows these Exp Heads as percentage of Op Inc and the trends over five of these Exp Heads quarters starting Q4-2014 until Q4-2014. While Emp Ben Exp shows an upward linear trend, Tech Fees and Finance Costs show a dowward linear trend.

Commenting on results, Prime Focus CEO Ramki Sankaranarayanan said: “In line with our strategy, both VFX and PFT have continued to demonstrate strong growth to offset the reduction in the traditional Post business. Our Hollywood VFX revenue has grown over 40 per cent on a YoY basis. PFT’s has nearly doubled its revenue and delivered a margin growth of 300 basis points. We will continue to press ahead with our strategy and look forward to delivering a solid FY-2015.”